Ethereum (ETH) is closing out July with an impressive performance, gaining over 60%. However, August 2025 could present a challenge for ETH, as the market reveals several hidden signs of a potential sharp price correction.

Based on recent data and expert analysis, here are four key warning indicators to watch closely.

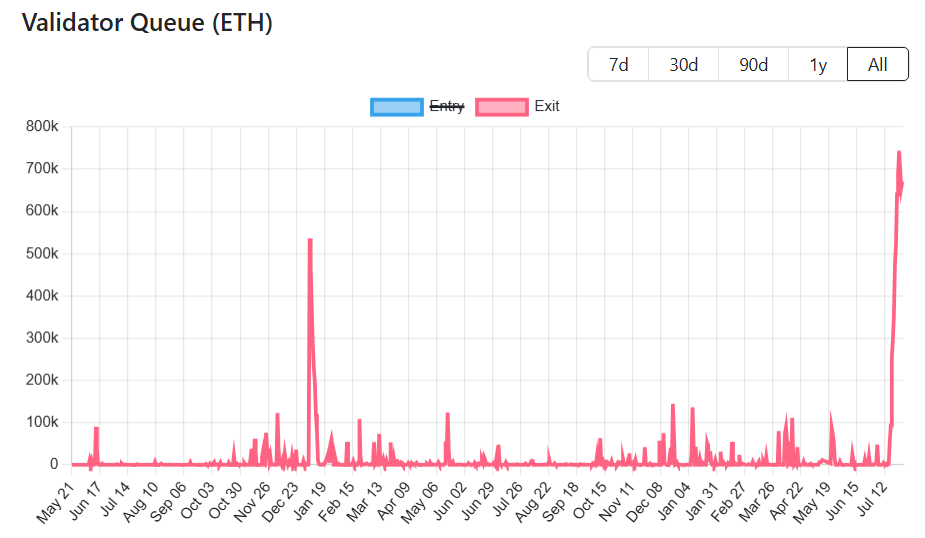

1. Over 700,000 ETH in the Unstaking Queue

The first red flag is that over 700,000 ETH is currently in the unstaking queue, the highest level in four years, according to data from ValidatorQueue.

This suggests that many users and institutions are preparing to withdraw their staked ETH, to likely take profits or reallocate assets.

One week ago, BeInCrypto reported about 350,000 ETH in the queue, valued at approximately $1.3 billion. Now that number has doubled.

Notably, the exit queue is significantly larger than the entry queue. While over 700,000 ETH is waiting to exit, only about 250,000 ETH is waiting to be staked.

ValidatorQueue data also shows that the delay time for unstaking will stretch around nine more days. This means Ethereum will enter August with a substantial supply flowing back into circulation — just as ETH approaches a strong resistance zone near $4,000.

“Validators are likely exiting to restake, optimize or rotate operators, not leaving Ethereum. On the other hand, they may want to lock in profits. Because it’s natural to assume that some stakers are preparing to sell, which could create short-term sell pressure and potentially lead to a price correction,” everstake.eth, Segment Lead at Everstake, commented.

