Following up from a somewhat unexpected turn of events earlier this week, Bitcoin prices have once again below $8,000. This is now the second time BTC has fallen below this crucial threshold since its resurgence in June earlier this year.

Understandably, this turn of events leaves many traders wondering exactly where the real support zone is when it comes to the BTC/USD charts.

As prices continue to fall and show signs of recurring bear movements, traders are finding it hard to pinpoint a solid support base that could put a halt to the plummeting prices. Regardless, some traders have theorized that the hard support line for Bitcoin is at or around the $7,500 price point.

The Scene Repeats

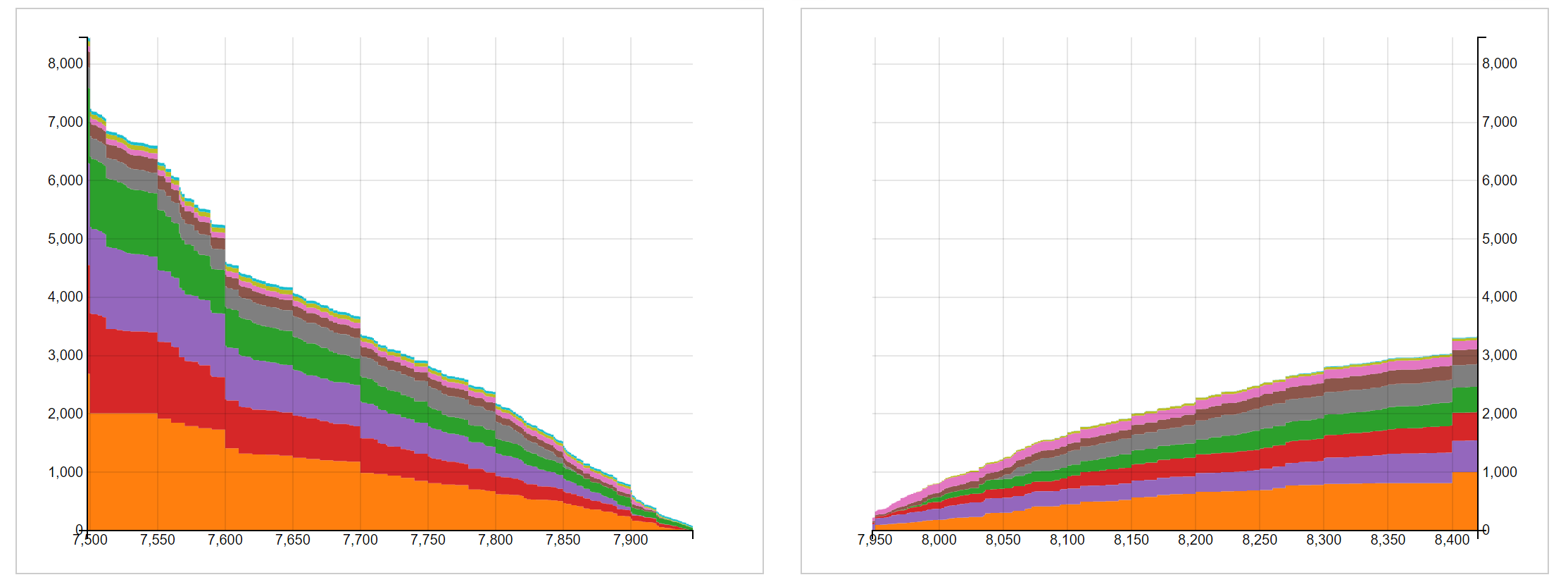

This is oddly similar to the situation last year, back in 2018 when the support lines were established around the $6,500 price point for months before crashing down to the $3,000 lows of this year. However, unlike last year, there is a huge amount of buying pressure waiting around the $7,500 mark. Looking at Bitcoinicity’s recently added combined order book, there is a combined 8,800 BTC ($70 million) in buying pressure waiting at $7,500, indicating that most bulls believe this value is where a market reversal is most likely to take place. Note that the combined order book only considers the total order volume across 10 specific exchanges, including Bitfinex, Kraken, GDAX among others. Because of this, the true amount of money waiting to move in at $7,500 is likely to be several-fold higher when considering all fiat to cryptocurrency exchange platforms.

Note that the combined order book only considers the total order volume across 10 specific exchanges, including Bitfinex, Kraken, GDAX among others. Because of this, the true amount of money waiting to move in at $7,500 is likely to be several-fold higher when considering all fiat to cryptocurrency exchange platforms.

The Moves Behind the Market

It is a common opinion that the recent fall in Bitcoin prices may have to something to do with the negative statements made by the US President Donald Trump back in July earlier this year. It is interesting to note that Trump’s negative statement came at a time when Bitcoin was just beginning to recover from this year’s lows, as BeInCrypto previously reported. Shortly following news that Trump was at risk of potentially being impeached, Bitcoin again saw its price crash. Although there is no direct correlation between these events, many long-term Bitcoin holders and even short-term speculators make their judgments based on how the price of Bitcoin moves against the dollar. Because of this, what happens in US politics can have a strong effect on the overall cryptocurrency markets, with Bitcoin being most affected due to comprising the great majority of the total market cap of all cryptocurrencies. However, despite the negative sentiments, which may or may not be part of propaganda and the current gloomy market conditions, there are several significant reasons why Bitcoin investors might want to think twice before hitting the ‘panic sell’ button, as BeInCrypto discussed an earlier article.

Facts like the 365 day moving average for transactional outputs reaching all-time highest levels, hash-rates smashing previous all-time highs, and perhaps most importantly—the active development of the Bitcoin source code are all indicators of positive health.

In some minds, these facts should easily outweigh any negative connotations that a short-term downturn in Bitcoin price could potentially bring.

However, despite the negative sentiments, which may or may not be part of propaganda and the current gloomy market conditions, there are several significant reasons why Bitcoin investors might want to think twice before hitting the ‘panic sell’ button, as BeInCrypto discussed an earlier article.

Facts like the 365 day moving average for transactional outputs reaching all-time highest levels, hash-rates smashing previous all-time highs, and perhaps most importantly—the active development of the Bitcoin source code are all indicators of positive health.

In some minds, these facts should easily outweigh any negative connotations that a short-term downturn in Bitcoin price could potentially bring.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored