Bankrupt crypto exchange FTX is seeking to claw back billions of dollars from embattled crypto lender Genesis Global Capital.

FTX is claiming that it got its assets out of the crypto exchange ahead of other creditors before both firms filed for bankruptcy.

According to a court filing on May 3, FTX creditors are seeking almost $4 billion from the crypto lender. Genesis, a subsidiary of Digital Currency Group (DCG), filed for Chapter 11 bankruptcy in January.

FTX Attempting to Clear Debts

The company lent billions of dollars to Alameda Research but was “largely repaid” by the time the firm collapsed, it stated.

The filing stated that Alameda repaid $1.8 billion in loans to Genesis. Additionally, it pledged $273 million to Genesis in the 90 days before FTX collapsed.

Another $1.6 billion was withdrawn from FTX by Genesis, and Genesis Global Capital International withdrew $213 million at the time.

FTX also alleged that Genesis was “one of the main feeder funds to FTX and instrumental to its fraudulent business model.” Loans to Alameda totaled as much as $8 billion in 2021, according to reports.

According to a Genesis spokesperson, the firm “remains focused on our restructuring process, through which we are working to reach a consensual resolution that maximizes value for all Genesis clients and stakeholders.”

The filing stated that:

“The Avoidance Actions will seek to claw back funds received by Genesis and non-debtor affiliates so that these funds can be shared with all other creditors of the FTX Debtors in the FTX Chapter 11 Cases.”

It added that the creditors include “several million customers owed over $11 billion as of the time of filing of FTX Chapter 11 Cases.”

FTX stated that the resolution of its clawback claims will depend on legal questions “concerning the valuation of collateral and the proprietary FTT token as well as payment practices on retail international cryptocurrency exchanges.”

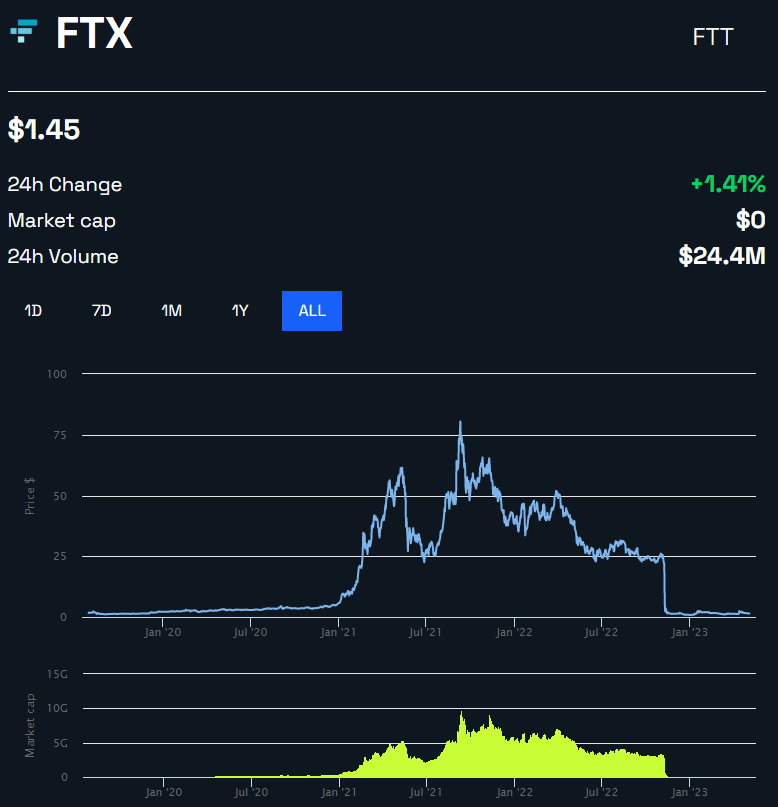

The FTT token was used as collateral for some of the loans the lender had with Alameda. However, the exchange token collapsed after the fall of FTX and currently remains down 98.3% from its peak.

Genesis Creditors Reject Deal

In February, Genesis announced a proposed deal for DCG to contribute to a settlement that would repay its clients. However, some of the creditors withdrew from the restructuring agreement in late April.

DCG, which also owns Grayscale, had hoped to sell Genesis to pay off at least $3.4 billion owed to creditors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.