Ethereum has experienced a week-long rally, pushing its price closer to the anticipated $3,000 milestone.

However, this surge faces resistance from notable investors selling, putting pressure on the crypto asset’s continued upward momentum.

Ethereum Investors Increase Selling Pressure

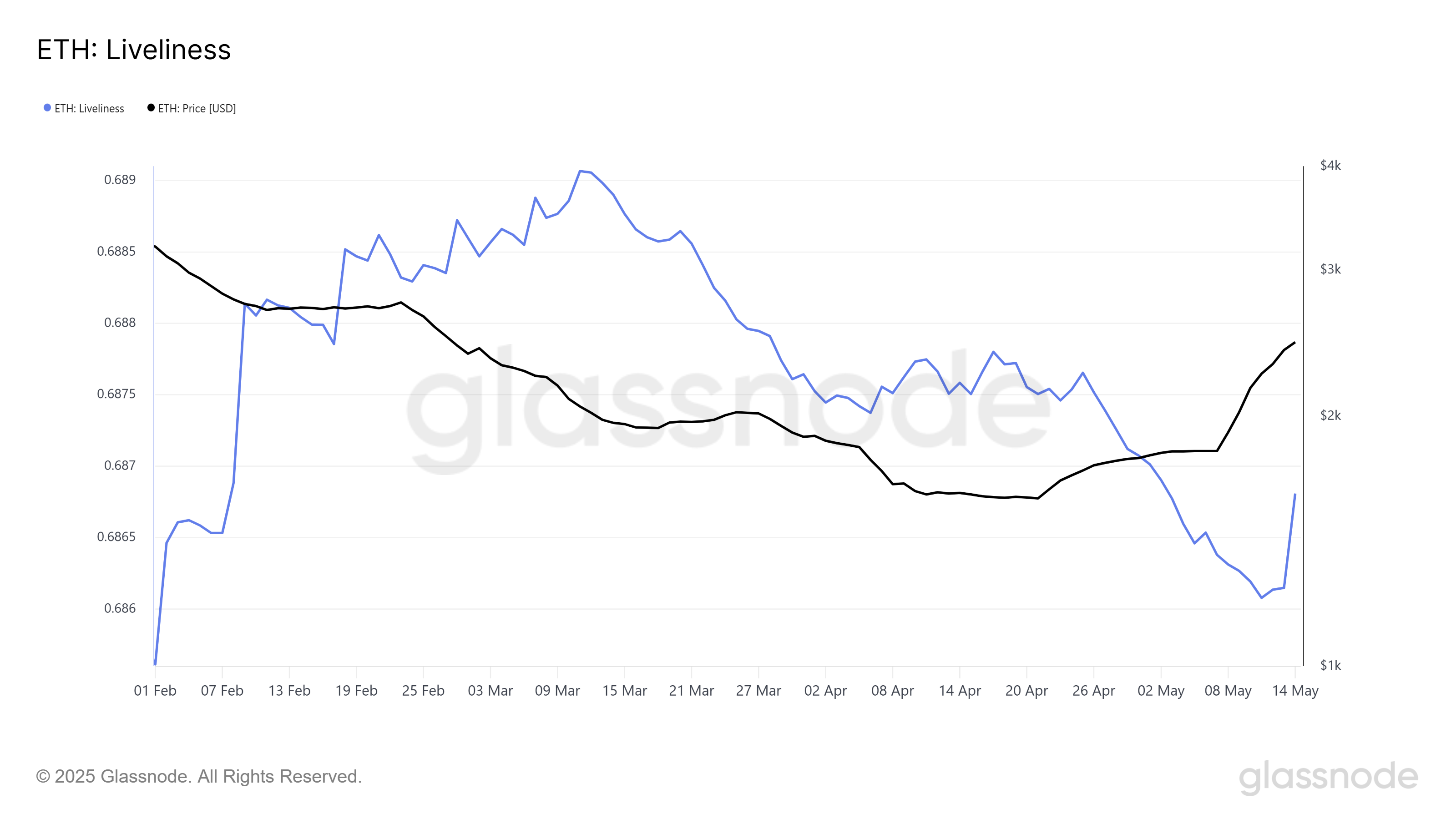

The Liveliness metric for Ethereum is showing a sharp increase, signaling increased selling activity among long-term holders (LTHs). This surge is the first significant uptick in three months, suggesting that key investors are booking profits at current price levels. Since LTHs are considered the backbone of an asset, their selling may pressure Ethereum’s price downward.

Such selling behavior from long-term holders often reflects skepticism about further price growth in the near term. This cautious stance could create headwinds, potentially limiting Ethereum’s ability to maintain its recent rally and challenge higher resistance levels.

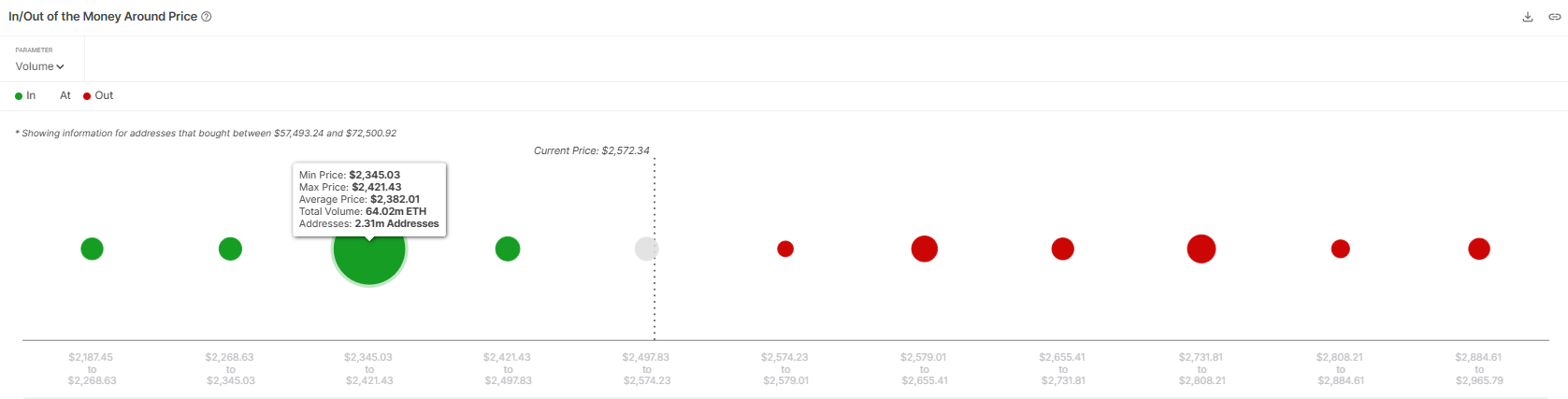

Ethereum’s In/Out of the Money Around Price (IOMAP) analysis identifies a crucial support zone between $2,345 and $2,421. Over 64 million ETH tokens, valued at approximately $164 billion, were acquired within this price range. This concentration of holders is unlikely to sell at a loss, offering strong price support.

This support level is critical as it may prevent Ethereum from falling sharply even if short-term selling increases. Investors who purchased within this range have little incentive to liquidate their holdings, helping to stabilize price action and contain any downside movement.

