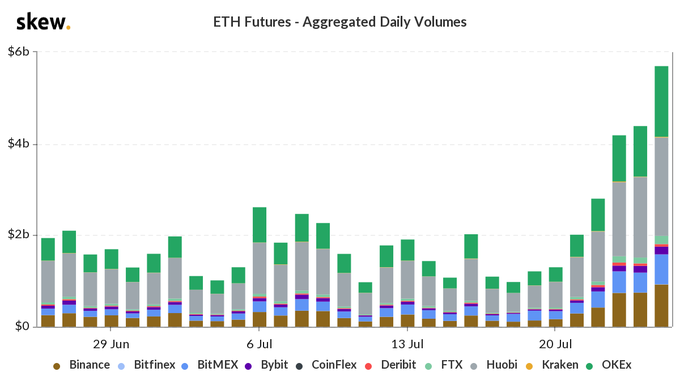

Ethereum futures and options volume has been picking up in the month of July, particularly over the past week. The spike suggests that the market is gaining confidence, just as Bitcoin crossed the $10,000 mark for the first time since June.

Market data platform Skew has shown that ETH volume has exceeded a three-month high on July 25. Aggregate daily volumes of ETH futures touched nearly $6 billion.

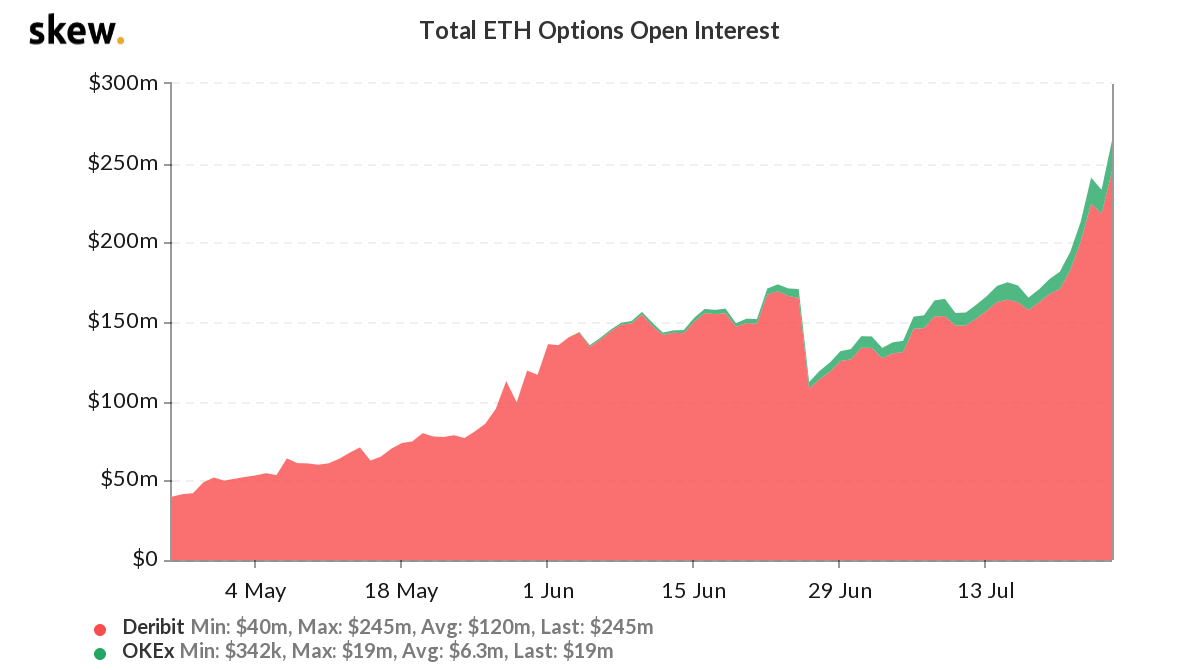

Ethereum options trading has hit an all-time high this year, with Deribit and OKEx accounting for most volume. BeinCrypto reported on the record volumes in June.

Ethereum options trading has hit an all-time high this year, with Deribit and OKEx accounting for most volume. BeinCrypto reported on the record volumes in June.

Bitcoin Futures Volumes Also Increasing

Skew also shows that Bitcoin futures and options are increasingly noticeable, with futures aggregate daily volumes reaching nearly $15 billion. Open interest is roughly $4.5 billion, led by Binance, which has seen daily volumes in the range of $400 million over the past week. Options volume, meanwhile, has been continuing a marked growth pattern, which began in recent months. Total BTC options open interest has topped $1.5 billion, with Deribit again being the biggest source of open interest and volume. Deribit reported $1 billion in open interest for the first time in June, which occurred at a time when open interest was growing across all relevant exchanges.

Institutional Investments on the Rise

Similar to equity futures products, cryptocurrency futures allow traders to bet on the future value of Ethereum. It is a popular investment vehicle for institutional investors, who have been pouring record sums into the cryptocurrency market. Grayscale investments reported that it has reached its highest level of quarterly inflows in Q2 2020 with $908.5 million. Q2 2020 doubled Q1 2020’s inflow, which itself was a record for the asset management firm. The vast majority of these investors have been hedge funds.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored