Bitcoin price continued its upward movement of the past week following news that the US Securities and Exchange Commission (SEC) met with prominent asset manager Fidelity regarding its proposed spot BTC exchange-traded fund (ETF).

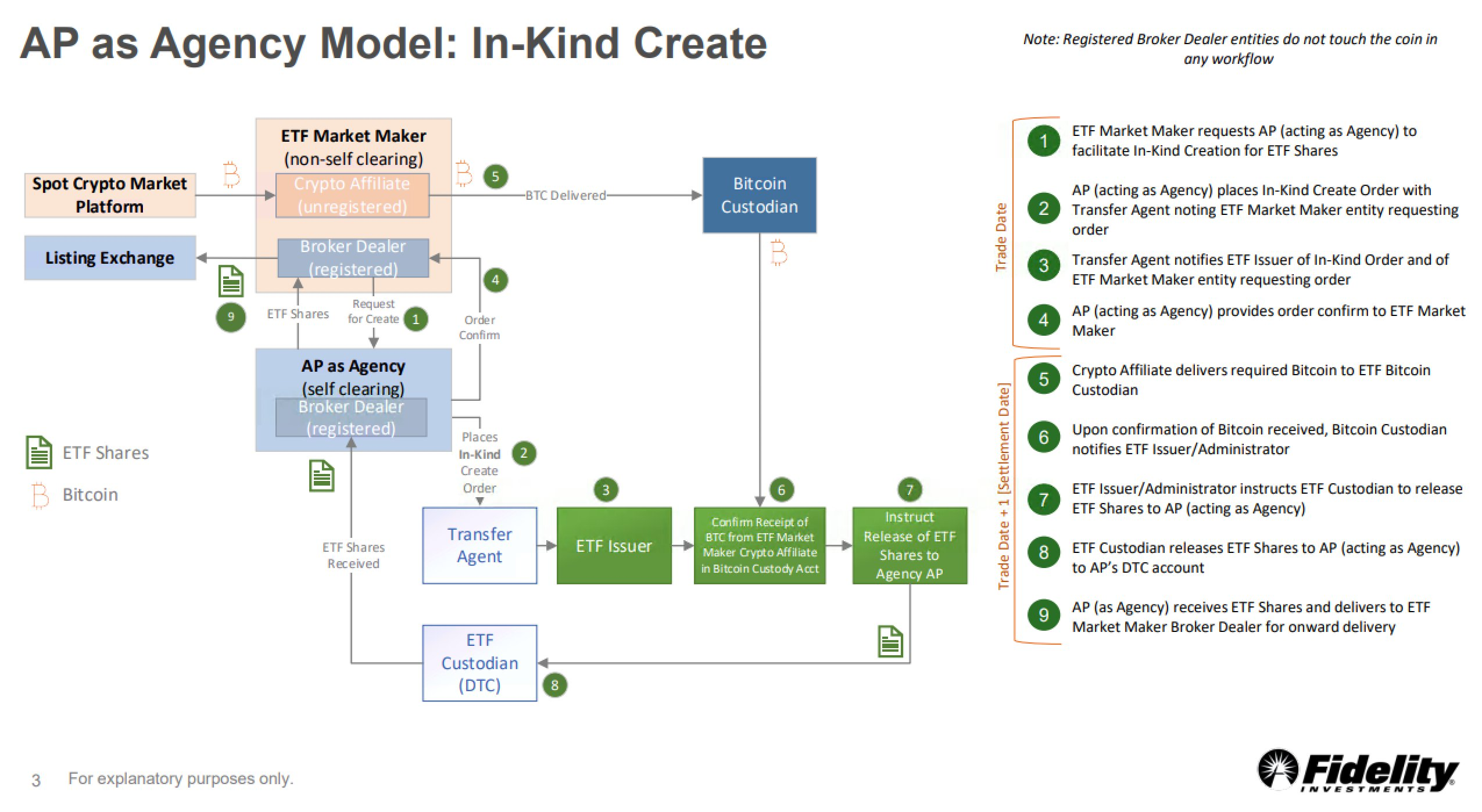

The meeting, held on December 7, involved Fidelity presenting a detailed paper outlining the “in-kind” creation and redemption models for the spot Bitcoin ETF. Several members of CboeBZX also attended the meeting.

