The supply-chain-focused startup Everledger shut down its shop as the funds were running dry. The Australian government and Tencent were some of its notable investors.

Abundant Venture Capitalist funding was available in 2020-21. But with the Quantitative Tightening measures, the market funding is running dry. Hence, startups are struggling to raise funds.

A Failed Funding Round

According to Financial Review, Everledger placed itself into voluntary administration due to a lack of funding. Founder Leanne Kemp explains:

The second tranche of funding due to Everledger did not materialise and subsequently we understand that there are external reasons and pressures on this investor which has meant Everledger was placed in a difficult and unexpected position.

The company already let go of its entire workforce on March 31.

Everledger created digital records of the ownership and provenance of physical assets on the blockchain. It also provided services to track the movement of precious gems, wine, and fine art while boasting customers such as luxury brand Alexander McQueen.

Everledger Shuts Down After Raising Over $27 Million

The company got into a difficult position despite the support of notable investors, including the Australian and British governments. In 2021, it received $3 million from the Australian government’s blockchain private grant program. It also received $3.5 million from the British government’s Future Fund

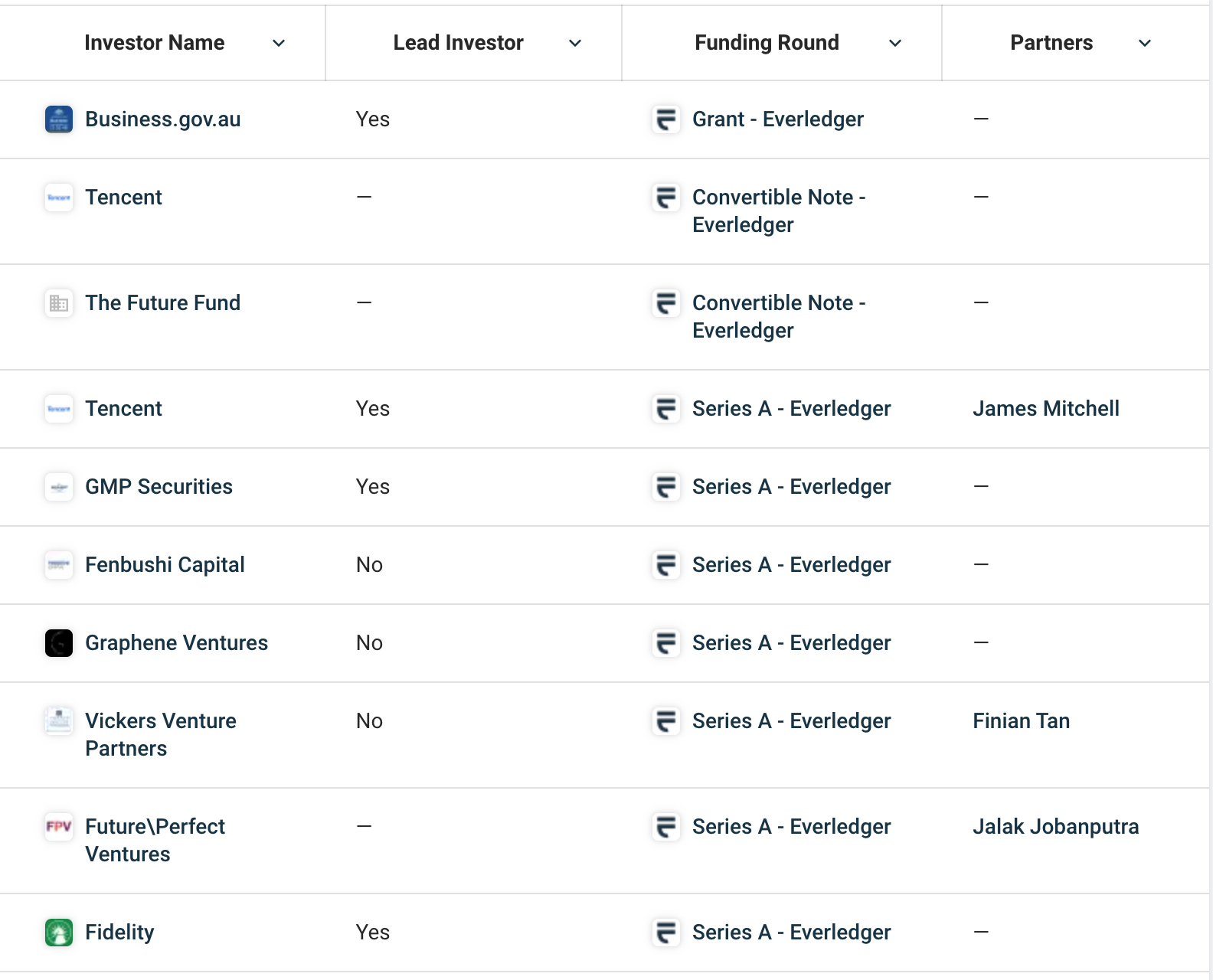

According to Crunchbase, the company raised a total of $27.3 million in funding through 8 funding rounds. The gaming vendor Tencent and Fidelity are some of the well-known investors.

In spite of receiving sizeable funding, the founder claims that Everledger was not a cash-burning startup. She justifies:

“Indeed, we planned this investment round as the last external funding round required before profitability. This is not a company that scaled too fast or took on venture capital and burnt it in 18 months”

Got something to say about Everledger or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.