Eole Inc., a Tokyo-listed digital marketing and communication services company, saw its shares rise after announcing a partnership with Singapore-based Slash Vision on Monday.

The company also launched a subsidiary focused on crypto asset management to expand digital finance operations.

Strategic Partnership Targets Crypto-Focused Financial Infrastructure

Tokyo-based Eole, operator of the free group messaging service “Rakuraku Renrakumou,” announced a capital and business alliance with Slash Vision on Monday. Slash Vision develops the self-custody crypto credit card “SlashCard”. This card allows users to transact in cryptocurrencies and stablecoins under Japan’s regulatory framework.

Under the agreement, Eole will acquire Slash Vision’s shares for approximately $1.36 million, and is expected to hold a 5.05% stake. Both companies plan joint initiatives, including linking Eole’s lending services to Slash Vision’s wallet. They also intend to develop on/off-ramp functionality between Japanese yen and stablecoins such as USDC and JPYC.

The partnership aligns with Eole’s midterm strategy to develop financial infrastructure using crypto assets. It also supports the company’s goal of providing decentralized finance (DeFi) access and broadening digital financial services. By formalizing these initiatives, Eole intends to clarify operational structures while remaining compliant with regulatory requirements.

Launch of Neo Crypto Bank Subsidiary With Slash Vision Partnership

Alongside its partnership with Slash Vision, Eole established Neo Crypto Bank LLC, a wholly owned subsidiary focused on crypto asset investment and management. The unit is designed to professionalize digital asset operations and implement standardized asset allocation, risk assessment, and portfolio management processes. This structure strengthens governance, ensuring financial reporting and compliance adhere to regulatory standards.

The subsidiary will be the central entity, overseeing Eole’s crypto portfolio and exploring additional crypto-based products, such as stablecoin services, DeFi applications, and lending integrations. By consolidating these functions, the company aims to ensure transparency and maintain a regulated framework for asset management.

Neo Crypto Bank will define accountability structures for investment decisions and operational risk management. This approach is intended to provide clarity for investors and support compliance monitoring. It also positions Eole to expand systematically into decentralized financial services while maintaining regulatory control and risk oversight.

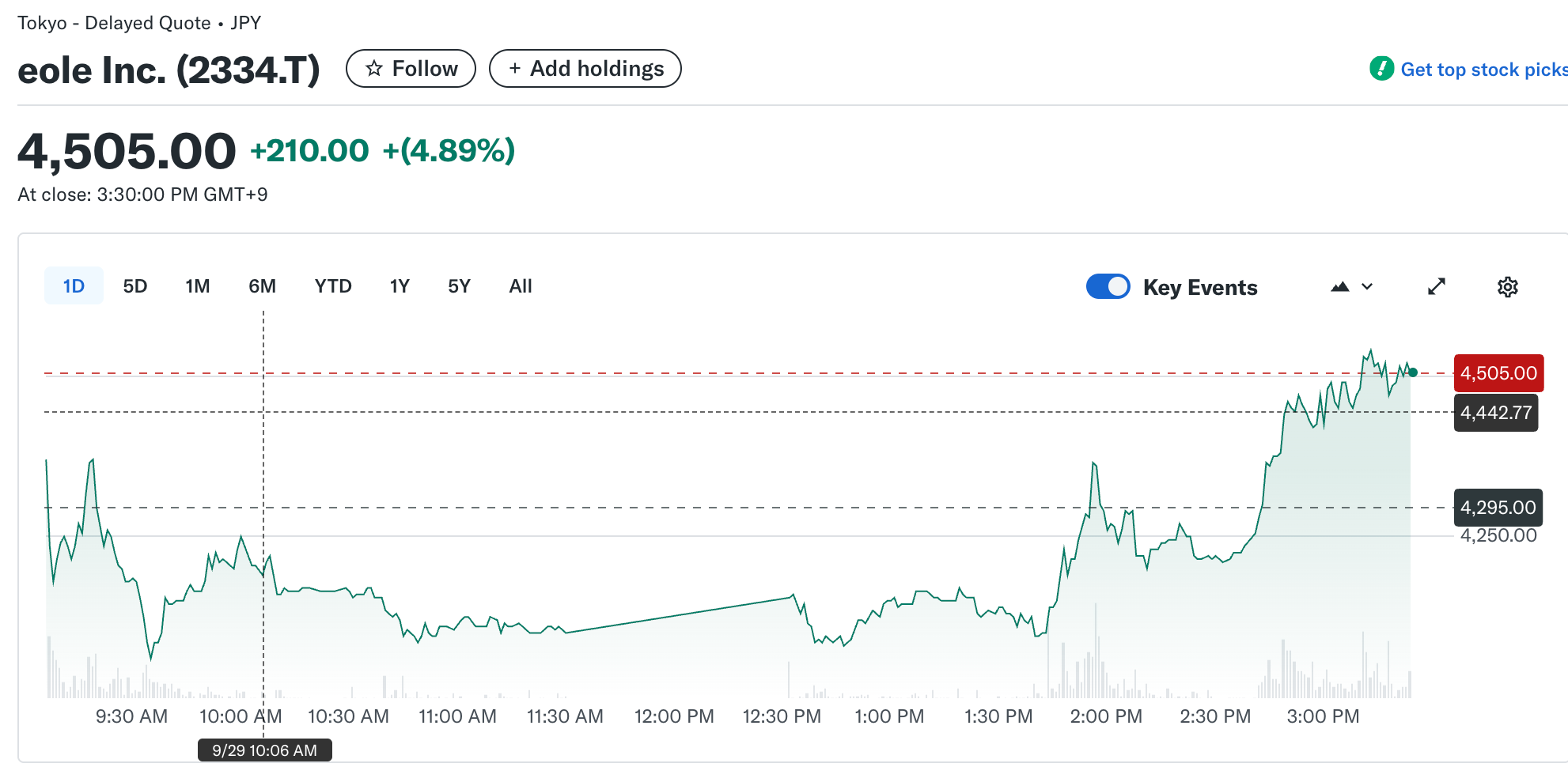

Stock Performance Signals Investor Confidence

Eole shares closed at 4,505, up from 4,290 the previous day, an increase of approximately 4.89%. The rise followed announcements about the Slash Vision partnership and the launch of the Neo Crypto Bank subsidiary.

Analysts noted that the movement reflects investor attention to firms bridging traditional finance and digital asset infrastructure. While the gain was modest, it was notable in a volatile market environment. Eole’s approach—taking an equity stake in Slash Vision, establishing on/off-ramp functions, and creating a dedicated subsidiary—appears to have reassured shareholders seeking operational clarity.

The pace of Japanese crypto regulation will likely influence Eole’s initiatives. Regulatory clarity could enable the company to expand services more aggressively. Conversely, regulatory uncertainty or market fluctuations may limit momentum. Execution and compliance will be critical in maintaining investor confidence.