The Ethereum price has been increasing since September 6, 2019. The upward move began with a low of ₿0.0161. After a rapid increase, the price of ETH reached a high of ₿0.0179 on September 11. A brief decrease followed before Ethereum initiated another upward move, which took it to a high of ₿0.0188 on September 16.

How long will Ethereum continue its upward move? Will it reach values above ₿0.02? Keep reading below if you want to find out the answer.

For our previous analysis, click here.

How long will Ethereum continue its upward move? Will it reach values above ₿0.02? Keep reading below if you want to find out the answer.

For our previous analysis, click here.

Ethereum Price: Trends and Highlights for September 16

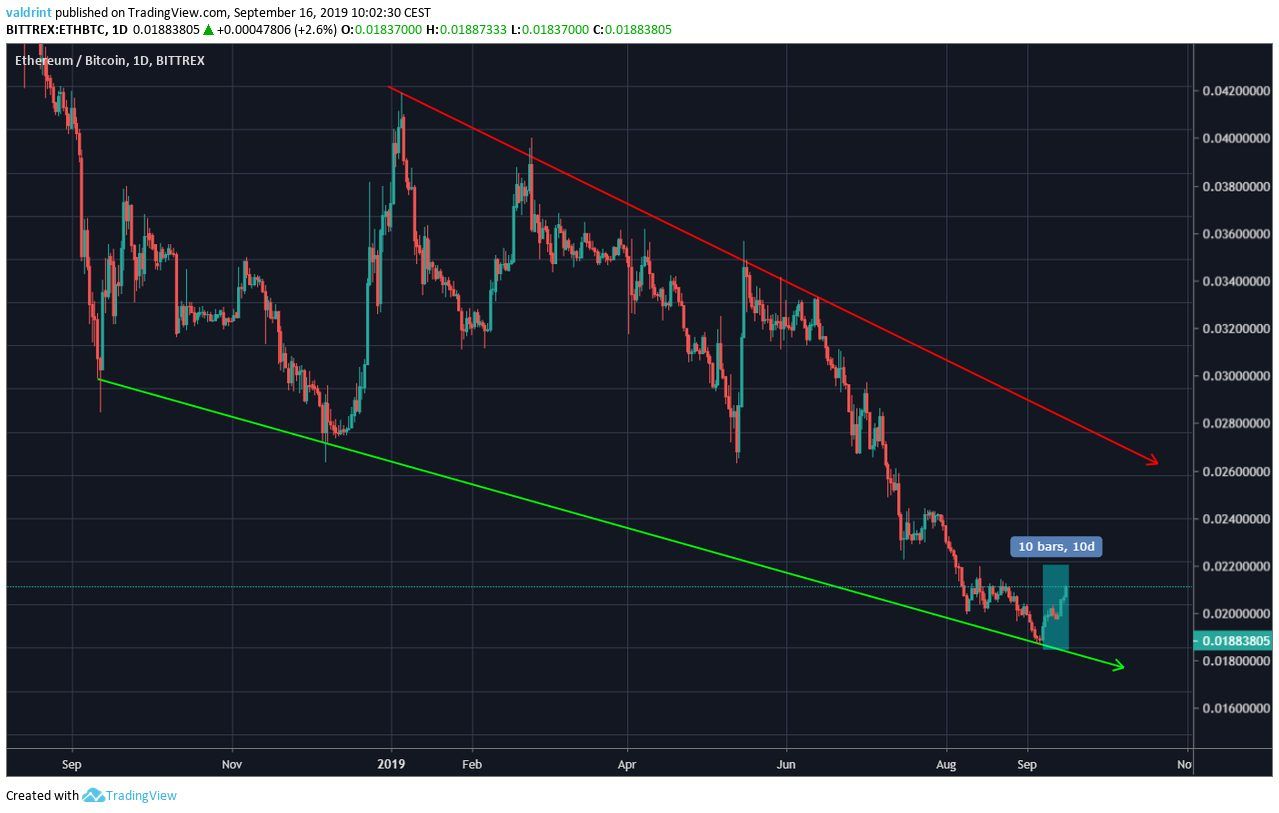

- ETH/BTC is trading inside a long-term descending wedge.

- There is resistance at ₿0.0191 and ₿0.02.

- ETH is trading inside a short-term ascending channel.

- Daily moving averages have made a bullish cross.

Long-Term ETH Price Pattern

A look at the daily chart shows that Ethereum has been trading inside a descending wedge since September of 2018. Once the Ethereum price reached the support line of the wedge, it began the upward move discussed in the introduction.

Taking a closer look inside the same time-frame shows that ETH is approaching a significant resistance area, which is found at ₿0.0191.

Once the Ethereum price reached the support line of the wedge, it began the upward move discussed in the introduction.

Taking a closer look inside the same time-frame shows that ETH is approaching a significant resistance area, which is found at ₿0.0191.

Will ETH be successful in breaking out from the resistance?

Will ETH be successful in breaking out from the resistance?

Technical Indicators

A look at the daily moving averages (MA) and the MACD suggests that further increases are in store for the price of ETH. The 10- and 20-day MAs have made a bullish cross on September 16.

The Ethereum price has been trading above both of them since.

Additionally, the MACD has previously made a bullish cross and is almost in positive territory.

This would serve as the final confirmation that an uptrend has begun.

The 10- and 20-day MAs have made a bullish cross on September 16.

The Ethereum price has been trading above both of them since.

Additionally, the MACD has previously made a bullish cross and is almost in positive territory.

This would serve as the final confirmation that an uptrend has begun.

Short-Term Channel

Moving to a shorter-term time-frame we can see that ETH is possibly trading inside an ascending channel. Additionally, we can see a second resistance area near ₿0.020. At the time of writing, ETH was trading very close to the resistance line.

As for the movement within the channel, the hourly RSI suggests that the price has developed short-term weakness.

At the time of writing, ETH was trading very close to the resistance line.

As for the movement within the channel, the hourly RSI suggests that the price has developed short-term weakness.

The RSI is in oversold territory and has generated significant bearish divergence.

As a result, we would expect the Ethereum price to decrease slightly before making another attempt at the resistance area.

The RSI is in oversold territory and has generated significant bearish divergence.

As a result, we would expect the Ethereum price to decrease slightly before making another attempt at the resistance area.

Ethereum Price Summary

The Ethereum price is trading inside a short-term ascending channel. According to our analysis, it is likely to continue increasing within the confines of the channel. For hypothetical trading purposes, we do not believe the current price level is suitable for the initiation of a position. We would consider Ethereum a buy at levels close to ₿0.0182. Do you think the Ethereum price will reach the resistance area? Let us know in the comments below.

Do you think the Ethereum price will reach the resistance area? Let us know in the comments below.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile. Images are courtesy of Shutterstock, Trading

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored