Fidelity International is planning to launch a money market fund that could trade on a blockchain, signaling a key moment for investors exploring innovative financial solutions.

This move adds to the growing trend of traditional finance (TradFi) institutions using blockchain technology to enhance their market reach and accelerate financial transactions.

Fidelity Plans Blockchain-Traded Fund

The firm filed with the US Securities and Exchange Commission (SEC), outlining its plans for the prospective tokenized money market fund. This marks an important step in integrating TradFi instruments with blockchain technology, which is critical in this era of speed and efficiency.

In hindsight, Fidelity joined JPMorgan’s Tokenized Collateral Network (TCN) in June. The move served as a pilot to the tokenization of its own money market fund with the bank’s Onyx Digital Assets. The firm also collaborated with Chainlink and Sygnum in early July to tokenize $6.9 billion in Fidelity’s Institutional Liquidity Fund data.

This growing interest in leveraging blockchain in money market funds comes amid a broader push for enhanced transparency and reduced costs. This is while providing investors with new avenues to manage their assets. Therefore, Fidelity’s prospective blockchain-traded tokenized fund could attract attention from institutional as well as retail investors.

Read more: What is Tokenization on Blockchain?

The recent move reflects the growing demand for digital financial products. It also serves as a testament to Fidelity’s commitment to embracing technology and enhancing client deliverables. The firm’s proactive approach positions the firm among TradFi players at the forefront of contemporary finance.

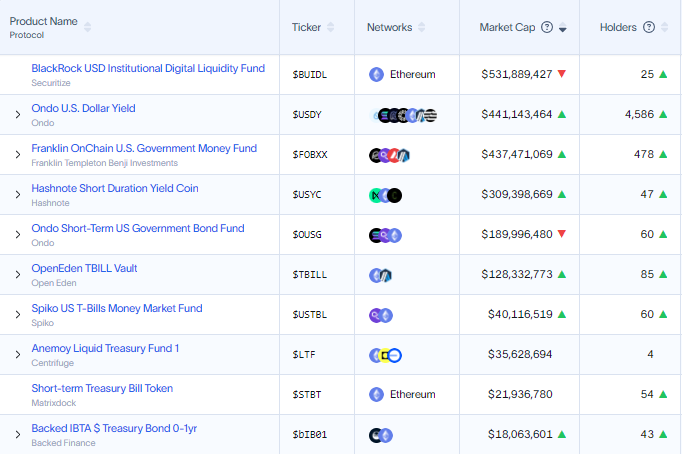

Forerunners like BlackRock and Franklin Templeton have already entered the blockchain space. Fidelity’s proposed tokenized fund closely resembles BlackRock’s BUIDL product, which has attracted over $500 million due to increasing investor interest.

These developments suggest an unstoppable evolution among TradFi, which will bring faster transactions and more transparency to the financial sector. It delivers a robust platform, expertly integrating the stability of traditional money market funds with the advantages of blockchain technology.

Recent Data Breach Necessitates Enhanced Security Protocols for Fidelity

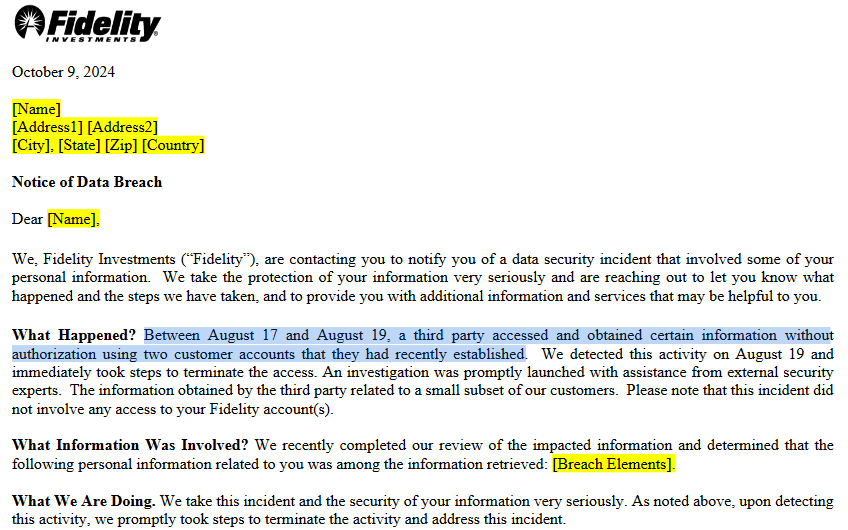

Meanwhile, Fidelity also faces challenges related to data security, illustrating the complexities involved in adopting new technologies. In a recent incident, Fidelity, which is also a crypto ETF (exchange-traded fund) issuer, suffered a data breach. The attack affected the personal information of more than 77,000 of the firm’s 51.5 million customers.

The perpetrator reportedly accessed customer names, among other personal identifiers, starting August 17. They capitalized on two recently established customer accounts. However, their access was terminated immediately after discovery on August 19, with help from “external security experts.” While no Fidelity accounts were accessed, the firm reported the incident to clients nonetheless.

With this notice, the firm committed to offering the 77,000 affected customers two years of free credit monitoring and identity restoration service. This is intended “to detect any unusual activity that may affect your personal financial situation.”

Read more: A Guide to the Best AI Security Solutions in 2024

Notably, this marks Fidelity’s fourth data breach in 12 months. Other incidences were reported on March 4, March 18, and July 19. As Fidelity navigates this new territory in digital finance, it must also prioritize security measures. Notwithstanding, the world may be on the verge of a major shift in global finance as renowned players adopt blockchain technology.