Goldman Sachs strategists have weighed in on the current state of the US stock market, predicting that a bear market—a decline of 20% or more—is unlikely.

Despite high valuations, mixed growth prospects, and lingering policy uncertainty, the team led by Christian Mueller-Glissmann highlights the strength of the private sector. It anticipates supportive moves from the Federal Reserve as key factors preventing a market plunge.

Bear Market Unlikely, But Crypto Doesn’t Look Good

Mueller-Glissmann’s analysis draws from historical trends. Since the 1990s, the frequency of significant downturns in the S&P 500 has decreased. This is due in part to longer business cycles, reduced macroeconomic volatility, and proactive interventions by central banks. These elements create a buffer that minimizes the risk of a deep bear market.

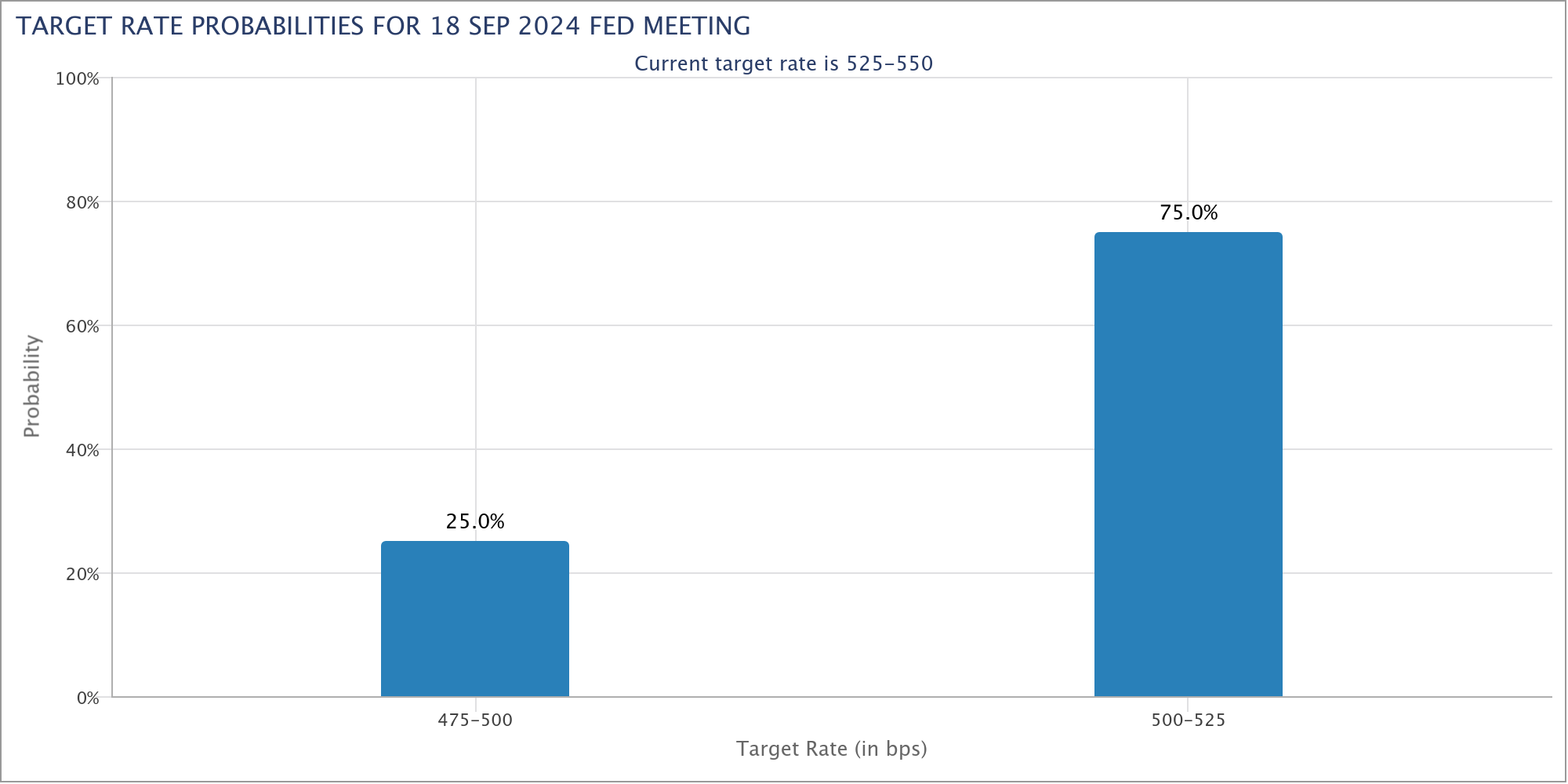

Additionally, Goldman Sachs expects the Federal Reserve to begin cutting interest rates, which could ease some pressure on the markets. While the stock market may still see a dip by year-end, the overall outlook remains cautiously optimistic.

