Bitcoin exchange-traded funds (ETFs) have significantly impacted the crypto market since their debut in January. Even marker observers have been impressed with the record performance of these financial products.

However, Grayscale’s Bitcoin Trust (GBTC), one of the prominent products, has experienced consistent outflows, sparking concerns about its future trajectory.

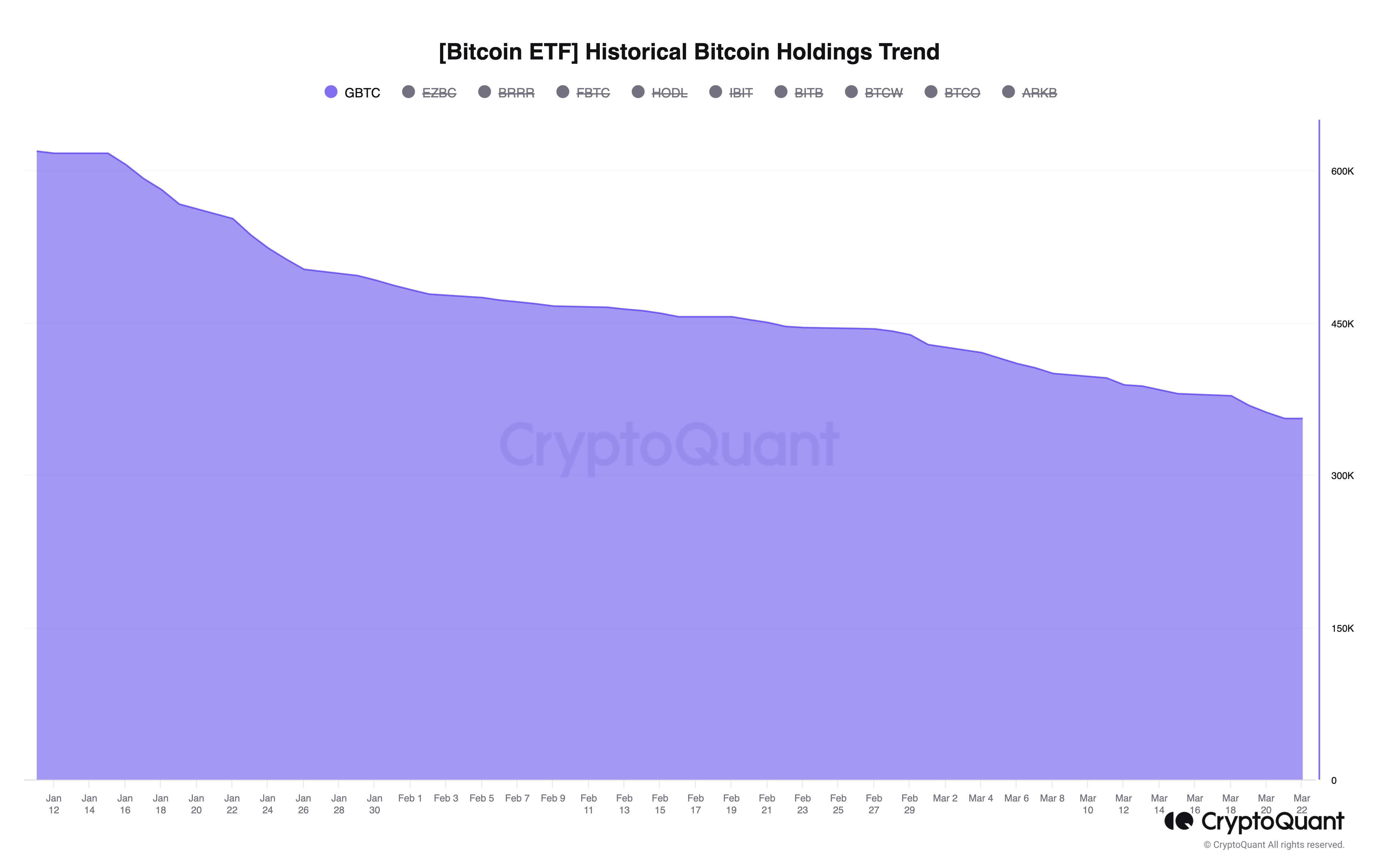

Grayscale’s GBTC Bitcoin Reserve Depletes

Arkham Intelligence, a blockchain analytics firm, has forecasted that GBTC could deplete its Bitcoin reserves within the next 96 days if the current rate of redemptions persists.

Since its conversion into a spot Bitcoin ETF in January, Grayscale’s Bitcoin balance has plummeted by 266,470 BTC. This marks a significant decline from its initial holding of approximately 620,000 BTC.

The downward trend is attributed to consistent outflows from GBTC averaging 25,900 BTC per week.

“Grayscale started the year holding 618,280 BTC for their Bitcoin Trust GBTC. They now hold only 356,440 BTC. If they carry on like this, there’s only 14 weeks until they run out for good,” analysts at Arkham Intelligence remarked.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Grayscale’s CEO, Michael Sonnenshein, acknowledged the anticipated outflows, attributing them primarily to profit-taking investors and arbitragers exiting the fund. On the other hand, market observers have attributed the GBTC outflows to its high fee structure. At the same time, Eric Balchunas, a senior ETF analyst at Bloomberg, noted that the past week’s outflows were predominantly from the defunct crypto lender Genesis.

Grayscale is exploring various initiatives to counteract this outflow trend. Some of these include introducing a mini fund providing a cost-effective alternative to GBTC. Sonnenshein also mentioned the firm’s plan to reduce its 1.5% fee, which stands in stark contrast to competitors’ rates ranging from 0.2% to 0.5%.

“We have seen this in countless other exposures, countless other markets, you name it, where typically when products are earlier in their lifecycle, when they’re new to be introduced, these tend to be higher. And, as those markets mature, and as those funds grow, those fees tend to come down, and we expect the same to be true of GBTC,” Sonnenshein said.