The US Federal Reserve announced an endless asset purchase program to combat the economic slowdown arising due to the COVID-19 pandemic.

However, this has sparked fears that the Fed could infuse new currency in the market, which would lead to a further drop in the dollar’s purchasing power. As a result, yields on all long-term treasury bonds, which are traditionally considered to be a safe haven asset, collapsed. This could rekindle investor interest in the broader cryptocurrency market as investors search for better investment alternatives.

Yields on the two-year, five-year, and 10-year U.S. Treasury bonds collapsed after the sudden announcement of the Fed’s endless asset-buying spree on March 23, 2020. Panicked investors sold long-term bonds to move their capital into short-term bonds. Shorter duration bonds are considered to be more cash-like due to their liquid nature.

U.S. Treasury Yields on Long-Term Bonds Collapse

Yields on all long-term U.S. Treasury bonds underwent a heavy correction after the Fed bought up assets. The U.S. 10- year Treasury bond yield slumped below 1 when Fed Chairperson Jerome Powell announced a rate cut last week. It then went on to fall below 0.8 after Monday’s announcement as investor capital flowed to more liquid assets such as short-term bonds and debt.

During the 2008 economic crisis, similar investor behavior was observed as well, in that capital moved from the equity market into government-backed bonds. Treasury bonds issued by the exchequer are considered as the safest investment option but also offer some of the lowest interest rates.

During the crisis, many investors rushed to buy central bank-backed bonds. The massive demand for bonds, however, resulted in them being oversold. This factor, coupled with an accommodative monetary policy, kept bond yields low as cheap credit was easily available.

There has also been a consistent fall in the yield of 10-year bonds issued by the U.S. Treasury, UK gilt, German bunds, and the Japanese Government between 2008 to 2017.

Federal Reserve Announces Slew of Measures

This asset-buying spree follows the Fed’s earlier decision of buying investment-grade securities from the open market as well as buying corporate and debt bonds. The latter is a first in the Federal Reserve’s 106-year history.

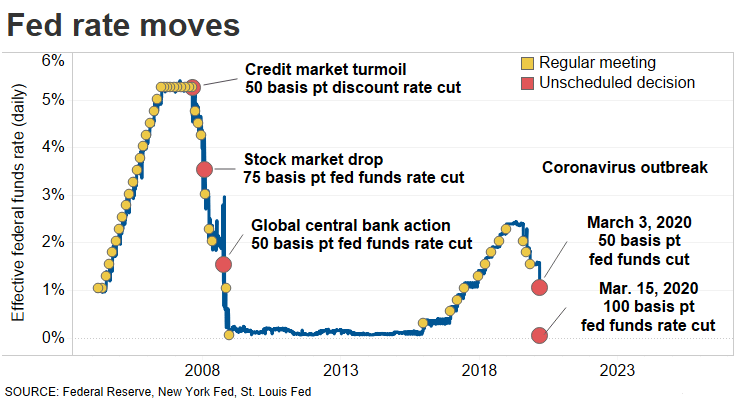

Small businesses and households have been severely impacted due to economic slowdown. On March 17, 2020, the Federal Reserve Board announced the setup of a Commercial Paper Funding Facility (CPFF) to support credit flow. In the same week, the Federal Reserve had also announced a 0.1 percent cut in interest rates, bringing down the benchmark rate to a range of 0 to 0.25 percent. It also unveiled a $700 billion asset purchase plan to maintain liquidity in the lending market.

Federal Reserve Very Likely to Print New Money

Still fresh from the scars of the global recession of 2008-09, the Federal Reserve has left no stone unturned as it scrambles to keep the economy together. The world’s most powerful Central bank has already deployed a $2 trillion asset-buying program and committed more funds to fight the slowdown. So far, the Jerome Powell-led Federal Reserve has announced unlimited purchases of government debt and bonds, municipal and corporate bonds, and mortgage-backed securities.

Beginning with the 100 basis point rate cut and the latest endless asset-buying program, the Federal Reserve has shown that it will not repeat mistakes made during the time of the previous economic crisis. It does not want to be scrutinized for putting the burden of another economic slowdown on the national exchequer and has already taken significant steps in this regard. It has shown signs that it could adopt a more aggressive stance to ensure the American economy does not enter another phase of extended contraction in economic activity.

https://twitter.com/ricburton/status/1242098383008845824

The bigger question here is how will the Fed be able to afford this endless buying of assets. In an interview, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, stated that the Federal Reserve has an ‘infinite’ amount of cash at its disposal.

Bitcoin and Precious Metals Could Witness Price Rise

The ‘infinite’ supply of fiat currency remains to be among the top reasons why the cryptocurrency asset class is considered to be superior to traditional, Central bank-backed economies. Digital currencies such as Bitcoin are limited in quantity and can only have a fixed number of units in circulation.

One of the biggest impacts of the Fed’s economic stimulus will be the rapid rise in inflation. Whenever new tender is printed, it leads to a fall in purchasing power. As a result, goods and services in the open market become more expensive over time.

Certain cryptocurrencies aim to alleviate this problem by making it impossible to print, mint, or generate new tokens. Precious metals are the only other asset type to exhibit this nature. This is the key reason why precious metals also tend to increase in valuation during periods of economic uncertainty. Having said that, it remains to be seen if the Fed’s asset purchases — along with Mr. Kashkari’s remarks — will go on to have a greater impact on the cryptocurrency market in the coming weeks.