AI crypto coins are surging, with the sector’s market capitalization rising nearly 7% on Tuesday. Tokens like Artificial Superintelligence Alliance (FET) and Bittensor (TAO) are leading the rally, posting double-digit gains.

Announcements from major artificial intelligence companies, including Nvidia, Microsoft, Apple, Google, and OpenAI, often spark activity among AI coin traders.

iPhone 16 Features Cause 10% Surge for FET and TAO

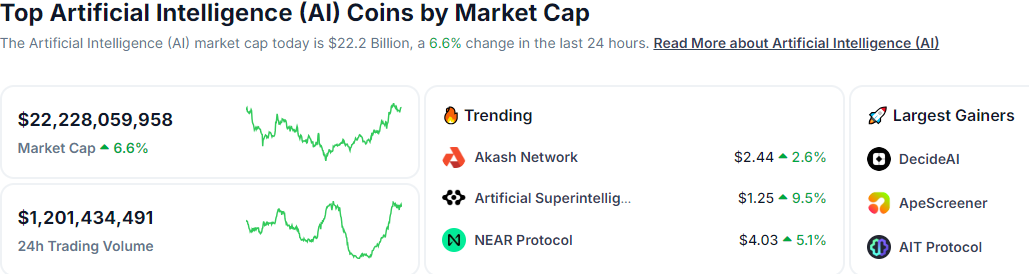

FET and TAO spearheaded the AI crypto rally with 10% gains on Tuesday, while SingularityNET (AGIX) and Ocean Protocol (OCEAN) climbed 9%. Other tokens in the sector, such as Near Protocol (NEAR), Internet Computer (ICP), and Render (RNDR), saw increases of around 5%. According to CoinGecko data, these surges have boosted the AI crypto sector’s market capitalization by 7%, reaching $22.22 billion at the time of writing.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

These surges follow news of Apple’s latest product release, the iPhone 16, which reportedly includes AI features. Rowan Cheung, founder of the artificial intelligence newsletter The Rundown AI, highlighted the new A18 chip, designed to optimize the performance of generative AI models.

“The next generation of iPhones is built to use AI from the ground up,” Cheung wrote.

The AI focus follows the firm’s Apple Intelligence platform, revealed after a series of generative AI news from industry players such as Google and Open AI. Several features of the iPhone 16 are built on this platform, enabling AI capabilities directly on users’ devices.

This development is bullish for AI crypto coins, as it suggests growing adoption and utilization of artificial intelligence technologies, which could drive further interest in the sector.

The “Inverse Cramer” Effect Moves AI Coins

In addition to the iPhone 16 news, another bullish catalyst for AI crypto coins is recent remarks from Jim Cramer regarding chip-making giant Nvidia. The famous TV personality and host of CNBC’s Mad Money said he is “waiting for NVIDIA to bottom.”

Cramer’s statement appears to have provided guidance to many AI crypto traders and investors who were uncertain amid the current market conditions, prompting them to take action.

Indeed, the television personality’s reputation as the ‘Inverse Cramer’ precedes him. The concept builds on the idea that whenever Jim Cramer makes negative comments about an asset or investment, it is likely to go up in value and vice versa.

In February 2023, for example, Cramer said Silicon Valley Bank (SVB) stock was a buy at $320. As of March 30, 2023, however, the stock was selling for a penny. Similarly, Binance ex-CEO Changpeng Zhao (CZ) took Cramer’s March 2023 remarks about not doing business with Binance as an endorsement of the trading platform.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

Therefore, Cramer’s Nvidia bottoming remark is taken as a positive signal for the chip-making conglomerate’s stock, NVDA. Taken together, however, the news about Apple’s iPhone 16 and Nvidia inspired optimism for AI crypto coin traders.