Hedera (HBAR) has been experiencing a continued downtrend in price despite the broader market showing a bullish macro outlook. However, the short-term market conditions indicate that HBAR could face further declines in the coming days.

This potential drop to critical support levels could pose risks for traders, especially if they fail to manage their positions effectively.

HBAR Is Facing Uncertainity

The Ichimoku Cloud indicator is currently presenting a bearish outlook for HBAR. The cloud itself is signaling downward momentum, and the presence of candlesticks below the basis line confirms this negative sentiment. This indicates that the market sentiment is leaning toward the bearish side, and any hope for a bullish reversal seems distant at the moment.

Furthermore, the expanding Ichimoku Cloud suggests that the bearish pressure on HBAR is likely to intensify. As the cloud widens, it indicates that downward momentum could continue in the short term.

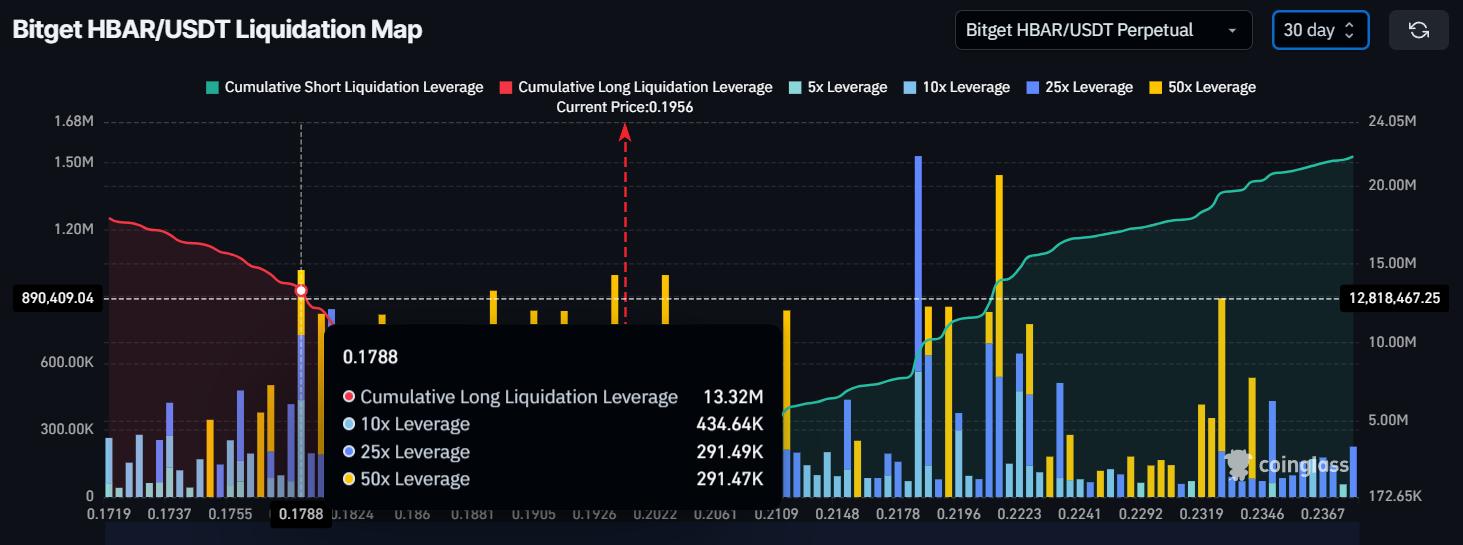

In terms of macro momentum, the liquidation map shows a concerning scenario if HBAR continues its downward trend. If the price falls to its critical support level of $0.177, it could trigger $13.3 million worth of long liquidations. This liquidation could impact market sentiment and cause traders to retreat, fearing further losses.

The resulting liquidation could further pressure HBAR’s price, accelerating the decline and creating more bearish sentiment in the market. As traders pull back, it could exacerbate the existing downtrend, leading to a cycle of selling and additional losses.

HBAR Price Is Looking For A Breakout

HBAR is currently trading at $0.195, within a descending channel. The altcoin is trying to secure this level of support, but the current market conditions do not offer much hope for a bullish outcome. The factors discussed, including the bearish Ichimoku Cloud and the potential for liquidation, suggest that a recovery is unlikely in the near term.

Given the ongoing market conditions, HBAR is vulnerable to losing $0.195 support. If this happens, the price could fall to $0.177, which has been a critical support level for HBAR over the past weeks. If the price breaks below this level, it signals a continuation of the bearish trend and a breakdown of the pattern, resulting in further price declines.

However, if HBAR manages to bounce off the $0.195 support level, it could potentially rise to $0.222, breaking out of the current pattern. This would completely invalidate the bearish outlook and help investors note recovery.