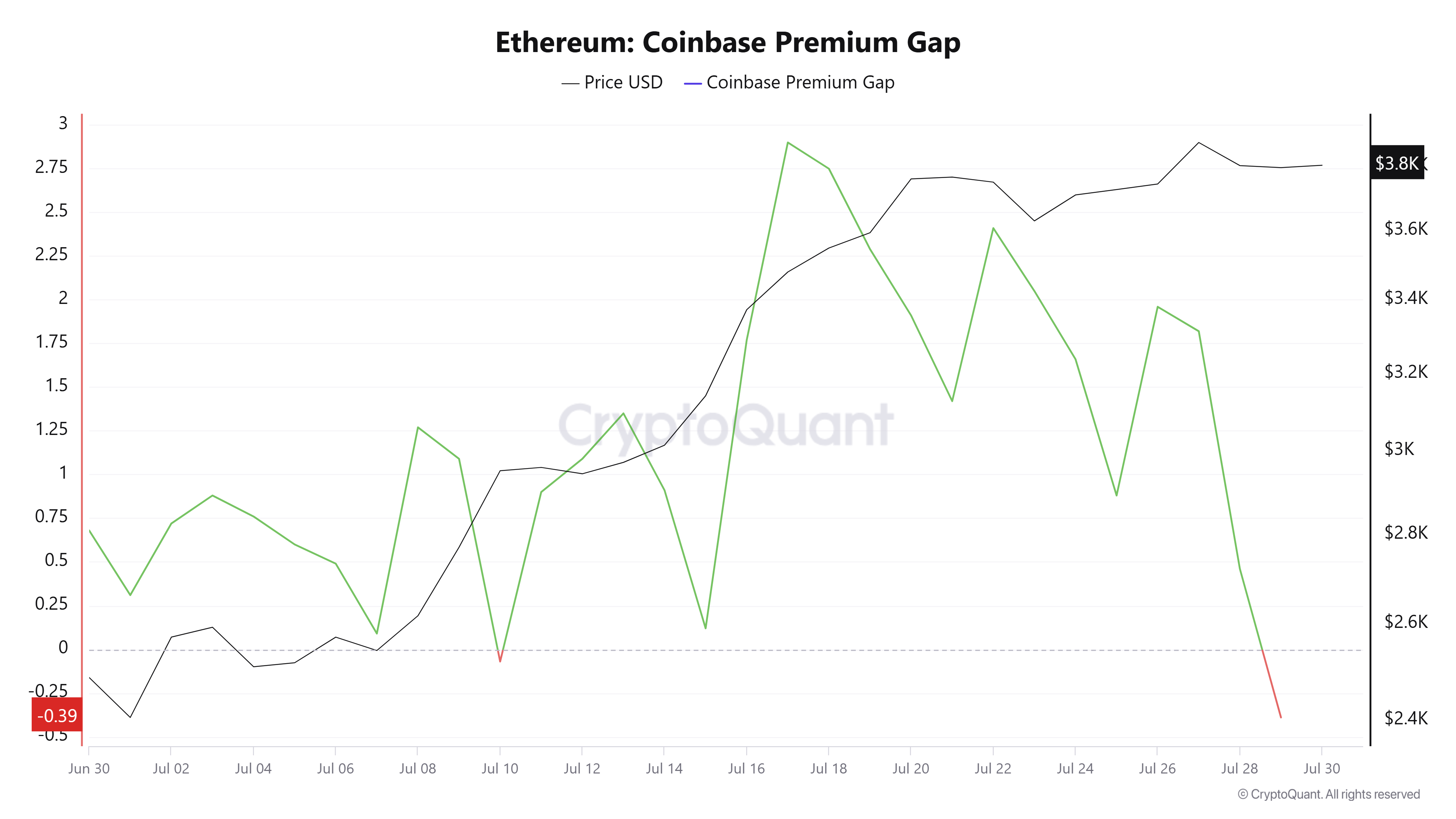

2. ETH Coinbase Premium Gap Turns Negative

According to CryptoQuant data, the second warning sign is that the ETH Coinbase Premium Gap turned negative at the end of July.

This index reflects the price difference between Coinbase and Binance and is often used to gauge demand from US investors compared to the rest of the world.

The Premium Gap remained positive throughout July as ETH rallied from $2,400 to nearly $4,000. But by the end of the month, it dropped sharply into negative territory — indicating a drop in buying pressure from US investors.

At the current price level above $3,800, most retail and institutional investors who bought ETH in Q2 are sitting on profits. That raises the question: Are they now satisfied with their returns?

“The demand in the US market is weakening. Caution is necessary,” analyst IT Tech said.

