What do the most powerful companies in the world have planned? Crypto, blockchain, and Web3 projects figure increasingly in the strategic plans of Fortune 100 executives. A full 52% of them have launched or planned to launch such operations since the beginning of 2020. That’s according to a new Coinbase study undertaken in partnership with The Block. When it comes to NFTs, in particular, the Fortune 100 know which way the wind is blowing.

The study will surprise those who continue to view cryptocurrency as a fringe financial asset lacking mainstream acceptance and legitimacy. Among its other findings are that the Fortune 100 crypto projects are not idle abstractions but are far along. And the trend extends beyond the top 100 firms. A full 83% of the Fortune 500 executives who reported said that their firms either have active crypto projects, or plan to launch them.

Crypto Projects Are the Future

The report describes a financial services sector whose leaders have not been idle when it comes to innovation. CEOs do not want competitors to gain an edge. And they know they cannot ignore crypto’s potential.

Hence, the report states, some 60% of the Fortune 100 initiatives reported since the early months of 2022 have already launched. Or, in some cases, are in a “pre-launch” phase.

According to the report’s authors, the launch of blockchain and crypto products is all but inevitable in today’s markets. It would be hard to run a fintech or financial services firm, and leave digtial assets out of your planning.

“These companies are innovating and investing in these technologies because they know that the century-old global financial system needs updating, that blockchain can be a foundational solution” the report states.

“Not keeping pace will mean losing ground in this global economy to competitors around the world,” it adds.

The report also presents a breakdown of the crypto and blockchain projects into industries and sectors. Those predominating are financial services, tech, and retail. About 75% of the Fortune 100 initiatives are in these three areas, the report states.

An area of growing popularity is investment in NFTs. Here, the report identifies Nike as the leader among the Fortune 100 in royalty revenue. As well as other key categories such number of collections launched, and purchaser base.

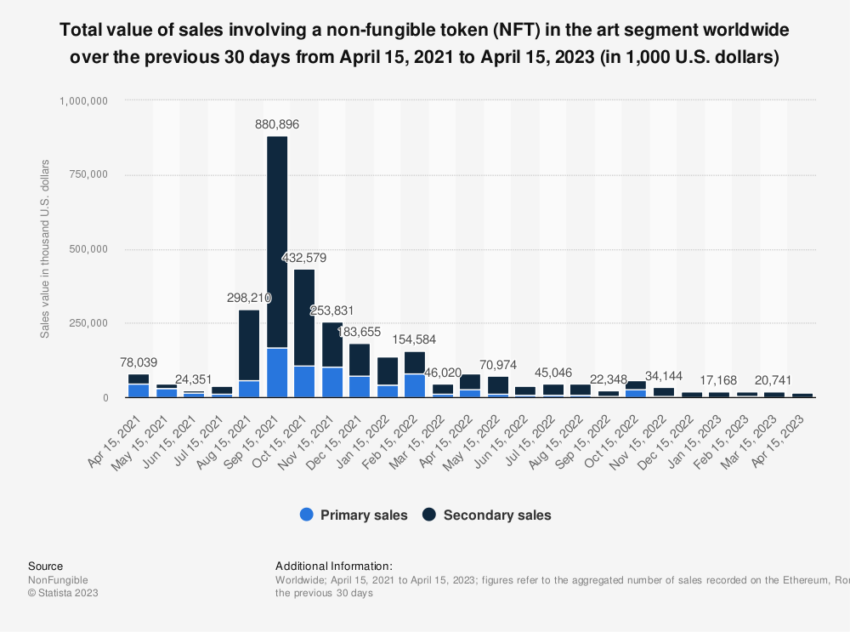

All told, NFT collections under the auspices of the Fortune 100 are a huge hit. The secondary market volume in this category is over $1.6 billion, the report states.

Crypto Investments Predominate

Some observers of the sector have described waning interest in crypto. For example, data compiled by Galaxy Digital Holdings in April found that investments in crypto firms dropped in the first quarter of 2023. Hitting $2.4 billion, the lowest quarterly figure since 2020.

But the Coinbase study argues for putting such short-term decline in perspective. It suggests that interest among the largest and most powerful corporations still runs strong. In point of fact, Fortune 100 firms have made 109 venture capital investments since 2017. More than $8 billion worth of rounds have benefited 80 crypto and blockchain startups.

“Blockchain is the heart of corporate innovation: data collection/management (for both customer and internal data) is a top current use case,” the report states.

It calls blockchain the focus of the highest number of planned initiatives. A full 77% of executives surveyed here believe that blockchain can improve the financial sector for all participants.

While financial products grow more sophisticated, the rules sadly are often useless. The Coinbase report takes an implicit swipe at using a test from 1946—the Howey Test—to regulate assets and services in 2023.

According to the report, 92% of respondents said policymakers need to devise new rules. Rather than rely on old rules that applied far more to the financial world of the past.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.