On November 8, the price of GRASS, the native token of the Solana-based Decentralized Physical Infrastructure Networks (DePIN) project, climbed to an all-time high of $3.95. However, with waning bullish sentiment and a spike in profit-taking activity, the token’s price has since plunged by 27%.

This analysis explores reasons why GRASS’ crypto price could fall even further from this level.

GRASS Traders Dump Holdings

DePIN token GRASS trades at $2.78 as of this writing, noting a 13% price decline over the past 24 hours. BeInCrypto’s assessment of the GRASS/USD 4-hour chart confirms the uptick in selling pressure.

For example, readings from the altcoin’s Relative Strength Index (RSI) show that market participants have sold their GRASS tokens more than they have bought new ones over the past few days. At press time, this indicator is in a downward trend at 44.80.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. On the other hand, values below 30 indicate that the asset is oversold and may witness a rebound.

GRASS’ RSI reading of 44.80 suggests that selling pressure is gaining momentum as token holders have begun to sell for profit.

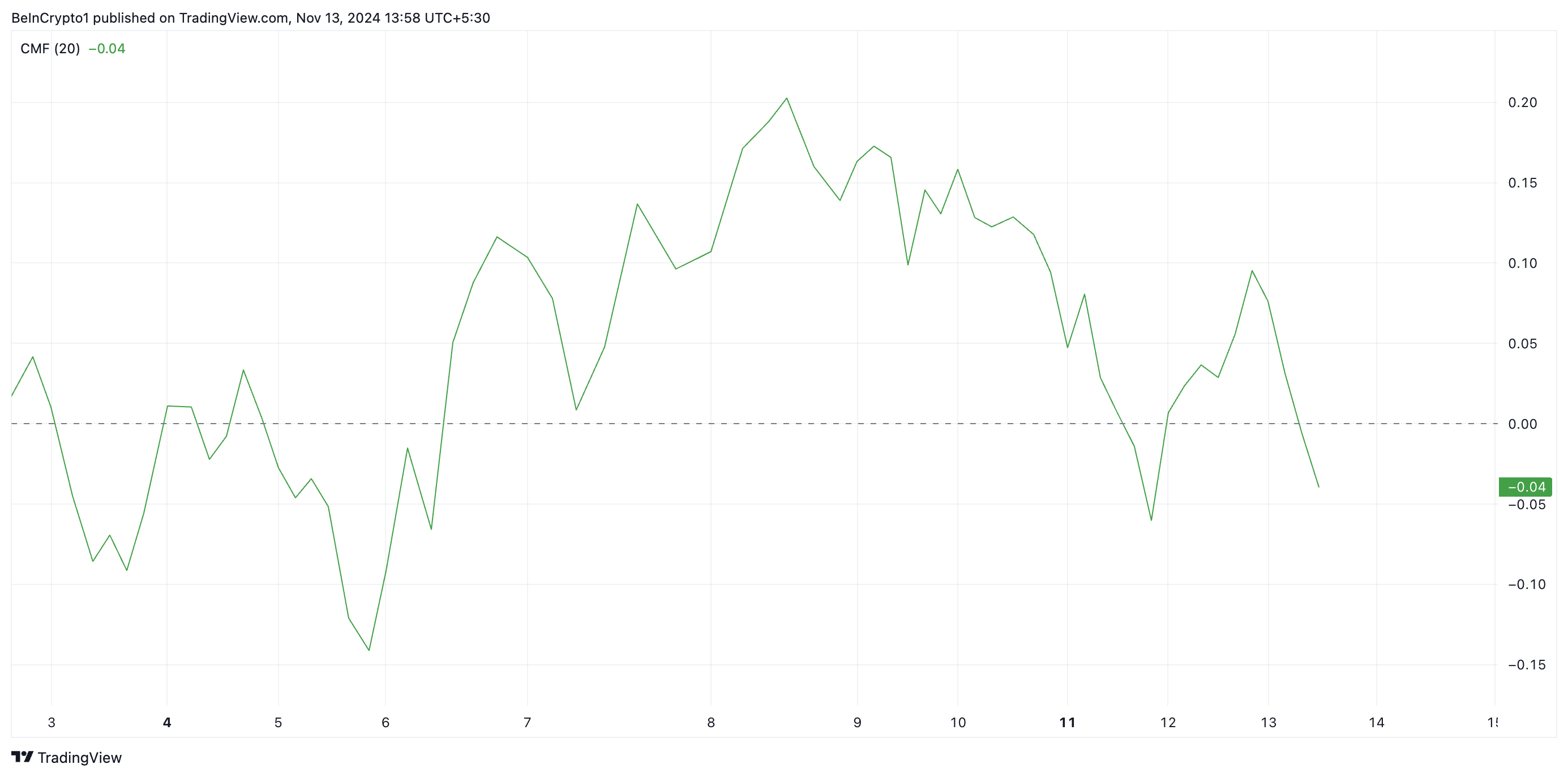

Furthermore, the token’s negative Chaikin Money Flow (CMF) confirms this bearish outlook. As of this writing, this indicator, which measures money flows into and out of an asset, is below zero at -0.04.

GRASS CMF. Source: TradingView

