Fantom holders have been loyal to the token despite the macro bearish undertone plaguing the crypto market. But how far can FTM holders push price action?

The global cryptocurrency market cap presented an over 15% decrease in the last 24-hours oscillating at $878.77 billion at press time. With most of the top altcoins bleeding, Fantom price action was in despair too.

On Oct. 22, Fantom price started to recover from the heavy losses charted throughout the year. FTM price saw sustained gains (barring a couple of days) from Oct. 22 onwards, until Nov. 8 when price action succumbed to bears.

A look at Fantom on-chain indicators suggested some positive outlook for the token in case a recovery began. However, with price down by 16.77% on the daily window and some key supply-demand indicators looking bleak there’s not much for FTM Holders to be excited about.

Fantom Holders to Rescue FTM Price?

At the time of writing, FTM price stood at $0.20, a 17.08% drop in price on the daily chart, while presenting a 9.68% drop on the weekly chart. While the recent crash has massively affected FTM price, FTM holders were still optimistic.

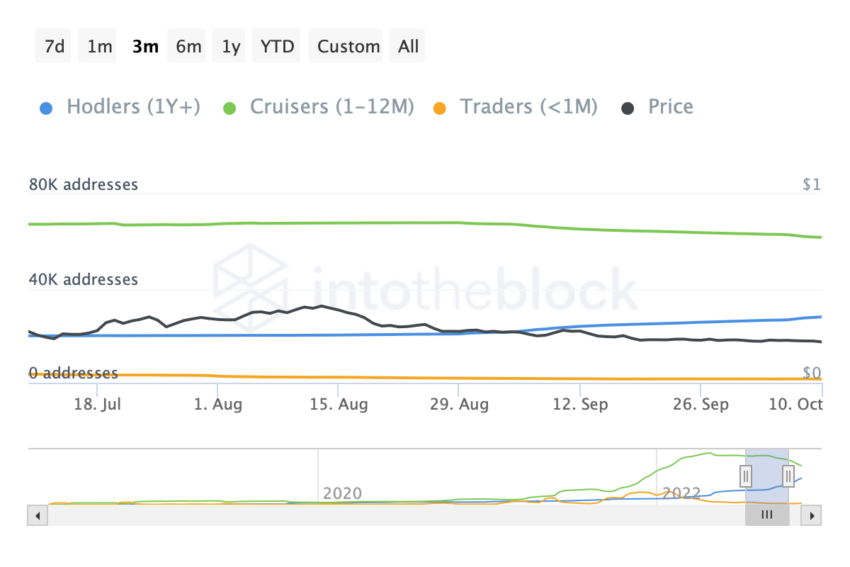

IntoTheBlock data highlighted that Fantom holders saw a 31.47% rise in the last 30-days. However, cruisers, which earlier dominated FTM addresses, saw a 13.36% decline. Addresses by time held data for Fantom showed a healthy rise in holders and traders over the 30-day window.

However, balance by time held showed that only holders increased their balance while both traders and cruisers had reduced their bags. One reason for this could be the lower price range in which Fantom has been moving.

Fantom price was down 94.17% from its all-time-high price of $3.47 made in Oct. 2021. Furthermore, Fantom short-term and long-term ROIs presented rather grim numbers with yearly ROI vs USD at 92.95%.

Even though Fantom holder addresses and holder balances saw a growth, it would be difficult for FTM holders to keep prices up in such a volatile environment.

Where are FTM Whales?

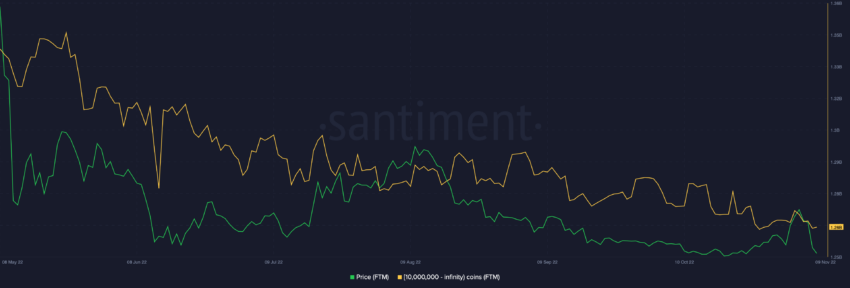

Holders increasing their balance is a positive long-term signal, however, whales often play a more significant role in macro price movement. Sadly, FTM whale addresses had been reducing holdings.

A look at Fantom supply distribution by balance of addresses showed that its largest whale cohort had reduced their holding by almost $90 million. FTM addresses with 10 million to infinity coins held over 1.35 billion coins in May and were now down to holding 1.26 billion as the indicator oscillated near its yearly lows.

That said, a down tick in active addresses and network growth for Fantom further induced some bearish pressure for the token. Lastly, Fantom DeFi total value locked was still near all-time low levels around the $468.87 million mark.

With DeFi TVL at a low, active addresses and trader count dropping the demand for FTM seemed to be waning. A push from retailers, traders and cruisers could prove to be healthy for FTM price.

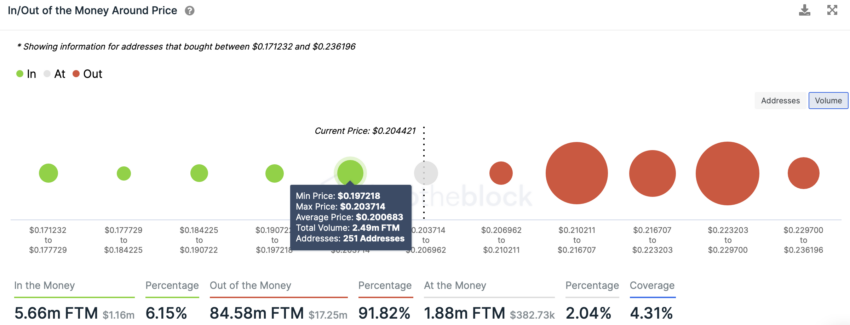

However, in the meantime, if FTM price fell below the $0.20 mark the same could lead to more losses since there is no major support wall for FTM price.

IntoTheBlock’s In and Out of Money Around Price suggested that at the $0.20 mark, 251 addresses held 2.49 million FTM token after which there’s no major supply wall to avoid price drop.

However, in case of the bearish invalidation if price rises, an uptick to the next resistance at the $0.21 mark could be expected.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.