Crypto investment platform Grayscale has reported another significant increase in its assets under management (AUM).

A global leader in digital currency management, Grayscale is a barometer of sorts for the wider crypto ecosystem. The announcement further illustrates an uptick in interest from institutional investors.

Grayscale already owns a sizeable chunk of the BTC and ETH supply. And according to an update from Grayscale’s Twitter account on Aug 5, that amount is going up.

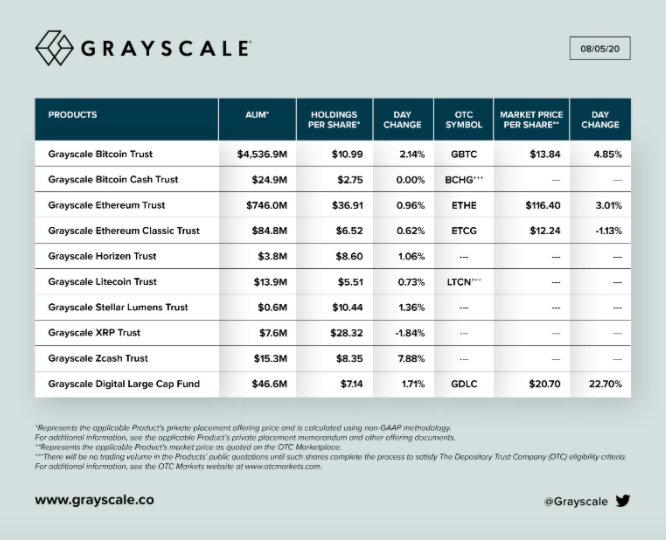

The tweet notes that the investment firm currently has $5.5 billion in AUM spread out across various funds, a nearly 15% increase from last week.

The funds are mostly held in Grayscale trusts for bitcoin (82.78%) and ethereum (13.61%), along with the firm’s digital large-cap fund. Smaller allocations include an assorted mix of other assets like Ethereum Classic, Zcash, and Litecoin.

Ethereum Classic represents just 1.55% of Grayscale’s total assets but it’s worth noting since ETC recently suffered yet another 51% attack. This is one in a series of attacks that allowed thieves to make off with approximately $5.68 million in ETC, perhaps more, as the amount stolen in the latest incident remains unclear.

The events have led the Ethereum Classic team to ask for related services like exchanges and mining pools to raise confirmation times.

Bullish Indicators Are Everywhere

Since the Covid-19 pandemic started, there has been a steady inflow of energy into the cryptocurrency space. In recognition of surging interest, Grayscale also just published a guide for financial advisors to educate themselves about digital assets tweeting:

“Over one-third of U.S. investors are interested in investing in crypto like #Bitcoin. For financial advisors, it’s time to get up to speed on the asset class.”

If this weren’t bullish enough, Barry Siebert, the Founder and CEO of Grayscale’s parent company Digital Currency Group tweeted, “You ain’t seen nothing yet”.