Hedera (HBAR) has experienced a modest recovery over the past few days but is still facing bearish cues from the broader market.

The altcoin has been attempting to breach a key price barrier but is struggling due to ongoing negative sentiment, especially in the Futures market. The market conditions remain challenging, making the outlook uncertain for HBAR.

Hedera Traders Are Uncertain

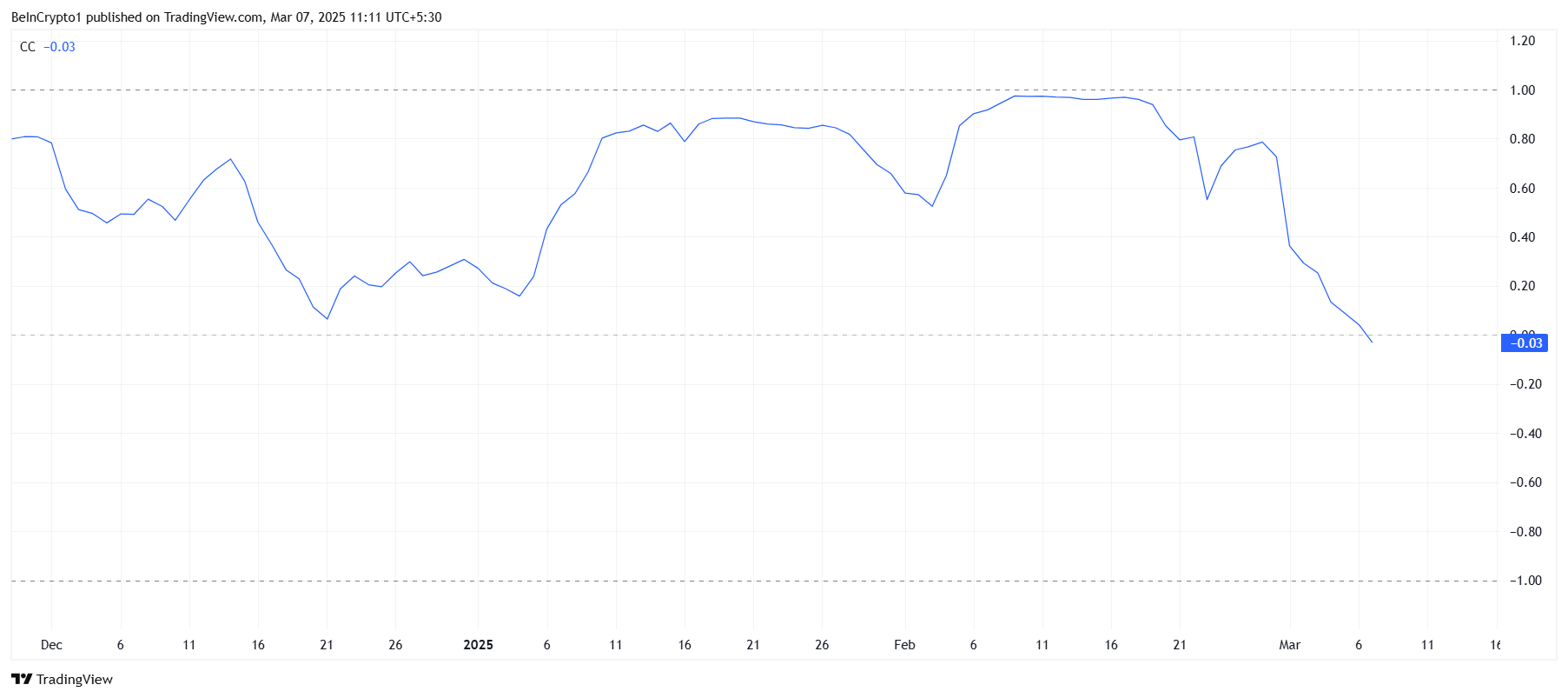

Currently, HBAR is displaying an inverse correlation with Bitcoin, sitting at -0.03. This suggests that while Bitcoin may be attempting a recovery, HBAR is not likely to follow its lead. Instead, the altcoin could move in the opposite direction.

As Bitcoin edges toward potential gains, HBAR may face further declines, especially in the daily chart.

The correlation reflects how HBAR’s price movements may not align with Bitcoin’s actions. As Bitcoin continues its recovery efforts, the broader cryptocurrency market sentiment may influence HBAR’s price in a contrasting manner. HBAR’s negative correlation with Bitcoin makes it vulnerable to additional downward pressure if the larger market remains volatile.

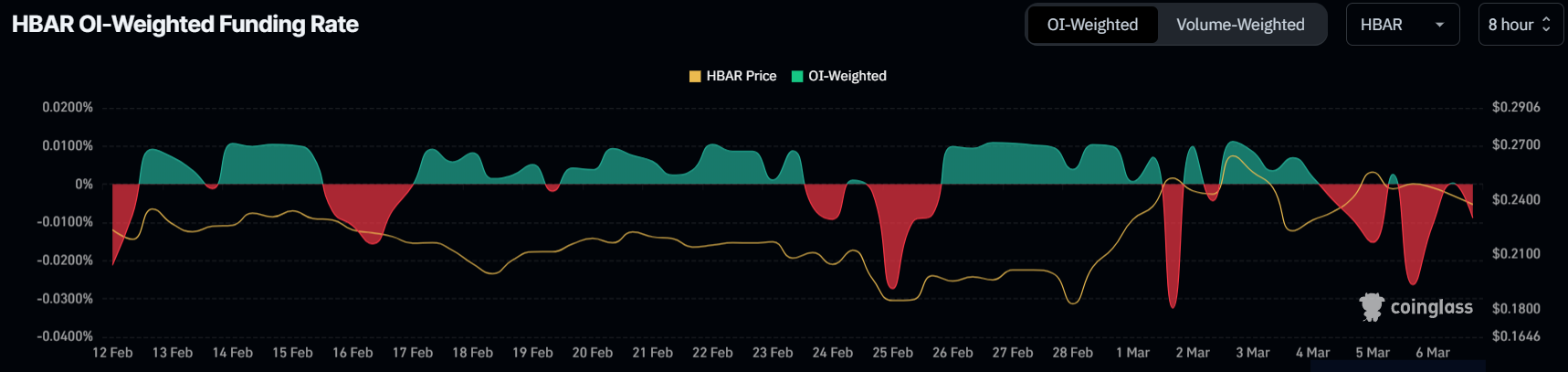

In addition to the correlation with Bitcoin, HBAR’s macro momentum is also shaped by the negative funding rate. The funding rate has been fluctuating and remains in the negative territory.

This indicates that traders are leaning toward short contracts, anticipating further price declines. The ongoing lack of strong recovery in HBAR has reinforced bearish sentiment as traders look to capitalize on any potential downturn.

The sustained negative funding rate reflects the market’s overall skepticism about HBAR’s short-term price action. With traders betting on further drops, the altcoin is under pressure to overcome these pessimistic views. Without a significant bullish catalyst, HBAR may struggle to break free from this bearish trend in the near term.

HBAR Price Faces Challenges

At the time of writing, HBAR price is trading at $0.246, facing the struggle of being stuck under the resistance of $0.250. The altcoin has maintained support at $0.222 for a while, and it is likely to continue holding above this level. However, the resistance of nearly $0.250 remains an obstacle to a breakout, which could prevent HBAR from making significant progress.

Given the current market conditions, HBAR is expected to consolidate between $0.222 and $0.250, as it has done in the past. This consolidation could continue, further delaying any recovery and preventing the altcoin from reaching higher levels. The broader market’s bearish sentiment may further restrict HBAR’s price action.

However, if HBAR manages to breach the $0.250 resistance level and flip $0.267 into support, it could signal a shift toward a bullish trend. In this scenario, the altcoin might rise to $0.314, effectively invalidating the bearish thesis and setting the stage for a more substantial recovery.