Digital monetary policy for central bank digital currencies (CBDCs) will be a top priority for global leaders at the Group of Seven summit being held in Hiroshima this week.

The leaders will discuss crypto rules for money laundering and CBDCs’ roles in improved payments efficiency and financial inclusion.

G7 Leaders Will Tap FSB’s Recommendations for Crypto Regulations

Leaders from Japan, the U.S., the U.K., Canada, France, Germany, and Italy will meet in Hiroshima City this week to discuss crypto, CBDCs, and other matters of global importance. These include climate change, nuclear disarmament, and the Russia-Ukraine war.

At a meeting earlier this month, the leaders committed to applying new crypto regulations from the July 2023 Financial Stability Board recommendations.

They also support the crypto Financial Action Task Force’s Travel Rule that imposes reporting requirements on digital asset service providers for all crypto transactions.

Europe’s new Markets in Crypto-Assets (MiCA) regulation implements the amended Travel Rule in its Transfer of Funds rule. MiCA will become effective from October 2024 or early 2025 in three of the G7 nations.

G7 decision-makers will also discuss a unified framework for central bank digital currencies. The new policy will welcome guidance from the International Monetary Fund’s CBDC handbook.

The document is due for release at the IMF and World Bank Group’s meetings later this year.

The summit will occur at the Grand Prince Hotel from May 19 to May 21, 2023.

Challenges of Unified Approach to Government Currency

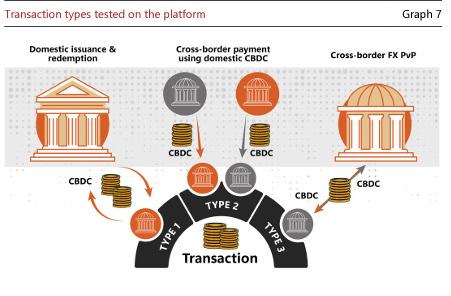

A unified digital currency system would need rules to function within and outside its originating country. Unlike private cryptocurrencies, which are essentially borderless, governments must define how their CBDC can be used.

Digital wallets need specific rules on allowed transactions based on global money laundering standards. A recent European Central Bank (ECB) survey found that Europeans consider transactions between peers a critical digital wallet feature, rendering compliance a key consideration.

Samsung recently agreed to partner with the Bank of Korea to test instant person-to-person transfers. An earlier central bank pilot exposed the money laundering compliance challenges of linking multiple CBDCs for remittances. The bank prioritized compliance over user privacy.

A U.K. bank official recently floated the idea of real-time digital wholesale pound settlements. It plans to launch a new real-time gross settlement system next year to enable fast interbank transactions and clearing.

The U.S. will also pilot its FedNow instant settlement system in July, while the European central bank recently released its third progress report on a potential digital euro.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.