The price of Gnosis native token, GNO, surged 20% after Thanefield Capital announced a proposed $30 million buyback program.

Holding significant amounts of GNO, this crypto fund plans a large-scale buyback to realign the token’s market value with its intrinsic book value.

$30 Million Buyback Proposal Details

Thanefield Capital proposed that Gnosis DAO deploy $30 million from its treasury over six months. This initiative aims to boost the GNO token’s value, which the fund argues is currently undervalued. According to Thanefield, Gnosis holds $630 million in non-GNO liquid assets and $100 million in venture capital investments. In contrast, GNO’s market capitalization is approximately $424 million, based on its circulating supply of 1.53 million tokens.

Read more: A Beginner’s Guide to Decentralized Autonomous Organizations

The proposal has received preliminary support from the Gnosis community, with 12 out of 14 governance forum voters in favor. Gnosis co-founder Martin Köppelmann endorsed the proposal, emphasizing the need to link the buyback to a growth program.

“I favor this proposal if it connects to a growth program where the GNO acquired in the buyback is consequently used to attract more users,” Köppelmann commented.

If approved, the buyback program will follow a two-pronged strategy. The first approach, the Time-Weighted Average Price (TWAP) strategy, will allocate $15 million to purchase GNO tokens over six months, aiming to exert a daily buy pressure of approximately $83,333. The second approach is discretionary, allocating another $15 million to optimize purchases based on market conditions. Karpatkey, an on-chain asset management project, will manage the buyback.

Gnosis DAO’s Financial Landscape

Gnosis DAO manages various initiatives, including the Gnosis Chain and CoW Protocol. It also has a significant stake in Safe, an Ethereum multisig provider. Despite these assets and previous buyback rounds, GNO’s market value has not reflected these successes. Thanefield Capital noted that long-term GNO holders have not benefited financially from Gnosis DAO’s product developments, venture investments, and treasury management.

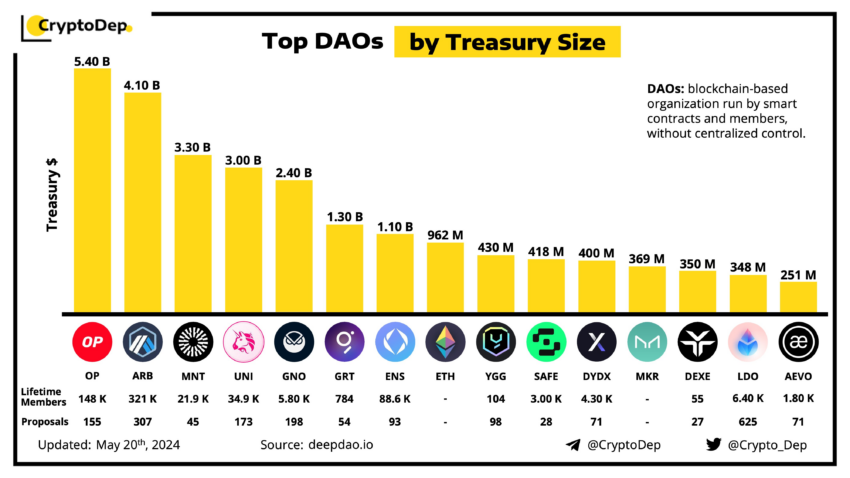

As of May 20, approximately 50,000 DAOs collectively hold $30 billion in assets. Gnosis ranks as the 5th largest DAO in terms of treasury size, holding over $630 million in assets, second only to Mantle in non-native marketable tokens.

Since the proposal’s announcement, Gnosis’ token price peaked at $320, a 20% increase, and is currently trading around $308. If implemented, the program could realign GNO’s market value with its intrinsic worth, benefiting long-term holders and enhancing market perception.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.