Institutional interest in Bitcoin is increasing, so much so that major firms are buying up the asset at unprecedented rates.

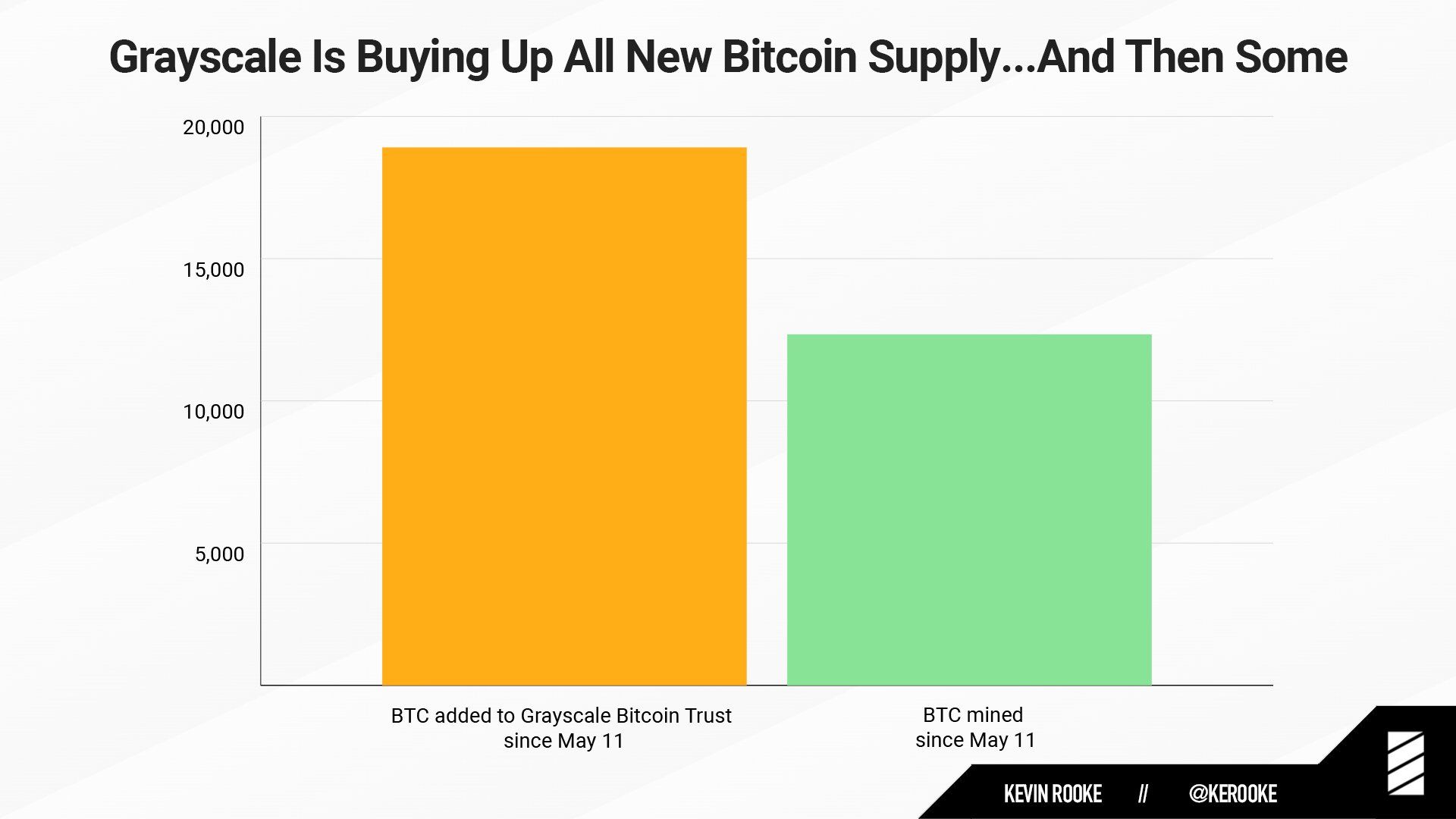

Grayscale has been aggressive on BTC acquisition since the halving. The investment firm has purchased 18,910 bitcoins over the past couple of weeks according to investor Kevin Rooke [@kerooke], who added,

“Wall Street wants Bitcoin, and they don’t care what Goldman Sachs has to say.”

According to those figures, only 12,337 BTC have been mined since the halving, and Grayscale has added 50% more to its coffers.

Grayscale’s Bitcoin Trust represents one of the industry’s largest institutionally targeted funds. It allows investors to gain exposure to BTC without having to buy the actual asset.

According to the latest performance reports, each share currently represents $8.96 in Bitcoin, with a market price per share of $10.88. Grayscale’s current assets under management (AUM) figure stands at $3.7 billion, which makes up 1.4% of the entire cryptocurrency market capitalization.

Company founder and CEO, Barry Silbert [@barrysilbert], replied to the tweet with a simple ‘shhhh’ indicating that Grayscale could be still aggressively buying and hoarding Bitcoin.