Last week, Brazil greenlit the first spot Solana exchange-traded fund (ETF), sparking debates about the possibility of US approval. However, several financial experts remain skeptical due to concerns over the native token, SOL.

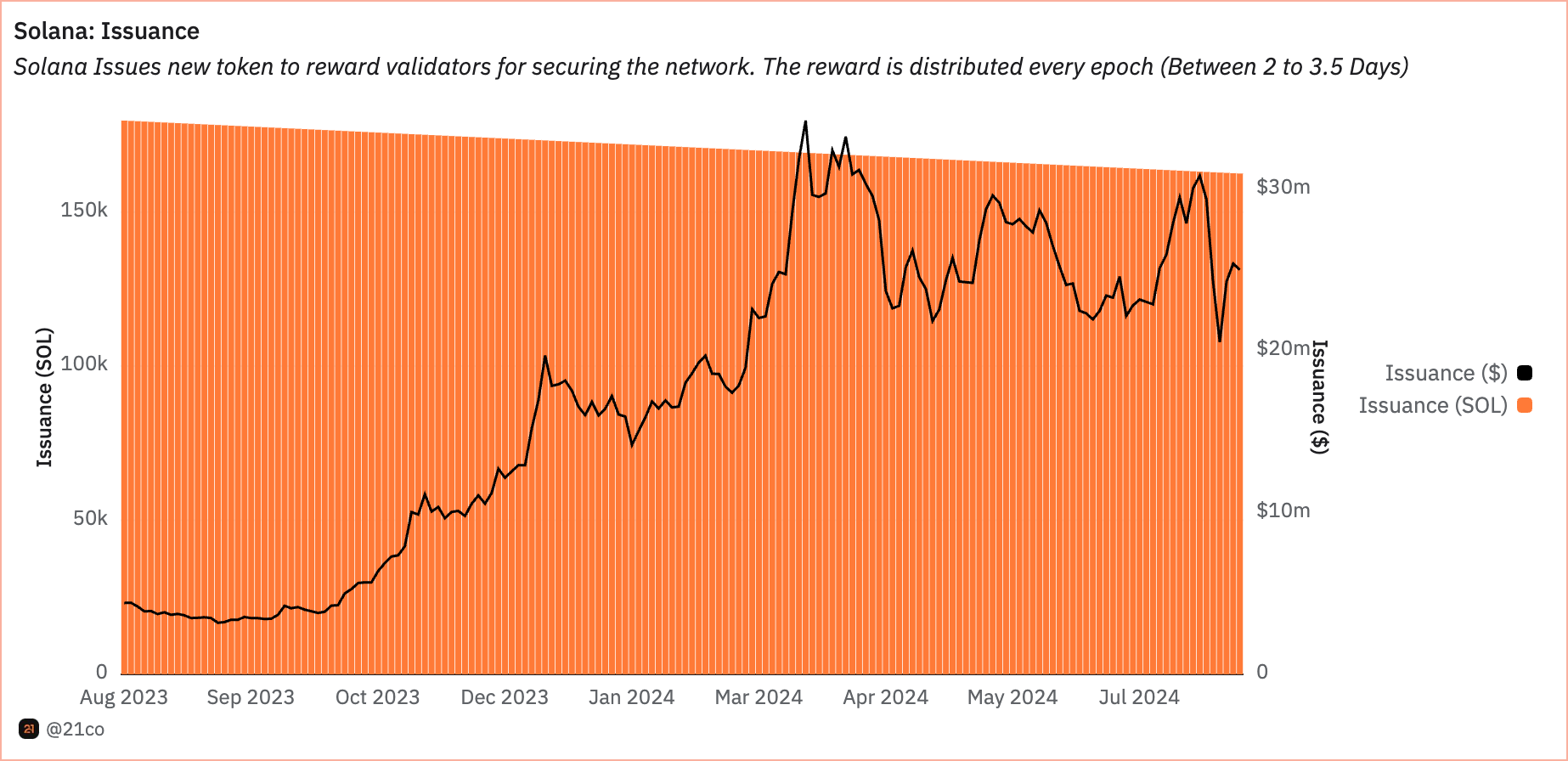

A key issue is the substantial daily issuance of SOL tokens.

SponsoredChallenges to Solana ETF Approval

Data from a Dune dashboard on August 11 showed an issuance of over 162,503 SOL, valued at approximately $25 million. These tokens are rewards distributed to validators to maintain network security. Critics argue that this high issuance rate might increase selling pressure, potentially destabilizing the asset’s long-term value.

One outspoken critic, known as smartestmoney.eth, questioned the market demand for SOL given its high emission rate.

“Who will be the next marginal buyer of SOL when a supply overhang of 165,000 daily emissions—with more unlocks to come—overpowers the demand?” He asked rhetorically.

Smartestmoney.eth also pointed to the lack of an ETF as a factor that could limit institutional interest, especially with players like Larry Fink turning towards Ethereum.

Read more: Solana ETF Explained: What It Is and How It Works

Additionally, there are concerns that the Brazilian approval of a Solana ETF might not actually benefit local investors. A user known as Caramel expressed skepticism on X (Twitter).

Sponsored“Brazil approved a Solana ETF! Solana’s fully diluted valuation shows that 20% of SOL is still locked. VCs are going to rob this country blind out of their wealth. March 2025, save the date,” pseudonymous X user Caramel said.

He referenced the unlock schedule of Solana, owned by the now-defunct FTX, highlighting a significant unlock of 7.5 million SOL scheduled for March 2025.

| Unlocks | # of SOL | Unlock Schedule | Tokens per Unlock |

| 1 | 12,000,000 | September 2021 – September 2027 (Linear monthly) | 142,857 |

| 2 | 32,524,833 | January 2022 – January 2028 (Linear monthly) | 451,734 |

| 3 | 7,500,000 | March 1, 2025 (Full Unlock) | 7,500,000 |

| 4 | 61,853 | May 17, 2025 (Full Unlock) | 61,853 |

BlackRock’s digital asset head, Robert Mitchnick, also expressed reservations about the feasibility of a Solana ETF. He emphasized the market cap and maturity disparity between leading cryptocurrencies and relatively smaller assets like Solana.

“I don’t think we’re going to see a long list of crypto ETFs. If you think of Bitcoin, today it represents about 55% of the market cap. Ethereum is at 18%. The next plausible investible asset is at, like, 3%. It’s just not close to being at that threshold or track record of maturity, liquidity, and etc.,” Mitchnick said.

Moreover, in an interview with BeInCrypto, Griffin Ardern, Head at BloFin Research & Options, discussed other potential obstacles for Solana, particularly its network stability.

Historically, Solana has experienced several severe downtime incidents, and even the entire blockchain network has rolled back transactions or been unavailable for more than 24 hours. SOL issuers may need to prove that the Solana network is mature and stable enough and that the probability of similar incidents is “low enough for investors to accept” to protect investors’ rights and interests better,” Ardern told BeInCrypto.

Despite these hurdles, some optimism remains in the industry. Asset managers such as VanEck and 21Shares have already filed for a Solana ETF in the US.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

The US Securities and Exchange Commission’s decision-making deadline is mid-March 2025. This shows that, while there are huge challenges, the door is not entirely closed for a Solana ETF.