The Ethereum (ETH) price has broken out from the $490 resistance area and has touched a new yearly high. However, ETH is approaching a crucial long-term resistance level which is likely to cause some resistance.

Ethereum’s Long-Term Levels

The Ethereum price has rallied significantly since a sharp drop in March that briefly sent the price below $100. While the price suffered another drop on Sept 4, it has regained all of its losses.

The price is currently approaching a significant resistance level at $545. The area is both a horizontal resistance area and the 0.618 Fib retracement level of the most recent drop.

Furthermore, if the move since Nov 2018 is an A-B-C correction (shown in white below), a likely top for the move would be around $535, the 1.61 Fib level of wave A.

Technical indicators have already begun to show some weakness. There is an unconfirmed bearish divergence developing on the weekly RSI, while one in the MACD has already been confirmed.

Furthermore, the Stochastic Oscillator could soon make a bearish cross, confirming the trend reversal.

Cryptocurrency trader @cryptodude999, outlined an ETH chart, stating that he’s building up shorts inside the current $500 resistance area. While the area is slightly below that which we have outlined as resistance, it’s close enough to coincide with it, making it a possible top.

Ethereum’s Short-Term Movement

On the daily time-frame, we can see that the price is in the process of breaking out from the $490 resistance area amidst a bullish belt-hold candlestick. It’s possible that this is the move that will take ETH towards $545.

The even shorter-term 6-hour chart shows that ETH has just broken out from a parallel ascending channel and is in the process of moving upwards, supporting a potential ETH target of $545.

ETH/BTC

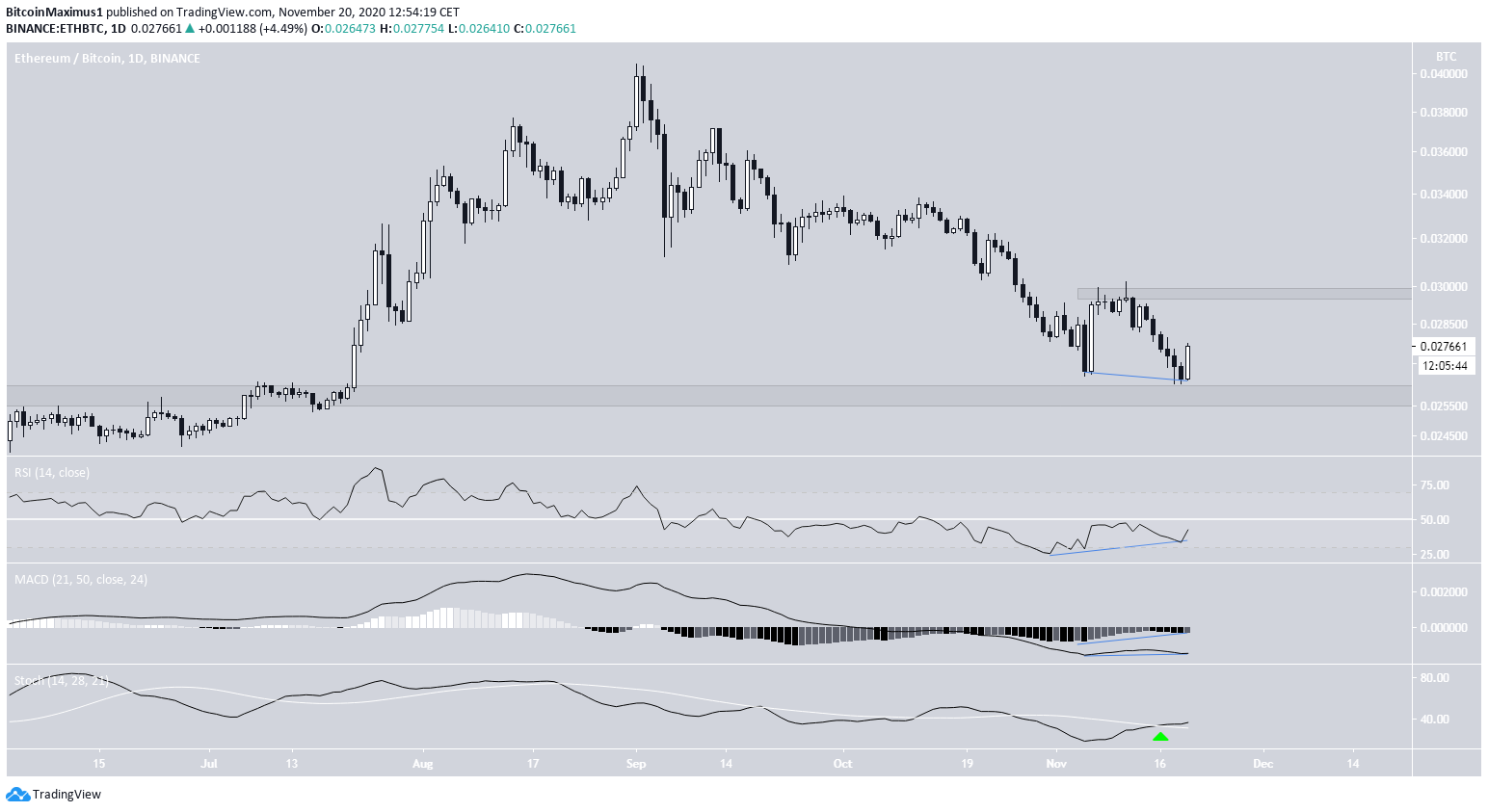

The ETH/BTC price has declined significantly since the beginning of Sept. However, the price reached the ₿0.0260 support area and has possibly begun a significant bounce. The price also created a double-bottom pattern that has significant bullish divergence on both the RSI and the MACD. The Stochastic Oscillator has formed a bullish cross.

If the price continues to move upwards, the closest resistance area would be at ₿0.0295

Conclusion

To conclude, the Ethereum price is likely to continue rallying toward at least $545, before possibly beginning a long-term downward move. It’s also possible that ETH/BTC has reached a bottom, potentially enabling a faster rally for ETH compared with BTC.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.