A CMF below zero suggests sellers are more dominant than buyers, often signaling bearish momentum. The further below zero, the stronger the selling pressure.

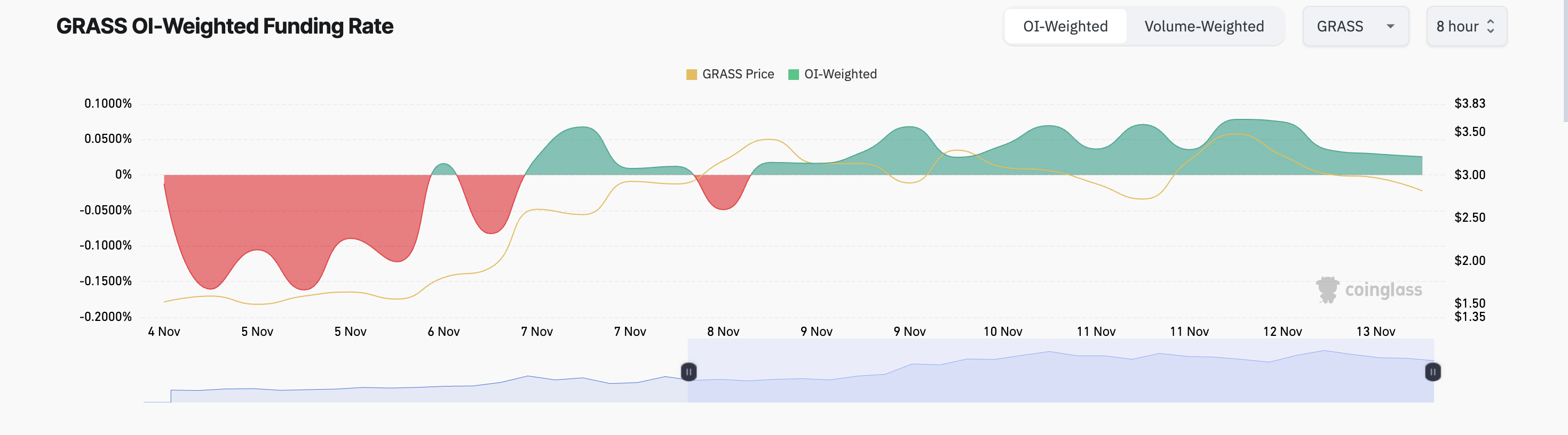

GRASS Futures Traders Hold Out Hope

Interestingly, despite the GRASS token price decline, its futures traders have continued to place bets in favor of a price rebound. This is reflected in the token’s funding rate, which has remained positive since November 8. As of this writing, this is 0.025%, per Coinglass data.

In futures trading, the funding rate is a periodic fee paid between traders holding long and short positions, incentivizing balance between the two. When it is positive, it means there is a higher demand for long positions.

This indicates that even though the GRASS token price has maintained a downward trend in the past few days, more traders are still opening new positions in anticipation of a price rebound than those hoping for a continued decline.

GRASS Price Prediction: Drop Below $2 Is Possible

As of this writing, GRASS trades at $2.78, slightly above support at $2.65. The strengthening selling pressure hints at a potential break below this level.

If this happens, the token will attempt to seek support at $2.26. Failure of the bulls to defend this mark will cause the GRASS token price to slip below $2 to trade at $1.86.

However, if the altcoin experiences a positive shift in market sentiment and demand resumes, its price may rally past the resistance at $3.22 and attempt to reclaim its all-time high of $3.95.