The amount of Ethereum held on cryptocurrency exchanges has plummeted to its lowest ever levels while ETH 2.0 staking is close to hitting a new milestone.

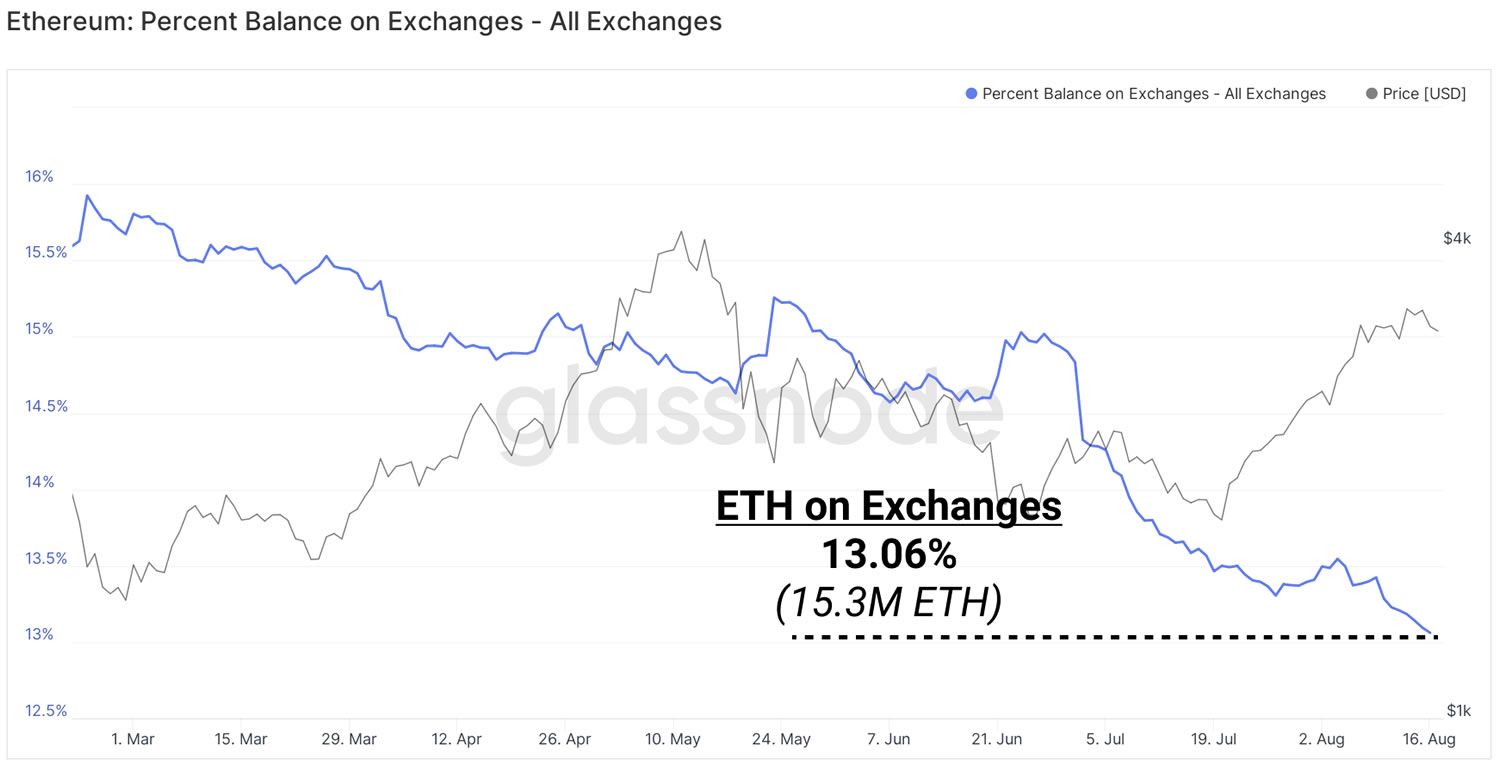

On-chain analytics provider Glassnode has delved into Ethereum metrics in its weekly insights report, noting that the recent increase in Ethereum prices has been supported by a continued outflow of ETH supply from exchanges.

“Exchange ETH balances have now declined to reach an all-time low of 13% of the circulating supply this week, equivalent to 15.3M ETH.”

Ethereum exodus to staking

When Ethereum leaves centralized crypto exchanges, it is usually viewed as a bullish sign. The assets may be getting moved into custody or cold wallets or more likely being invested in DeFi or staked. Conversely, when there are large inflows to exchanges, it is considered bearish as investors may be starting to prepare for liquidation.

Glassnode also reported that Open Interest (OI) in ETH options markets has also expanded over the last few weeks. Open Interest on derivatives markets reached $3.9 billion this week, about 40% below the all-time high set in May, it added. OI refers to the total number of outstanding derivative contracts that have not been settled.

The data indicated that a lot of Ethereum was now flowing into staking services such as those provided by Lido.

“A reasonable volume of ETH is finding its way into the Ethereum 2.0 staking contract, preparing for the network transfer away from Proof-of-Work and towards Proof of Stake.”

Lido deposits have continued to surge upward, it added, hitting 12% of total staked supply last week or 815,000 ETH. At current prices, Lido deposits are worth $2.44 billion which has been good news for holders of its governance token, LDO as it surged 30% on the day.

ETH 2.0 staking milestone

The amount of ETH staked directly on the Beacon Chain deposit contract is a shade under seven million according to the ETH 2.0 launchpad. This represents nearly 6% of the entire supply and is valued at $21 billion at current prices.

The Beaconcha.in block explorer reports a slightly lower figure of 6.77 million ETH staked, but it is still a record high. There are 211,663 validators on the network and current yields are 5.9% per year in ETH.

Ethereum prices had just reclaimed $3,000 at the time of press. ETH has retreated 2.5% on the day but is up 10% over the past fortnight and 64% over the past month.