The strategists maintain a neutral stance on asset allocation but carry a “mildly pro-risk” view for the next 12 months.

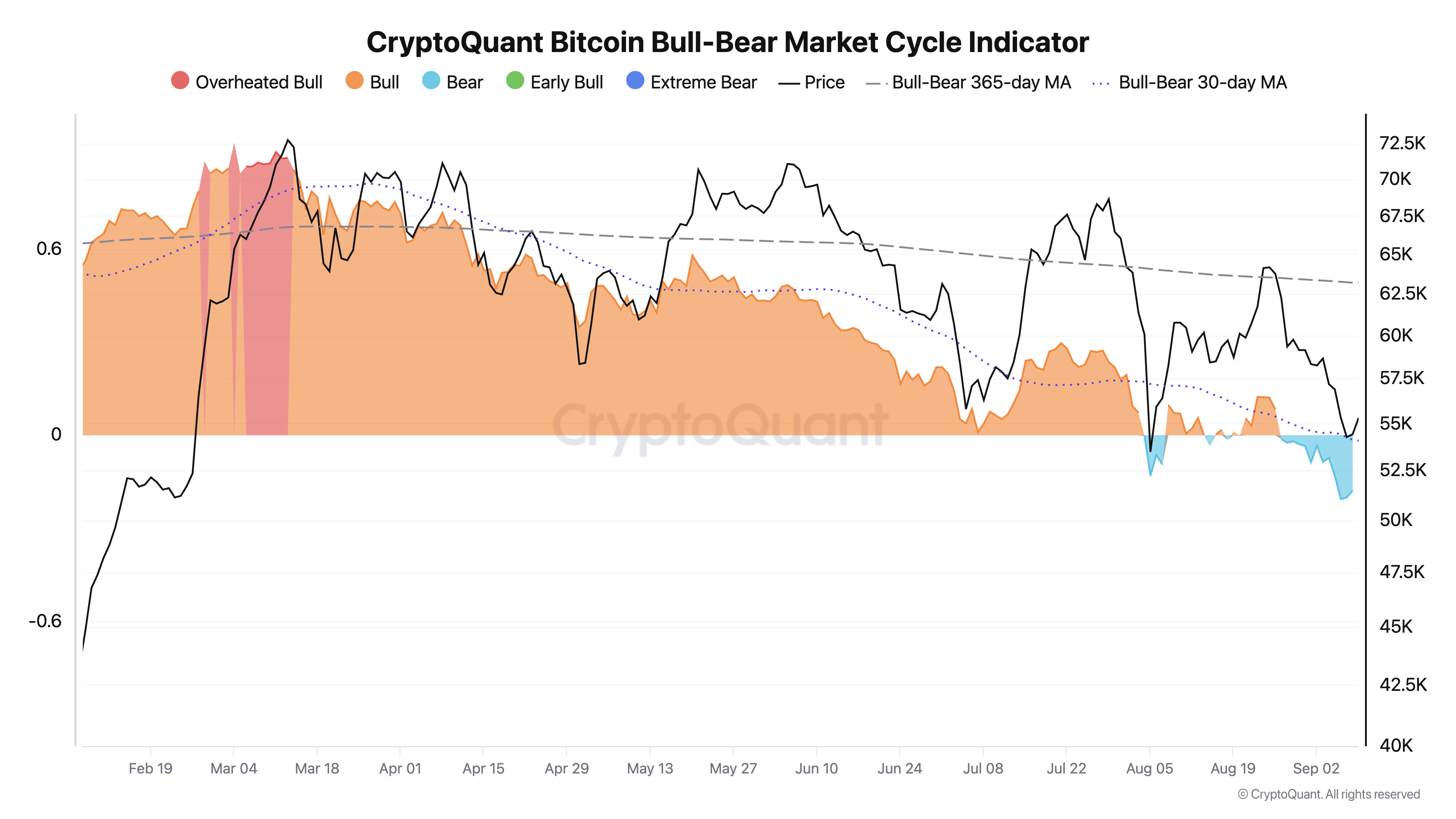

Contrary to the stock market outlook, the cryptocurrency market is showing signs of a potential bear market. Julio Moreno, Lead Analyst at CryptoQuant, notes that Bitcoin is struggling due to declining demand.

“All valuation metrics are in bearish territory,” Moreno said.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Veteran trader Peter Brandt adds that there’s a 65% probability Bitcoin could drop below $40,000, though he remains optimistic about a long-term price surge, potentially reaching $130,000 by 2025.

“In early June I was assigning a 50% probability of $30,000 (approximately a 50% price decline) and a 50% chance of $140,000 (approximately a doubling of price). Since June my technical price indicators have been stacking up in favor of the $30,000 probability,” Brandt said.

In conclusion, while the US stock market appears resilient, the cryptocurrency sector may face headwinds as investors navigate uncertain economic waters.