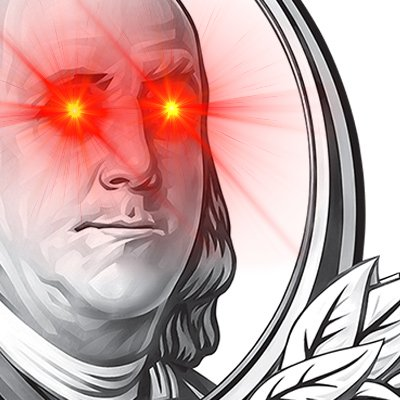

Franklin Templeton embraces crypto to the fullest, boldly updating its logo to feature laser eyes. This audacious move starkly contrasts Vanguard’s conservative approach, as they block access to Bitcoin ETFs.

The divide among traditional financial firms highlights the ongoing debate about the role and potential of cryptocurrencies.

Franklin Templeton Goes Laser Eyes

76-year-old asset manager Franklin Templeton has embraced cryptocurrency culture. Indeed, the company updated its X profile picture to include laser eyes on its logo featuring Ben Franklin. This is seen as a clear nod to the crypto community and its aspirations.

“Franklin Templeton is one of the largest asset managers in the world. Their new profile pic has laser eyes,” crypto investor Scott Melker said.

The addition of laser eyes is more than a mere aesthetic update. It signals Franklin Templeton’s support for the crypto market’s collective hopes for a parabolic Bitcoin price rally.

This gesture of solidarity comes at a pivotal moment, as issuers of the newly approved spot Bitcoin ETFs vie for a share of investors’ capital. Hours after US regulators greenlit the innovative products, Franklin Templeton, with a hefty $1.5 trillion in assets under management, made the strategic alteration.

The laser eyes on Ben Franklin are a subtle hint at the fierce competition that lies ahead in the cryptocurrency ETF market.

Vanguard Blocks Access to Bitcoin ETF

However, this story of corporate crypto embracement is not uniform across the financial sector. Vanguard, known for its conservative stance, has taken a markedly different approach. Reports indicate that Vanguard is actively blocking customer access to publicly listed, SEC-approved Bitcoin ETFs.

The backlash from clients has been swift and decisive. Vanessa Harris, a former Vanguard client, shared her experience.

“Just fully transferred my retirement account from Vanguard to Fidelity because Vanguard won’t support Bitcoin ETFs, and appears to be manipulating the price of Bitcoin by only allowing people to sell GBTC, not buy,” Harris said.

Vanguard’s reluctance to offer spot Bitcoin ETFs stems from its view on the high volatility of cryptocurrencies. On the other hand, other brokerages like E*TRADE, Charles Schwab, and Fidelity, where users can actively trade in spot Bitcoin ETFs.

A spokesperson for Vanguard confirmed the firm’s stance on cryptocurrencies and Bitcoin.

“We also have no plans to offer Vanguard Bitcoin ETFs or other crypto-related products – our perspective is long-standing that cryptocurrencies’ high volatility runs counter to our goal of helping investors generate positive real returns over the long term,” the spokesperson affirmed.

This divergence in corporate attitudes towards Bitcoin ETFs underscores a broader debate within the financial sector about the role and potential of cryptocurrencies.

Recently, JP Morgan CEO Jamie Dimon, a consistent critic of Bitcoin, once more expressed his negative view on the leading digital currency. He reaffirmed his belief that it serves as a mechanism for criminal activities and tax evasion.