Fidelity Meets SEC Over Bitcoin ETF

In its presentation, Fidelity detailed how various parties will coordinate to create the spot Bitcoin ETF shares and ultimately deliver them to the market maker for further distribution through a broker-dealer.

Nate Geraci, the President of the ETF store, pointed out that the most important part of the workflow was that “Registered Broker Dealer entities do not touch the coin in any workflow.”

The presentation follows the appearance of Fidelity’s ‘FBTC’ ticker symbol on the US Depository Trust and Clearing Corporation (DTCC) website. Fidelity is the third-largest asset management firm in the world, with more than $4 trillion in assets under management.

This is not the first time a Bitcoin ETF applicant has met with the SEC. Last month, the financial regulator held talks with several applicants, including Grayscale, BlackRock, Hashdex, and others.

What’s Next For the BTC Price?

Observers have suggested that these engagements have helped increase the bullish sentiments surrounding the crypto market.

Crypto trader Mags said Bitcoin was testing an important level, highlighting two scenarios where the price moves towards $48,000 or retraces to $35,000. He added that whatever scenario plays out the current market bullishness will continue.

“BTC traded within a massive range back in 2021-2022, price broke down later and printed bear market lows at $15,500. Price recently reclaimed the old 2021-2022 range and is currently testing the mid-range… The overall idea is bullish, any dips are opportunities for buying,” Mags said.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

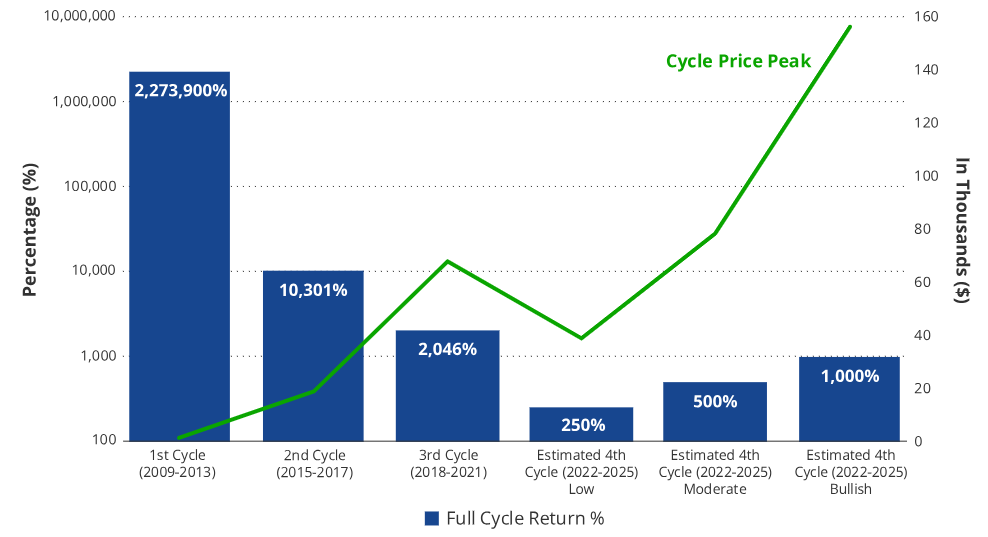

On the other hand, asset manager VanEck stated that BTC’s price is unlikely to fall below $30,000 during the first quarter of next year and could reach a new all-time high by the fourth quarter. According to the firm, more than $2.4 billion is expected to flow into the spot Bitcoin ETFs that would be approved during the first quarter, setting the ground for a bullish year for the top crypto.

“If Bitcoin reaches $100,000 by December, we make a long-shot call that Satoshi Nakamoto will be named Time Magazine’s ‘Man of the Year,'” VanEck predicted.

Bitcoin’s price has increased by more than 180% year-to-date, according to BeInCrypto data. The flagship asset reached a yearly peak of more than $44,000 before retracing to its current levels of $43,860 as of press time.