Ethereum Foundation has released its first report to reveal the treasury holdings, explaining that it follows a “conservative treasury management policy” to ensure funding for the core objectives.

On more than one occasion, crypto commentators, including trader Edward Morra, have pointed out that the non-profit has been successfully timing the market, to cash out Ethereum peaks.

Ethereum Foundation criticisms

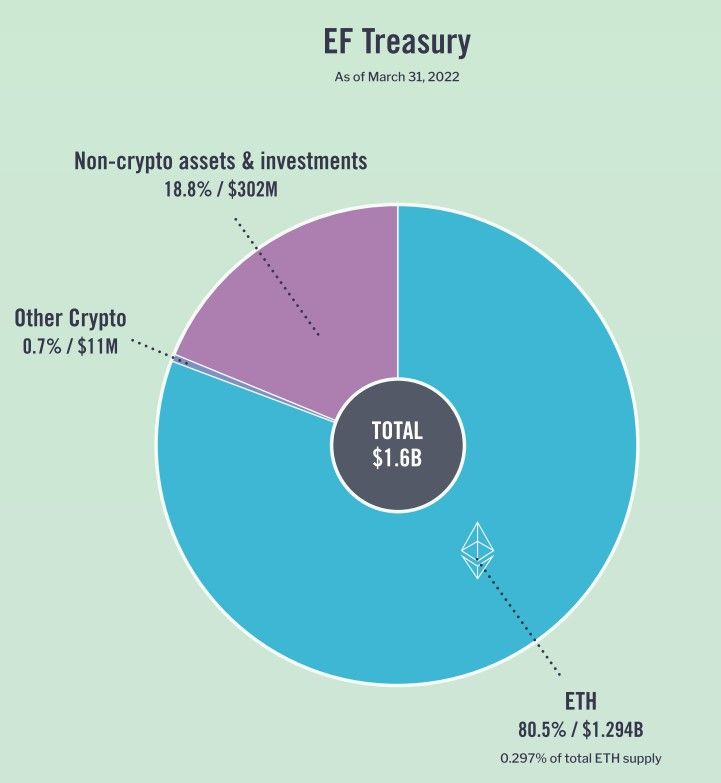

As per the report, the foundation held a treasury of around $1.6 billion, out of which, $1.3 billion were in crypto holdings at the end of March. The non-profit also stated that during the same period, 99.1% of their crypto holdings were held in ETH, marking close to 0.297% of the total ETH supply.

According to Aya Miyaguchi, Executive Director of the Ethereum Foundation, they want to explain the ‘reasoning and philosophy’ that decide their course of action. Miyaguchi commented, “Beyond allocating financial support, there are many important stories to tell about how EF teams contribute to the ecosystem. There is a lot of non-financial work that EF community members do behind the scenes as well.”

The Executive Director also agreed that “we are not a normal top-down organization.”

Not your usual non-profit

The foundation behind the Ethereum project argues that it’s not a typical non-profit or even a company. Instead, the organization maintains that “Their role is not to control or lead Ethereum, nor they are the only organization that funds critical development of Ethereum-related technologies. The EF is one part of a much larger ecosystem.”

In the report, EF explains that it follows a “conservative treasury management policy” to ensure funding for the core objectives even during a multi-year market downturn. It noted, “This part of our budget is immune to changes in the price of ETH on a significant timeline. “

Ethereum’s performance and EF cash out

The crypto market that surpassed a $3 trillion cumulative market capitalization last year, has been on a struggling road to recovery with the cryptocurrency market cap close to $1.92 trillion today. Meanwhile, Ethereum has been down 5% in the last 24 hours and over 17% in the last two weeks, according to CoinGecko.

Lately, Ethereum has also lost a significant market share when it comes to total value locked (TVL) on decentralized applications on the network. As per Defillama, Ethereum now only claims 55% of the total TVL. While it remains the leader in the top spot, Ethereum dominated close to 70% of the total TVL last year.

When it comes to criticism around EF profiting at its peaks, the foundation clarified its stance. According to them, ‘they increase their non-crypto savings in response to rising ETH prices, which provides a greater safety margin for their core budget and funding non-core but high leverage projects through a market downturn.’

This essentially means that EF agreed that it sold the ETH in a bull market to contribute to its non-crypto holdings.

Meanwhile, the foundation also reiterated, “The EF believes in Ethereum’s potential, and our ETH holdings represent that long-term perspective.”

Join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.