In a recent statement, the Floki team addressed the Hong Kong Securities and Futures Commission’s (SFC) concerns about their high-yield staking programs. It also emphasized its commitment to compliance and explained the mechanics behind its high annual percentage yield (APY) offerings.

Last Friday, the Securities and Futures Commission (SFC) of Hong Kong issued a warning targeting the “Floki Staking Program” and “TokenFi Staking Program.”

Floki’s Staking Rewards Under Scrutiny by Hong Kong Regulators

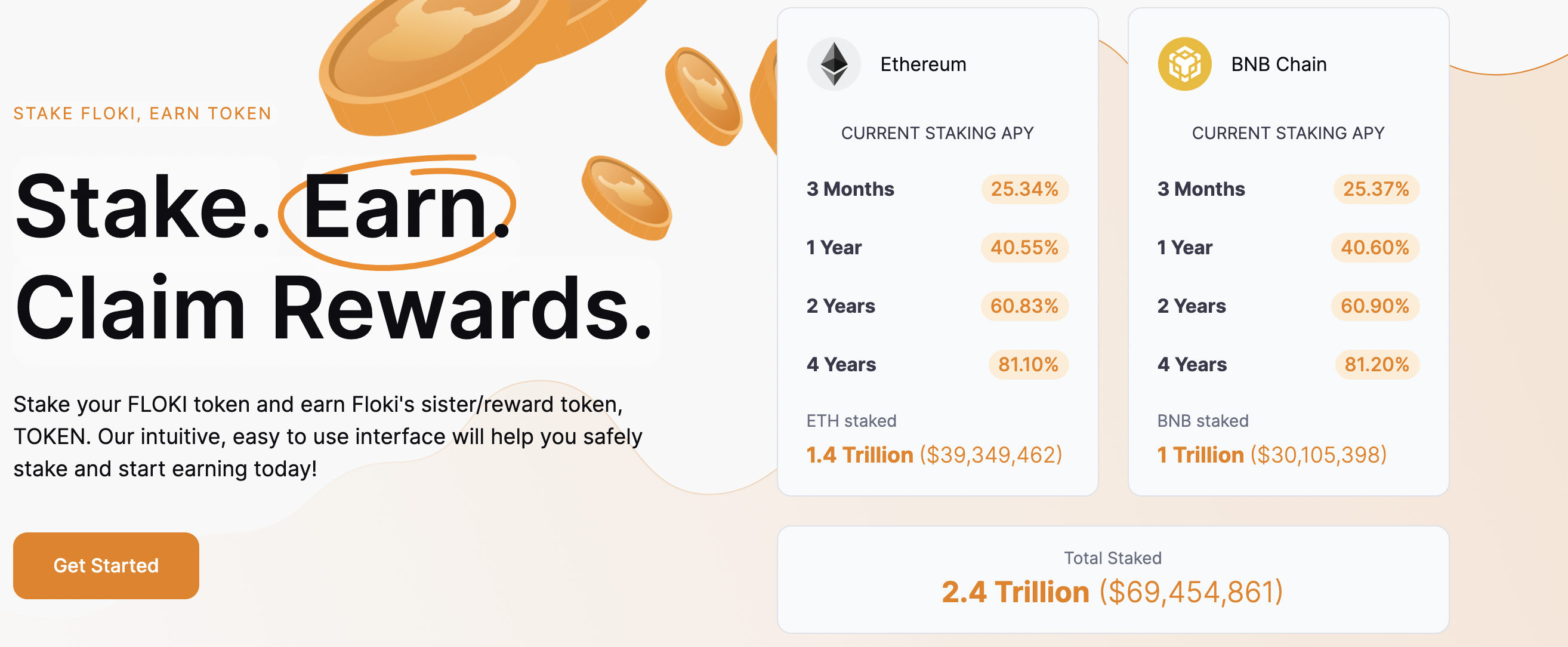

The Hong Kong SFC claims that Floki’s staking products, which promise returns from 30% to over 100%, lack official authorization in Hong Kong.

Read more: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

The SFC’s concern revolves around the feasibility of such high returns. Both programs now feature on its Suspicious Investment Products Alert list. Investors are urged to be wary of schemes offering “too-good-to-be-true” returns.

In retort, the Floki team outlined its compliance efforts. The Floki team has taken steps to block Hong Kong users from its staking programs. This includes website warnings and other technical barriers. To date, the Floki team reports no Hong Kong user participation.

The team also shed light on its high APY strategy. It rewards stakers with TOKEN, the utility token of TokenFi. This approach aims to avoid token inflation. Also, a significant portion of TokenFi’s supply goes to stakers.

Instead of raising tens of millions of dollars in VC funds and/or doing a huge presale prior to launch, which would have resulted in VCs and presale buyers getting most of the token supply, we opted not to raise funds from VCs or do a presale. Instead, the majority of the TokenFi token’s supply was allocated to users who stake FLOKI,” said the Floki team.

The Floki team also addressed the sustainability of its high APY. It noted that the APY is market-driven, and the value of rewards fluctuates with TokenFi’s market performance.

The dialogue between the SFC and the Floki team reflects a broader crypto industry conversation. It touches on innovative rewards, community empowerment, and regulatory compliance. This is especially relevant in places like Hong Kong, where crypto regulations are still taking shape.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This unfolding debate highlights the need to balance innovation with regulation. The SFC’s warnings and Floki’s response aim to protect investors and support community interests in the crypto space.