On Monday, September 30th, the United States Securities and Exchange Commission issued a $24 million fine to the blockchain company block.one.

This was done in order to punish them for carrying out an unregistered ICO for more than a year, which BeInCrypto reported on previously. The ICO in question was EOS.

Senior eToro analyst Mati Greenspan stated that he has shifted a portion of his Binance Coin profits to EOS.

However, he did not specify a time-frame or a target for this move. This could be a long-term switch from BNB to EOS, or just a swing trade in order to maximize profits, Nevertheless, we are going to look at the current market outlook for both coins and analyze their future potential.Just shifted a bit of my $BNB profits to $EOS. That SEC fine was a godsend. #NotTradingAdvice #DYOR

— Mati Greenspan (tweets ≠ financial advice) (@MatiGreenspan) October 2, 2019

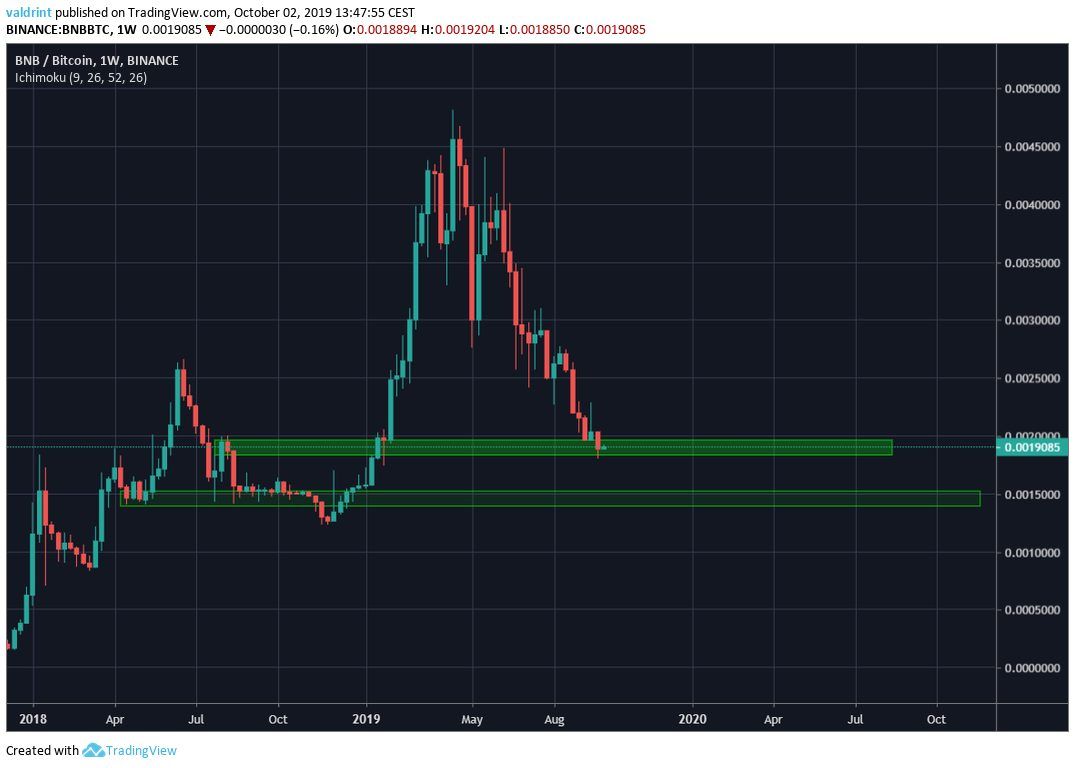

Binance Coin

Looking at the weekly BNB chart, we can see that the price has been trading inside the minor support area at 190,000 satoshis. The main support area is found slightly below the current level at 150,000 satoshis. Additionally, BNB has been trading inside a descending channel since June 26.

Even though the channel is a neutral pattern, the developing bullish divergence in the RSI makes us believe that the price will increase towards the resistance line.

If it reaches this, it would amount to a 17.5% increase from the current price.

Additionally, BNB has been trading inside a descending channel since June 26.

Even though the channel is a neutral pattern, the developing bullish divergence in the RSI makes us believe that the price will increase towards the resistance line.

If it reaches this, it would amount to a 17.5% increase from the current price.

Therefore, we can conclude that BNB has a short/medium-term increase potential of roughly 17.5%.

For a longer-term move, an upward move all the way to the top of the channel would amount to an increase of roughly 70%.

Therefore, we can conclude that BNB has a short/medium-term increase potential of roughly 17.5%.

For a longer-term move, an upward move all the way to the top of the channel would amount to an increase of roughly 70%.

EOS

Looking at the EOS chart we can see that the price is at a very significant support area, found at 30,000 satoshis. Unlike BNB, EOS is not trading inside a clearly visible trading pattern.

However, it has generated bullish divergence in the RSI which is visible even in the weekly time-frame, increasing its significance.

Unlike BNB, EOS is not trading inside a clearly visible trading pattern.

However, it has generated bullish divergence in the RSI which is visible even in the weekly time-frame, increasing its significance.

An upward move to the first resistance area amounts to an increase of 50%, while the second resistance area is roughly double the current price, amounting to a 100% increase.

An upward move to the first resistance area amounts to an increase of 50%, while the second resistance area is roughly double the current price, amounting to a 100% increase.

Summary

While the BNB price looks like it has the potential to initiate a short-term upward move, the EOS price is currently inside a very significant long-term support area. Furthermore, its long-term growth potential seems higher, offering much higher potential for future increases. Therefore, even though BNB looks like it is ready to make an upward move, the long-term potential of EOS makes it a more prudent investment. Do you think BNB or EOS will increase more during the next month? Let us know in the comments below.Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile. Images are courtesy of Shutterstock, TradingView.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored