BeInCrypto breaks down the five biggest altcoin movers and shakers from the previous week. Will their momentum continue this week?

The five altcoins that increased the most last week were:

- Oasis Network (ROSE): 92.26%

- Civic (CVC) : 88.09%

- Fantom (FTM) : 84.95%

- Quant (QNT) : 84.62%

- IOTA (IOTA) : 80.76%

ROSE

On Aug 23, ROSE was rejected by a descending resistance line that had previously been in place since the March 14 all-time high price.

However, it regained its footing after and managed to break out on Aug 31. It has been moving upwards at an accelerated rate since.

Currently, it’s attempting to break out from the $0.206 resistance area. This is both the 0.786 Fib retracement resistance level and a horizontal resistance area. Doing so would likely cause ROSE to move towards a new all-time high price.

The MACD and RSI are both moving upwards, supporting the legitimacy of the upward move.

CVC

Similar to ROSE, CVC made an attempt at breaking out from a descending resistance line on Aug 24. After the initial rejection, it broke out on Sept 3.

Two days later, it managed to reach a new all-time high price of $0.98. However, it decreased sharply the same day.

Currently, CVC is attempting to find support above the $0.60 horizontal area, which previously acted as resistance. Doing so would likely allow for the continuation of the upward movement.

FTM

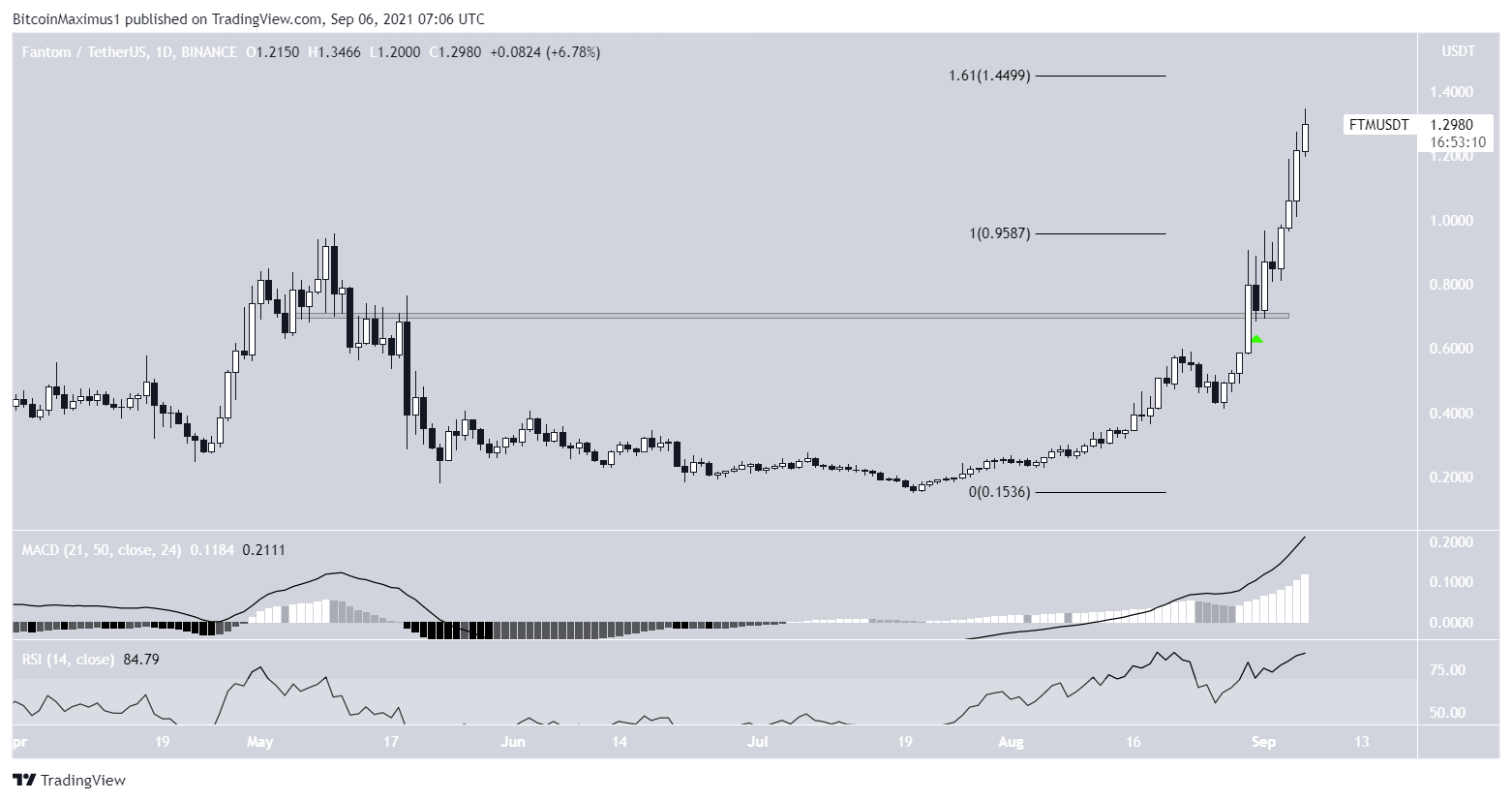

On Aug 30, FTM broke out from the $0.705 horizontal resistance area. It validated it as support the next day (green icon) and has been moving upwards since.

After reaching a new all-time high price on Sept 3, FTM accelerated its rate of increase. On Sept 6, it reached a new all-time high price of $1.34.

The next resistance area is found at $1.45. This is the 1.61 external Fib retracement resistance level when measuring the most recent drop.

Both the MACD and RSI are moving upwards.

QNT

QNT has been moving upwards rapidly since July 20. After breaking out from the $180 resistance area on Aug 28, it validated it as support throughout the next ten days.

It initiated another upward move on Sept 3 and has reached a high of $385 on Sept 6.

While technical indicators are still bullish, the rally has become completely parabolic, something which is not sustainable in the long term.

IOTA

IOTA has been moving upwards since July 20. It created a higher low on Sept 2 and accelerated shortly after.

However, it was rejected by the $1.88 resistance area and is decreasing. This is the 0.618 Fib retracement resistance level and a horizontal resistance area.

It seems that the increase is part of the third wave of a bullish impulse. Therefore, after a drop that would complete a fourth wave pullback, another upward move would be expected.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.