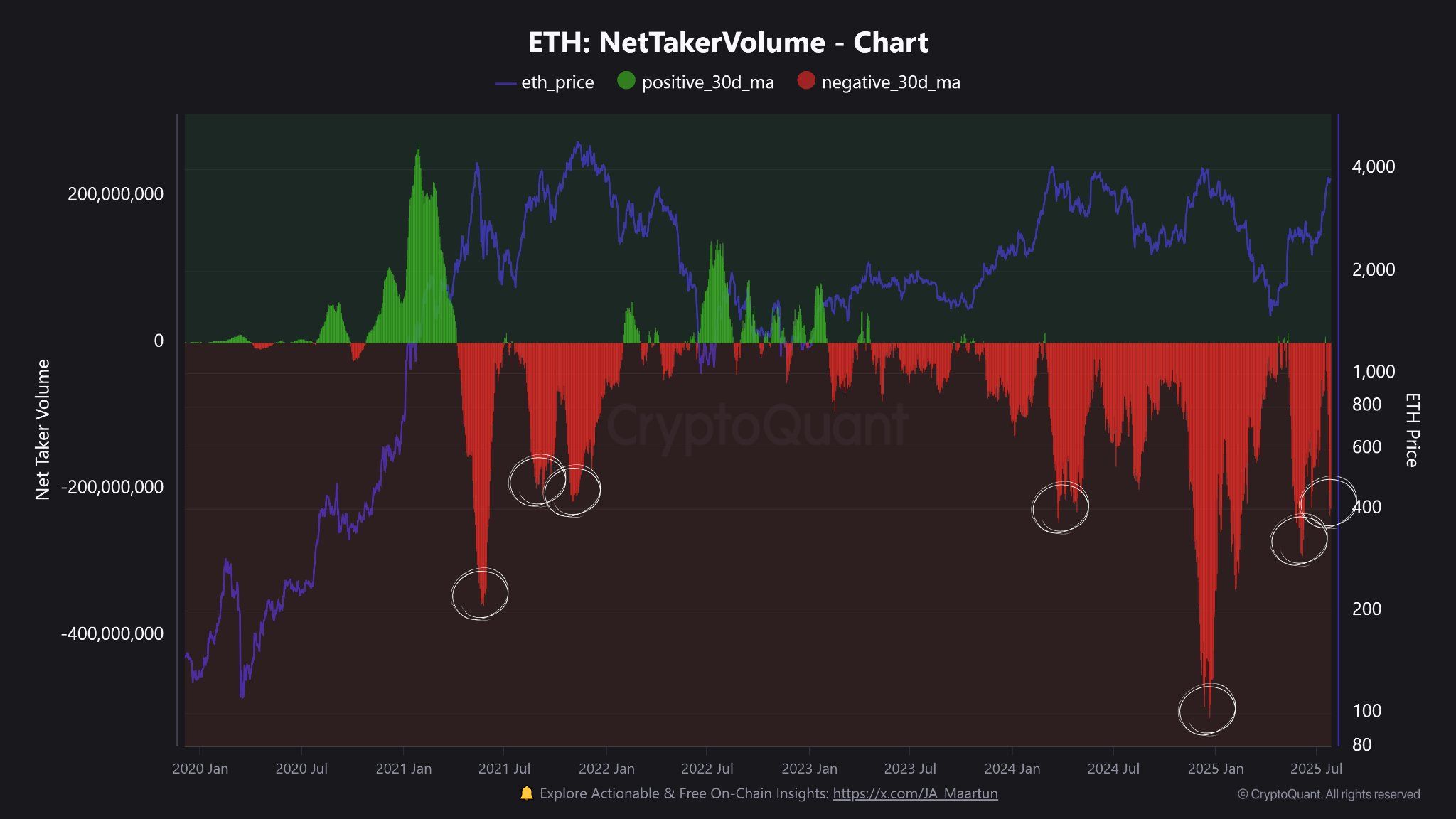

3. Net Taker Volume Turns Negative by $231 Million

Ethereum’s Net Taker Volume showed a negative figure of $231 million at the end of July. This means that sell orders exceeded buy orders significantly, according to analyst Maartunn.

Net Taker Volume reflects trader sentiment, tracking those who actively place orders. It reveals which side — buy or sell — is dominating the market.

A negative reading indicates net selling across exchanges, typically signaling bearish sentiment or capital outflows.

“Consistent sell-side aggression. Taker sell volume outweighed taker buy volume by $231 million on a daily basis,” Maartunn said.

Historically, deep negative Net Taker Volume has coincided with major ETH price peaks. While the current figure is not as extreme as the $500 million drop earlier this year, it remains a warning sign worth monitoring.

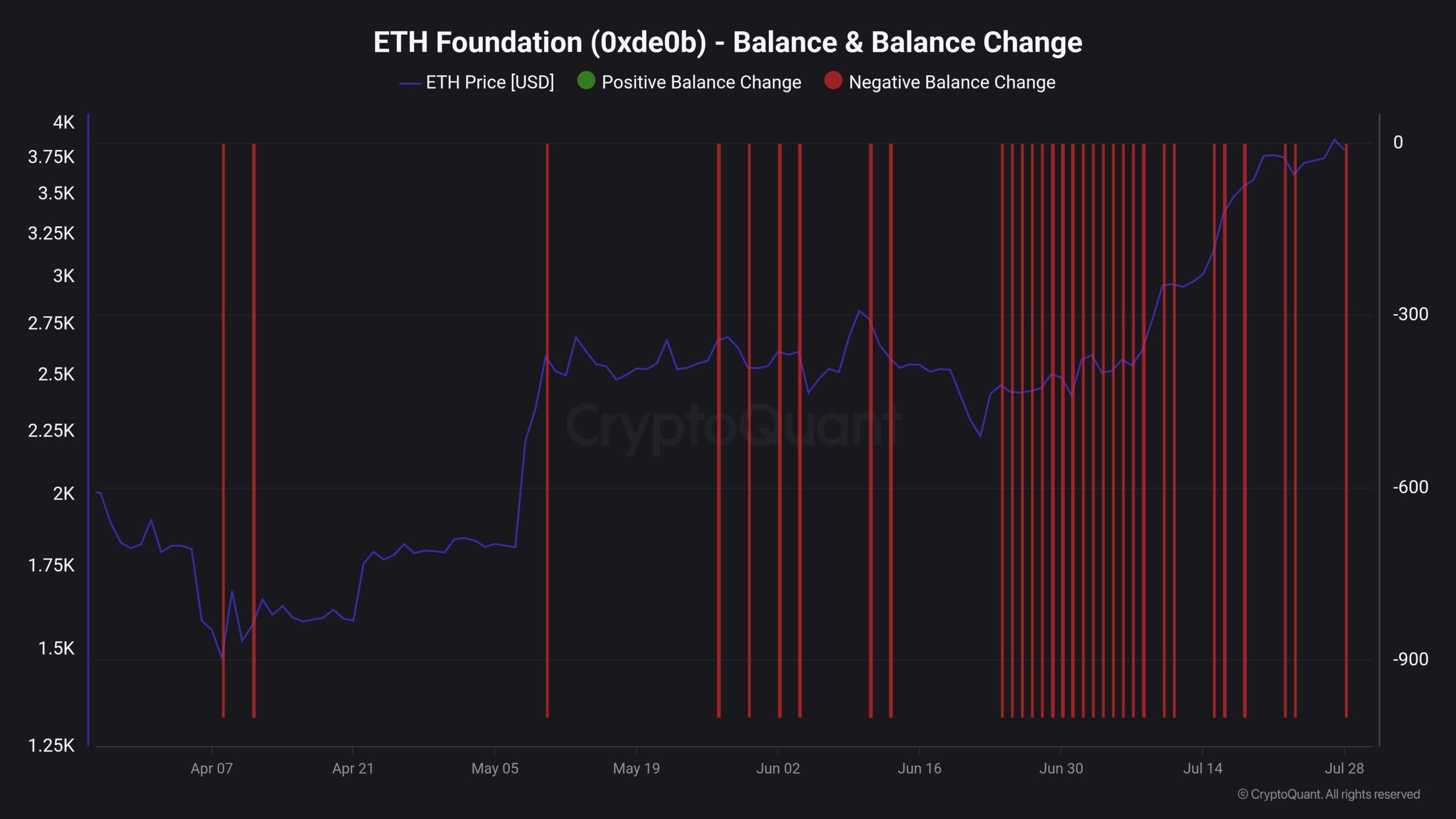

4. Ethereum Foundation Sells 25,833 ETH

The final warning sign is that the Ethereum Foundation has sold 25,833 ETH — worth nearly $100 million — over the past few months, according to Maartunn.

This is significant because the Ethereum Foundation is one of the most influential entities in the ecosystem, having held a substantial amount of ETH since its early days.

These sales might fund development initiatives or treasury management. Still, they add psychological selling pressure to the market — especially when combined with other bearish signals.

“Is this what belief looks like? In the past few months, the Ethereum Foundation has dumped 25,833 $ETH — nearly $100 million. Follow actions, not words,” Maartunn added.

Data shows that the Foundation ramped its selling activity in July, as ETH surged.

Despite these cautionary signals, Ethereum continues to trade above $3,800. Accumulation by institutions and Ethereum treasury managers keeps ETH in high demand — positioning it as the most sought-after crypto asset after Bitcoin.