The United States Federal Reserve (Fed) has warned that a spike in interest rates and stablecoins could pose risks to the U.S. economy.

The report contains the Fed’s assessment of the resiliency of the U.S. financial system, and how financial stability can be promoted.

Two of the most notable highlights are the fact a sharp rise in interest rates risks the economy, and so do stablecoins.

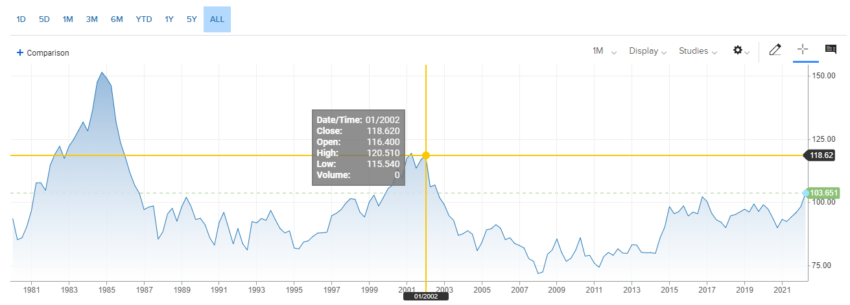

The U.S. economy, like many others in the world, is shedding value following the Fed raising interest rates by half a percentage point. The S&P 500 closed below 4,000 yesterday for the first time since March 2021. And analysts anticipate even greater losses.

An increase in interest rates has largely been the reason behind the market drop. The world’s biggest economy has also been suffering from high inflation rates, affecting consumers. The Fed notes that further adverse news in inflation and interest rates create more problems.

Fed warns of higher volatility

It also says: “Additionally, a sharp rise in interest rates could lead to higher volatility, stresses to market liquidity, and a large correction in prices of risky assets, potentially causing losses at a range of financial intermediaries, reducing their ability to raise capital and retain the confidence of their counterparties.”

The Fed also believes that stablecoins are prone to runs and that as the sector continues to grow rapidly it “remains exposed to liquidity risks.” The report goes on to say that the assets backing them might lose value and become illiquid.

Some analysts believe that the dollar has benefited from the high levels of Treasury yields. They also suggest that economic turmoil in other markets could lead to further strengthening of the dollar.

For example, if the Ukraine war drags on then related currencies in Europe may face a drop in value. The U.S. dollar, meanwhile, could be a safe haven.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.