Ethereum price remains under pressure after a sharp decline that unsettled investors across the crypto market.

Although Ethereum appears to be entering a historically favorable accumulation zone, on-chain indicators reveal mixed conviction among different holder cohorts.

Ethereum Is In a Prime Accumulation Range

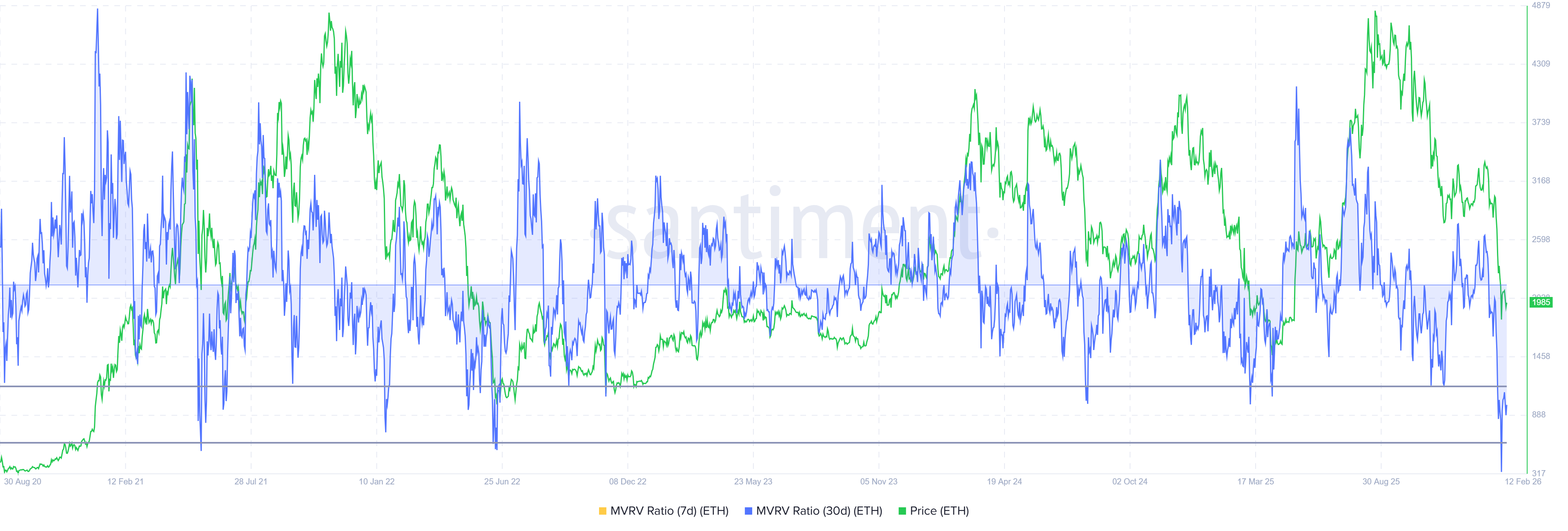

Ethereum’s Market Value to Realized Value, or MVRV, ratio indicates that ETH has entered what analysts describe as an “opportunity zone.” This range lies between negative 18% and negative 28%. Historically, when MVRV falls into this band, selling pressure approaches exhaustion.

Previous entries into this zone often preceded price reversals. Investors typically accumulate when unrealized losses deepen. Such behavior can stabilize the Ethereum price and initiate recovery phases. However, historical probability does not guarantee immediate upside.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Current macro conditions complicate the outlook. Liquidity constraints and cautious sentiment may delay accumulation. While MVRV suggests undervaluation relative to realized cost basis, broader market weakness could suppress momentum and extend consolidation before any meaningful rebound begins.

Ethereum Holders Are Leaning Differently

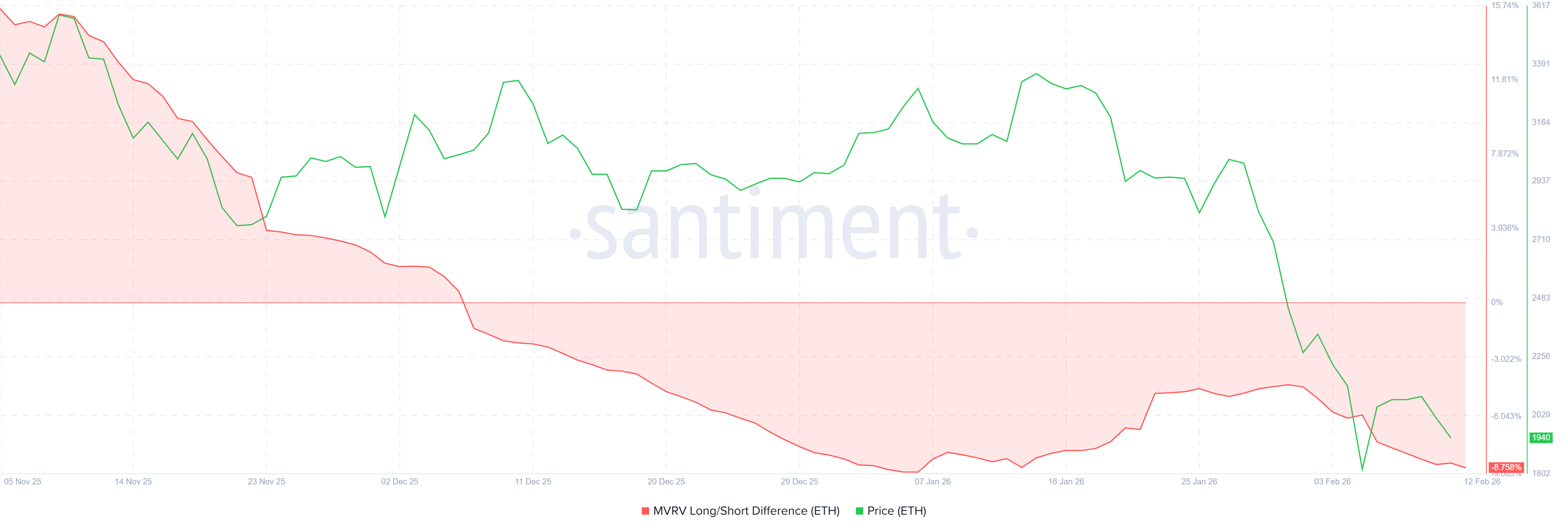

Short-term holders are regaining influence over Ethereum price action. The MVRV Long/Short Difference measures profitability between long-term and short-term holders. Deeply negative readings signal greater profitability among short-term holders compared to long-term investors.

Toward the end of January, the metric suggested profitability was shifting away from short-term traders. That trend hinted at an improving structure. However, the recent decline reversed that dynamic, restoring short-term holder profits. These investors typically sell quickly, increasing vulnerability to renewed downside pressure.

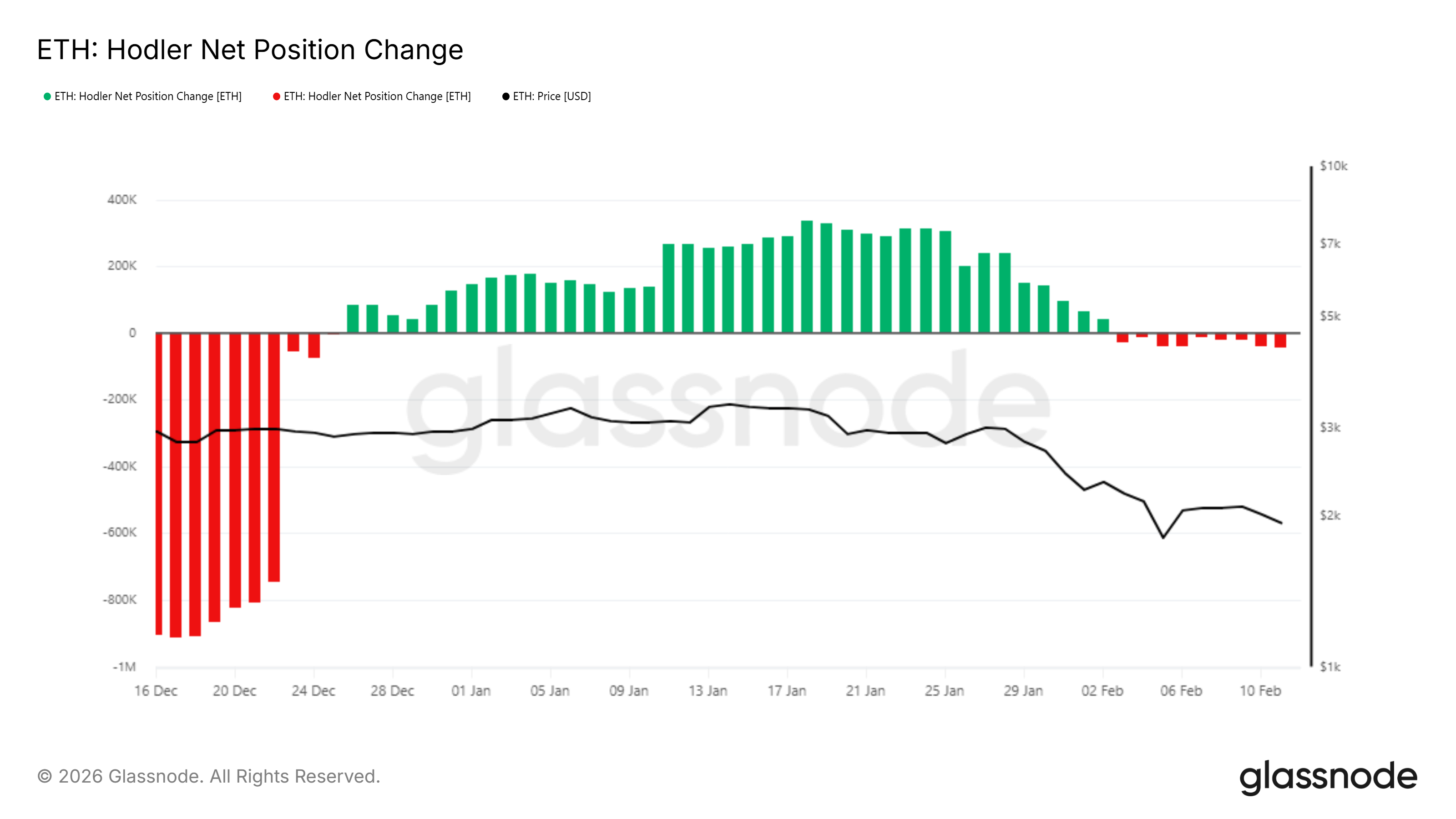

The HODLer net position change metric reveals another shift. Long-term holders previously exhibited steady accumulation. In recent days, the buying pressure has transitioned into distribution, reflecting reduced confidence among strategic investors.

Long-term holder selling adds structural risk. These participants often provide foundational support during downturns. Without renewed accumulation from this cohort, the Ethereum price may struggle to absorb supply. Current data shows limited evidence of strong counterbalancing demand.

ETH Price May Look At Consolidation

Ethereum price trades at $1,983 and remains above the $1,811 support level. Despite this stability, the altcoin recently marked a nine-month low at $1,743. Maintaining $1,811 is critical to prevent deeper technical deterioration.

Given ongoing selling from both short-term and long-term holders, recovery may face resistance near $2,238. Continued weakness could keep ETH trading closer to support rather than challenging overhead barriers. A confirmed breakdown below $1,811 may expose Ethereum to $1,571.

Alternatively, reduced selling from short-term holders could ease pressure. If long-term holders resume accumulation, Ethereum may attempt a stronger rebound. A decisive move above $2,238, followed by a rally past $2,509, would invalidate the bearish thesis and improve the medium-term outlook.