The US Federal Reserve has often been accused of obscuring economic truths and manipulating data for political purposes. This issue is increasingly relevant as economists grow pessimistic about inflation and the International Monetary Fund (IMF) raises concerns about global economic stability. Can blockchain technology fix things?

Blockchain technology may solve these problems, enabling transparent, tamper-proof economic data and reducing the potential for manipulation.

The Fed’s Track Record: Questionable Economic Reporting

In recent years, the Federal Reserve has been accused of withholding crucial economic information from the public. Recently, The Hill reported that the central bank often played politics by presenting biased economic data. This manipulation of information impacts public perception and policy decisions, undermining trust in the institution.

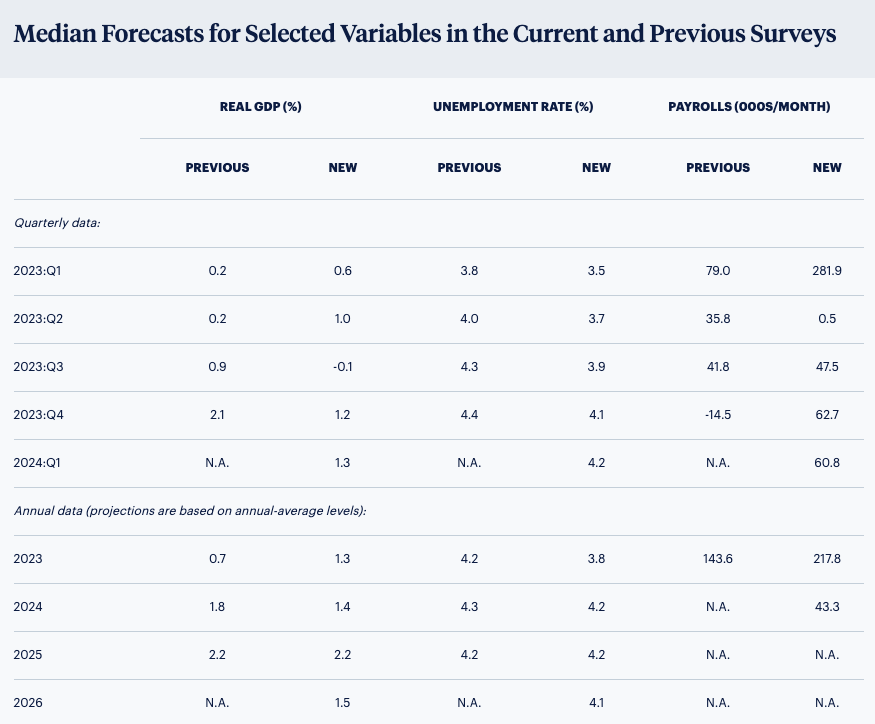

The Wall Street Journal also reported that economists have grown more pessimistic about inflation. The Philadelphia Federal Reserve’s Survey of Professional Forecasters estimated inflation to be higher than previously expected.

Even the Fed’s staff predicted an increased likelihood of a banking crisis leading to a recession within the year. This contradicts Chairman Jerome Powell’s public statements, which have painted a more optimistic picture of the economy.

“Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years,” as per the publicly posted minutes from the meeting.

The discrepancy highlights the potential inaccuracy and unreliability of the Federal Reserve’s economic reporting.

The IMF’s World Economic Outlook raises concerns about global economic stability. It cites increasing geopolitical tensions, inflationary pressures, and mounting debt levels as significant risks to global economic stability.

Meanwhile, US Treasury Secretary Janet Yellen issued a warning that the government might exhaust its cash reserves by June 1 if Congress fails to increase or temporarily suspend the debt ceiling.

These issues emphasize the importance of accurate, transparent economic data in informing policy decisions and maintaining public trust.

Blockchain: A Solution to Economic Transparency

Blockchain technology, a decentralized digital ledger, offers the potential to revolutionize the way economic data is recorded and shared. By storing information in a transparent, tamper-proof, and accessible manner, blockchain can help eliminate the possibility of manipulation and provide a clearer picture of the economy.

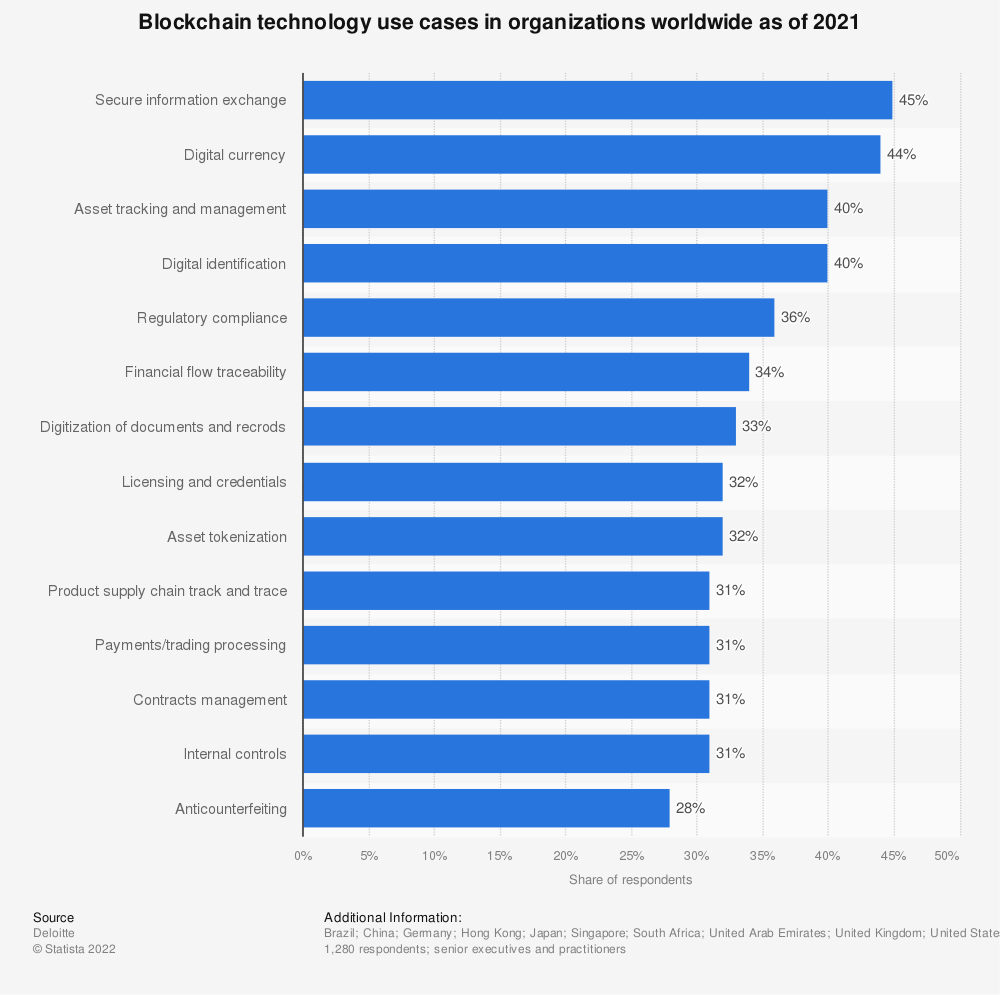

This technology already plays a vital role in various industries, such as finance, supply chain management, and healthcare, demonstrating its potential for widespread adoption.

The Federal Reserve could create a more transparent and accountable system for reporting economic data using blockchain technology.

Indeed, with all transactions recorded on the blockchain, it becomes virtually impossible for any single entity to manipulate the data. This would help reduce the potential for politically motivated manipulation of economic information during periods of economic turbulence or uncertainty.

As a result, the central bank’s economic reporting would be more credible and reliable, fostering greater public trust and informed decision-making. Blockchain’s decentralized nature could enable real-time access to economic data, allowing for more timely and accurate analysis.

Blockchain Implementation: Overcoming Challenges

Implementing blockchain technology in economic data reporting has challenges, including privacy and security concerns.

To ensure the protection of sensitive financial data, robust encryption, and security protocols must be put in place. This will involve collaboration among the Fed, blockchain developers, and cybersecurity experts to develop solutions that address these concerns while maintaining the transparency and integrity of the system.

For blockchain technology to revolutionize economic data reporting, widespread adoption and collaboration among various stakeholders are also essential. This includes the Federal Reserve, government agencies, financial institutions, and private sector organizations.

These entities can establish standardized protocols and processes by working together. The goal is to ensure the seamless integration of blockchain-based systems into existing economic infrastructure.

Although blockchain technology has shown great promise in various industries, it has limits. Scalability, energy consumption, and transaction speed are among the challenges.

As blockchain technology continues to evolve, developers and researchers must find innovative solutions to these issues to ensure blockchain can effectively support the demands of the modern economy.

A Future of Trust and Transparency

The US Federal Reserve’s history of questionable economic reporting has eroded public trust and raised concerns about the accuracy of its data. Blockchain technology offers a potential solution to this issue, providing a transparent, tamper-proof, and accessible platform for recording and sharing economic information.

By embracing this technology and overcoming its inherent challenges, the Fed and other economic institutions can pave the way for a more transparent, accountable, and trustworthy economic reporting system.