ETH Price Needs To Find Support

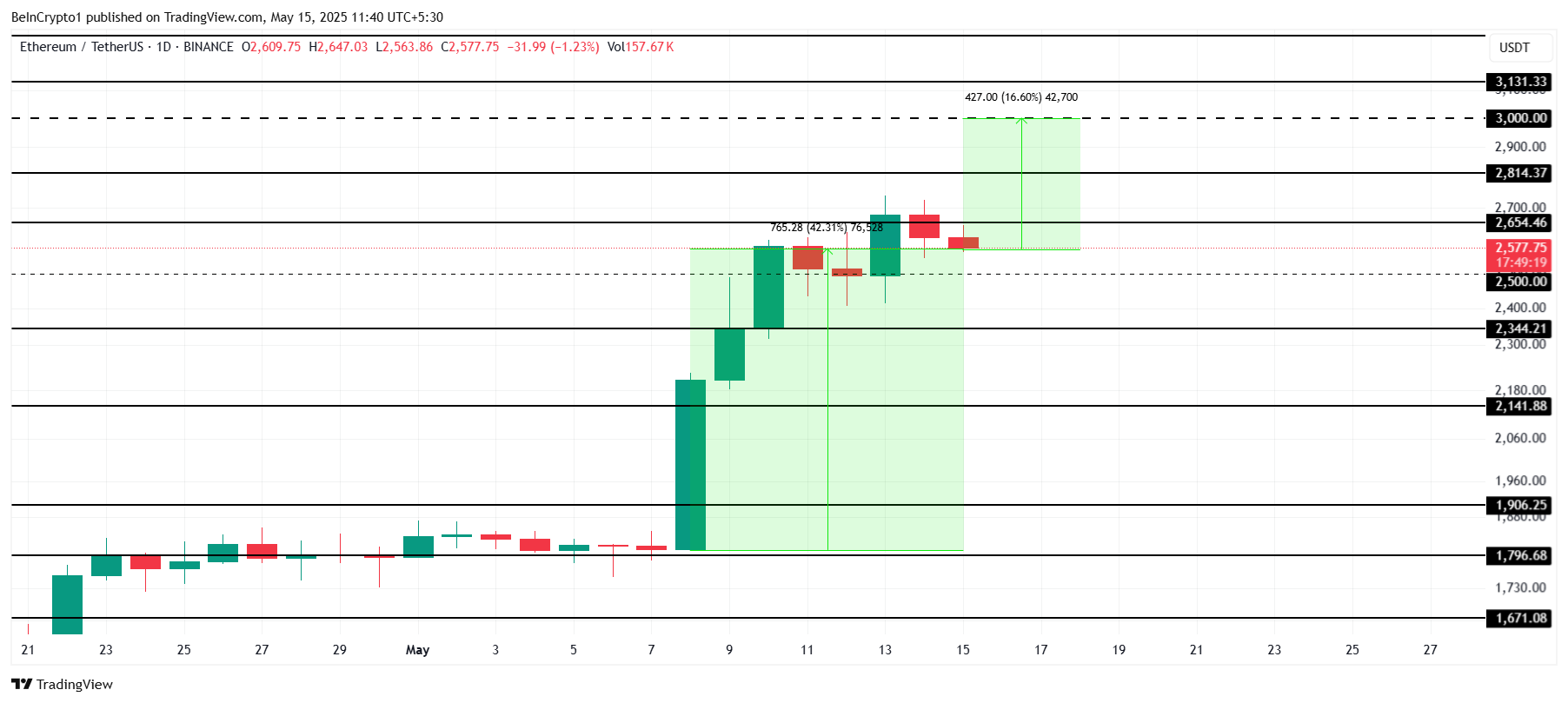

Ethereum’s price has surged 42% over the past seven days and is currently trading at $2,577. Holding steady above the $2,500 support, Ethereum aims to overcome the resistance at $2,654 to continue its upward momentum.

Standing only 16% away from reaching $3,000, ETH does face the challenge from LTH selling, but the solid support range mentioned above could keep the price from falling. Thus, once the selling halts, ETH will have another shot at a further rise, provided it can secure $2,814 as support.

If broader market conditions sour, Ethereum risks increased selling pressure as investors seek to minimize losses. A decline below $2,344 could trigger further drops to $2,141, undermining the bullish outlook and potentially halting the rally.