The Bitcoin price reached a high of $9,939 on May 14. According to the Elliott wave theory, it is possible that this was the local top and a corrective period will soon begin.

May 14 has been a very volatile day for the Bitcoin price. Beginning at $9,300, the price began a rapid upward move that eventually led to the high of $9,939. What followed was a massive one minute candle that took the price to $9,511 before closing at $9,732. Well-known trader @Anbessa100 tweeted a Bitcoin chart, stating that she believes that a local top is in, which was reached during the aforementioned high.

Local Top?

The Bitcoin price was subject to a rapid decrease on May 10 that caused it to reach a low of $8,117. Since then, BTC has been retracing upwards, and today it reached a high between the 0.786-0.88 fib levels at $9,650-$9,800, which is the final area prior to the price creating a double top at $10,060. If the price increases above this level, the current movement cannot be considered a retracement anymore. The ascending support line drawn in the tweet acted as support three times and has been validated twice as resistance after the price broke down. However, its exact slope is a matter of some debate, since it can change significantly based on whether we use wicks or closing prices. The BTC price is following a curved ascending support line. This is not sustainable in the long-run. Furthermore, the bearish hourly candlestick had extremely high volume, so it would make sense if this was the local top, as stated in the tweet.

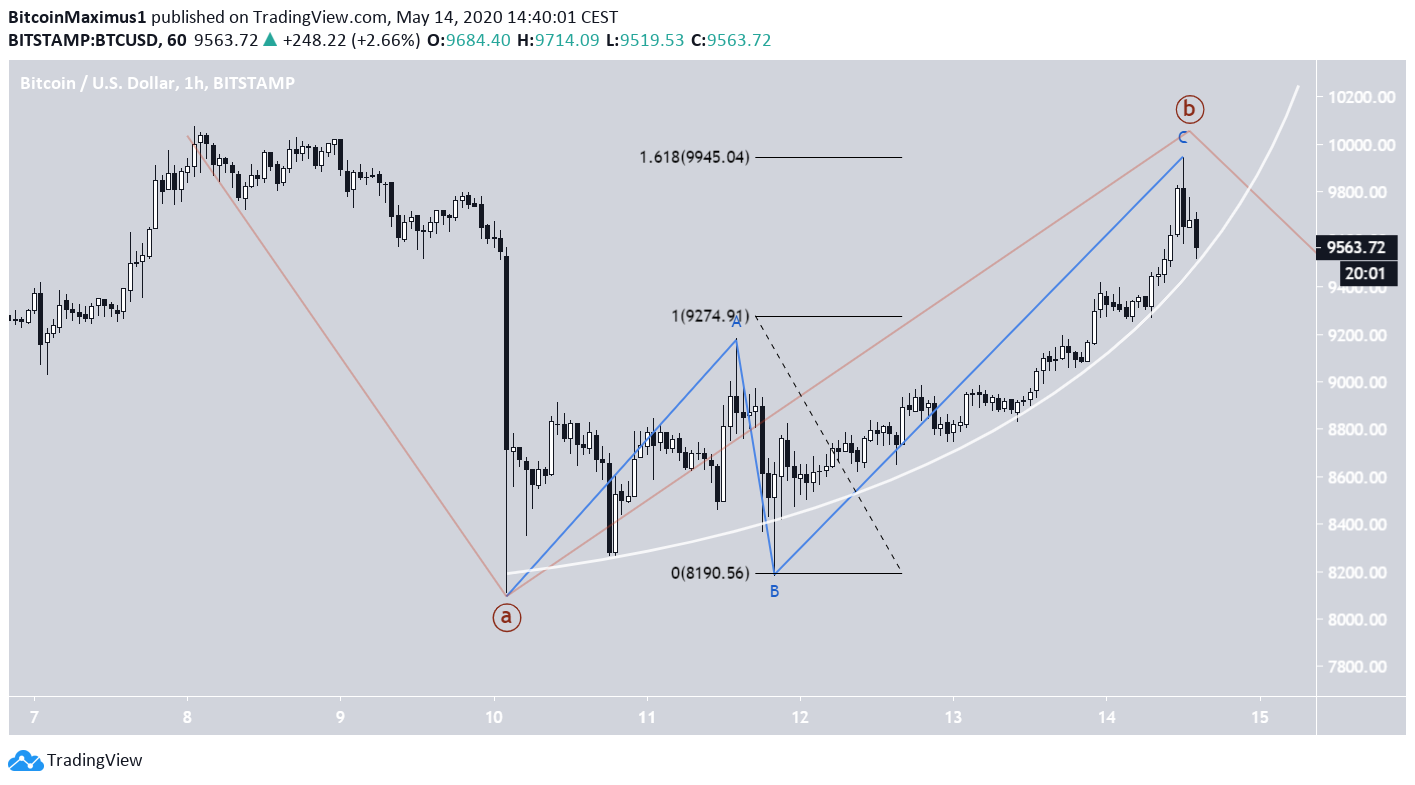

Wave Count

It seems that BTC has created a flat, A-B-C correction. The difference between a flat and a zigzag is a wave count, which is 3-3-5 instead of 5-3-5. One of the rules of a flat A-B-C correction is,If Wave C is longer than Wave B, then Wave C is often about 161.8% of Wave A from end of Wave B by price.Interestingly, measuring the length of wave A and projecting it to the end of wave B, we arrive at the exact high of $9,947 reached today. Therefore, it is very possible that this was the top, which would be confirmed by a breakdown from this ascending support line.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored