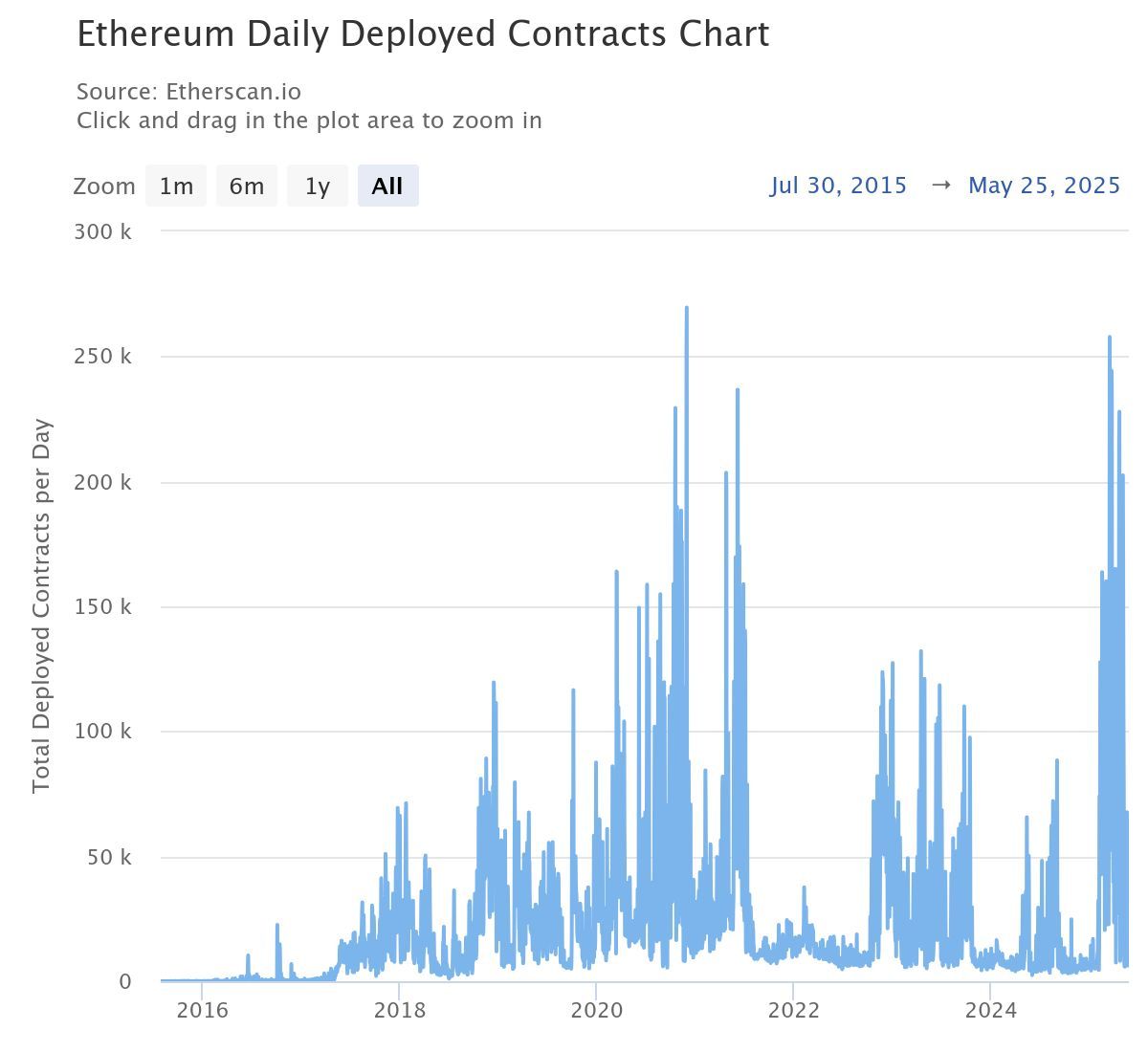

In 2025, Ethereum (ETH) experienced a significant surge in smart contract deployment activity. The number of contracts deployed daily has reached levels not seen since 2021.

This marks a strong revival in the Ethereum ecosystem, one of the world’s leading blockchain platforms. It also strengthens bullish predictions for ETH’s price, raising the question: Can Ethereum reclaim its all-time high from 2021?

What Could Drive Ethereum to $10,000?

According to Etherscan data, the number of smart contracts deployed daily on Ethereum has skyrocketed since the start of the year. The chart shows that in Q1 2025, daily deployments reached the highest level since 2021, when ETH hit its all-time high of over $4,800.

This surge in Q1 was mostly in anticipation of the Pectra upgrade. Additionally, the growing number of smart contracts reflects Ethereum’s increasing utility, which drives up demand for ETH.

However, the price of ETH hasn’t fully reflected this positive trend. It dropped from $3,700 to $1,400 before recovering to $2,500 at the time of writing.

Despite the price lagging behind smart contract growth, crypto investor Ted remains optimistic. He believes ETH could soon surpass its 2021 highs.

“Ethereum daily contract deployments just hit levels not seen since the 2021 bull run. Builder activity is rising, clear signal of on-chain momentum returning. Price follows fundamentals. ETH to $10,000 this cycle,” Ted predicted.

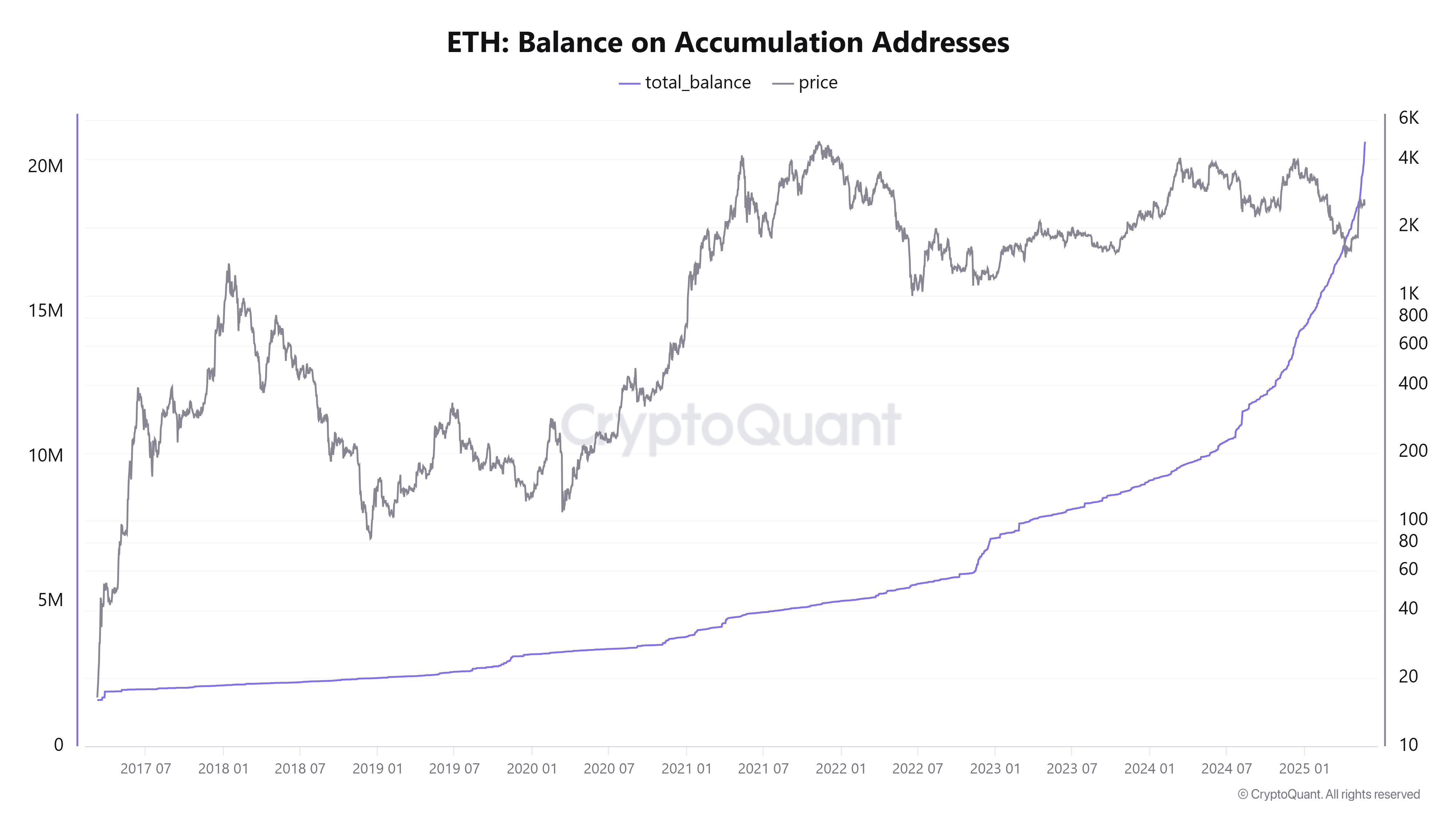

At the same time, data from CryptoQuant offers further optimism. The amount of ETH flowing into accumulation wallets just hit an all-time high. These wallets usually belong to large investors, also known as “whales.” The increase in inflows suggests strong long-term confidence in ETH’s potential.

As a result, the ETH balance in accumulation wallets reached a new high—nearly 21 million ETH, or 17.5% of the circulating supply. In 2025, the upward trend in this chart highlights intense ETH demand.

Record highs in smart contract deployment and ETH accumulation reinforce the view that Ethereum appeals to developers and investors, despite a volatile crypto market.

Past Price Performance Suggests a Short-Term Return to $4,000

Analysts have also made bullish price predictions based on ETH’s chart patterns.

Analyst Cas Abbe used the 2-week Gaussian Channel indicator to assess Ethereum’s price trend. By comparing past price behavior, Abbe forecasts that ETH could hit $4,000 in Q3 2025.

“ETH is trying to reclaim the 2W Gaussian Channel. Since 2020, ETH has only reclaimed this channel twice. Both times, it rallied strongly. In 2020, ETH rose from $300 to $4,000. In 2024, it climbed from $2,400 to $4,100. If ETH regains this level again, I’m confident it will reach $4,000 in Q3 2025,” Abbe said.

Another important factor is ETH’s performance compared to Bitcoin (BTC) in 2025. Data from CoinGlass shows ETH surpassing BTC in Q2. Currently, ETH’s Q2 return is +40%, whereas BTC’s is +33%.

CoinGlass’s historical data also reveals that ETH usually outperforms BTC in Q2. ETH’s average Q2 return is 64.22%, compared to BTC’s 27.30%.

However, recent on-chain analysis from BeInCrypto highlights growing investor caution. Many investors are locking in profits after ETH rebounded over 80% since early last month. This selling pressure could be a headwind for ETH’s path to higher price levels.