More Ethereum is leaving centralized finance (CeFi) and exchanges and entering decentralized finance (DeFi) than ever before, which could be keeping prices and demand for the asset elevated.

On-chain analytics from various providers has revealed that there has been somewhat of an exodus of Ethereum from centralized exchanges over the past month.

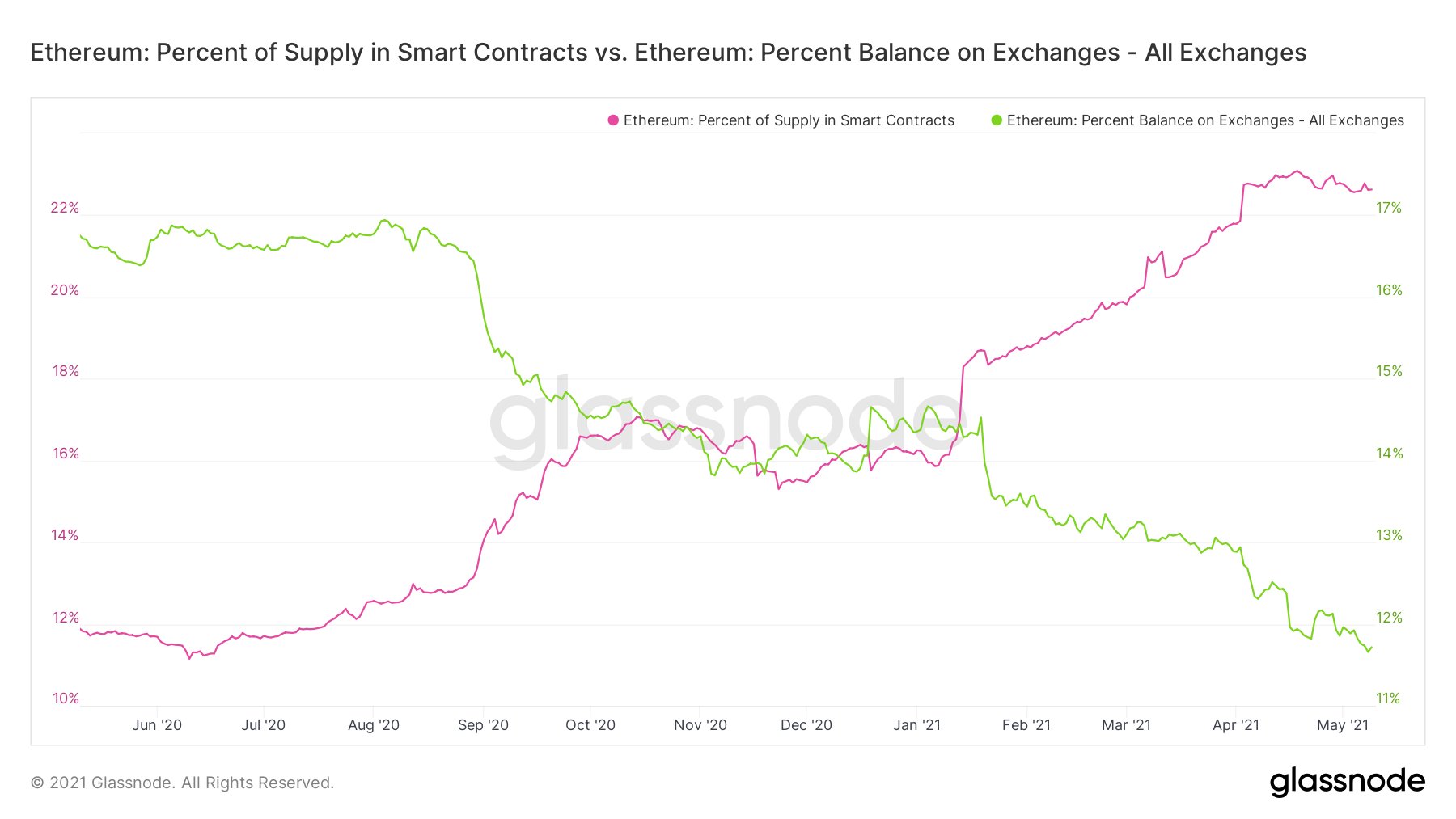

A recent chart from Glassnode shows how clearly evident this has been. Following a period when both were relatively even, the divergence accelerated in January and there is now around double the amount of ETH locked into smart contacts than there is on centralized exchanges.

The Ethereum exodus

It’s worth noting that the amount of ETH in smart contracts is not necessarily locked or unavailable for resale. Though that does apply to the Beacon Chain deposit contract. It currently holds 4.4 million ETH, or 3.8% of the total supply, locked away until Phase 1.5 merges the two Ethereum chains together sometime next year.

There are platforms now such as Lido that offer staking services without having to lock up the principal. However, the majority of ether on ETH 2.0 is likely to be immobile for the time being.

Glassnode reported that the amount of ETH on exchanges has declined by 30% over the past nine months, falling from 19 million to around 13 million, or 12% of the supply today. It’s the lowest balance on centralized exchanges in almost two years.

Conversely almost 23% of the supply, or 26 million ETH, is now held in DeFi and various other smart contracts.

DeFi and cold storage

EthHub co-founder Anthony Sassano stated that of the 10 million or so ETH that are locked in DeFi, around 6.6 million is currently in money market protocols such as Maker, Aave, and Compound. This means that these funds are being used as collateral and not actively traded.

A further 2.4 million ETH or so is being used in automated market makers as a pairing asset. The rest of the ETH is being stored in smart contract wallets, or cold storage, of which the most popular is the Gnosis Safe, holding 1.8 million ETH.

Sassano concluded that it’s good to see ETH being utilized. This drives demand and returns ether to the hands of holders rather than centralized exchanges.

“All in all, it’s just good to see ETH being brought “home” into wallets individuals actually control instead of wallets that centralized exchanges control.”

At the time of writing, ETH was cooling from yesterday’s all-time high, trading down 5% on the day at $3,920 according to CoinGecko.