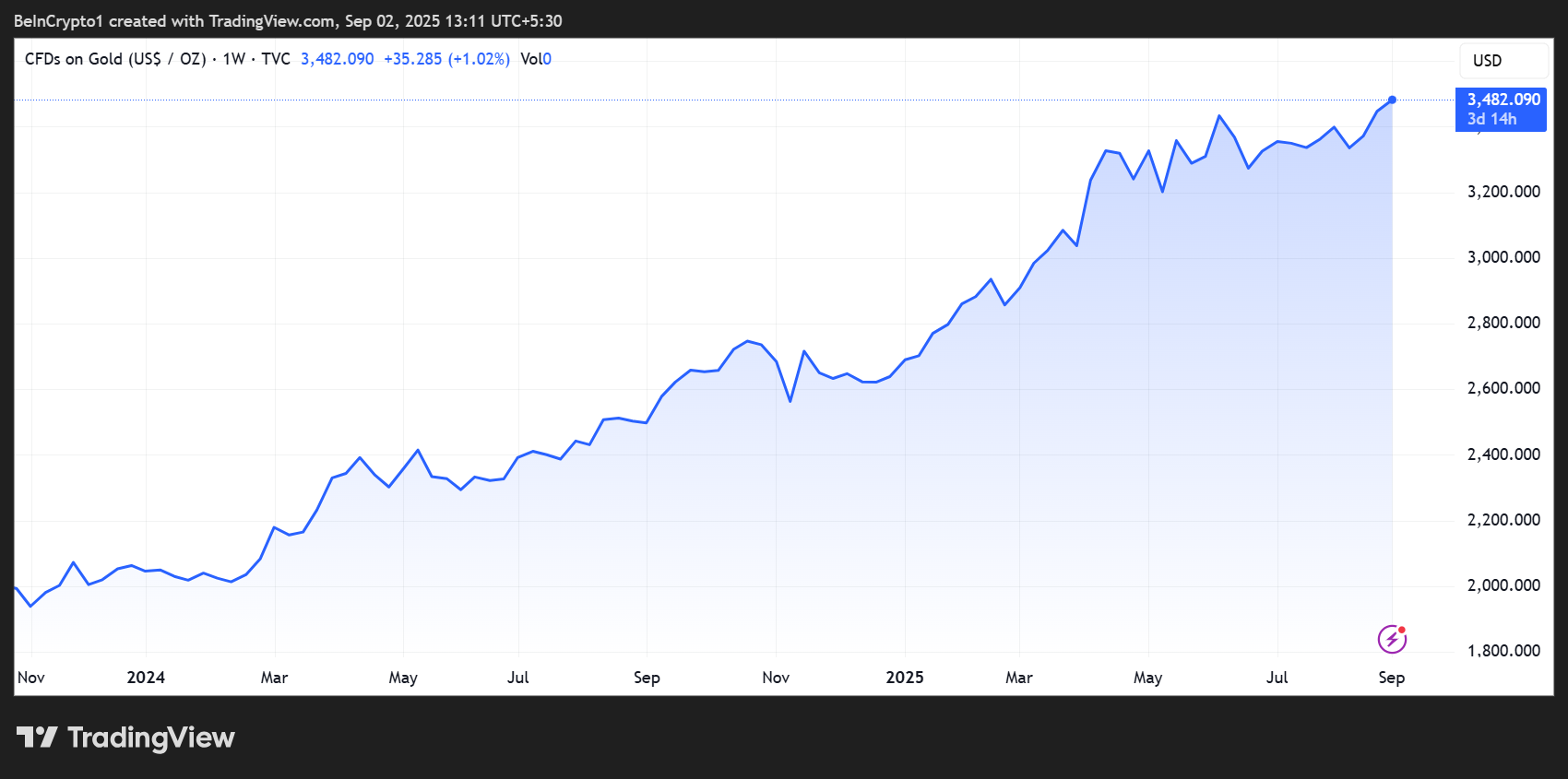

Gold has surged more than 6% in just 10 days, touching fresh all-time highs (ATH) and sparking intense debate about its implications for Bitcoin (BTC).

As the ultimate safe-haven asset flashes strength, analysts debate whether this is a warning sign for crypto or the setup for Bitcoin’s next big move.

Gold Surges Amid Global Liquidity Backdrop

Gold was trading for $3,482 as of this writing, after establishing a new ATH of $3,508 on Tuesday.

According to Alpha Extract, the current gold rally is not happening in isolation. The analyst points to a recurring market pattern.

“Global Liquidity is rising. There’s a recurring pattern this cycle: when gold starts its run, Bitcoin often consolidates—and vice versa,” the analyst shared in a post.

They highlighted a mix of forces driving gold higher, including concerns about Federal Reserve (Fed) independence, fiscal policy risks, and rising 30-year yields across global markets.

With the Fed poised to cut rates even as inflation remains above the 2% target, pressure is building across the financial system.

Alpha Extract noted that global liquidity expanded by $0.13 trillion last week, a +0.09% increase, calling it the main driver of risk assets.

While some short-term momentum indicators show weakness, the analyst argues the top is not in yet.

At the same time, the medium-term models have flipped negative, signaling caution. Meanwhile, a reversal model approaches oversold levels, hinting at a potential inflection point for risk-taking.

Bitcoin at a Crossroads: Complement or Competitor to Gold?

For Bitcoin investors, the key issue is whether gold’s rally is bullish or bearish for crypto, with the relationship proving anything but straightforward.

Martyparty, a macro analyst, suggested that gold and global liquidity act as leaders in the current cycle.

“Gold and Global Liquidity leading the way—Bitcoin follows,” he stated.

If history rhymes, Bitcoin could be set to benefit once gold’s run stabilizes. Analyst MacroScope echoed this view, noting that the last time gold spiked to the $3,400–$3,500 range earlier this year, Bitcoin retraced sharply before staging a breakout to new highs.

“Gold is screaming to be long BTC once this BTC retracement is done,” they argued.

However, some do not see gold’s breakout as a positive for Bitcoin. Longtime crypto critic Peter Schiff argued that gold’s rise comes at Bitcoin’s expense.

“This is starting to get interesting. Gold is now up almost $30, about to hit $3,480. Silver is up over 70 cents, about to hit $40.50. Meanwhile, Bitcoin is back below $108,000 and looks poised to go much lower. Gold and silver breaking out is very bearish for Bitcoin,” wrote Schiff.

Schiff’s perspective suggests that some analysts see gold and Bitcoin as complementary hedges, while others view them as competitors for safe-haven flows.

Elsewhere, former Coinbase executive Balaji Srinivasan pointed out that the dollar’s share of global reserves has fallen to 42%, while gold continues to gain. The shift, he suggests, highlights why gold is rising—and why Bitcoin could be next in line.

The gold price breakout has revived one of the market’s most enduring debates: whether the yellow metal and Bitcoin move in opposition or harmony.

With global liquidity expanding, fiscal risks mounting, and the dollar’s dominance eroding, both assets appear set to play larger roles in a shifting financial order.