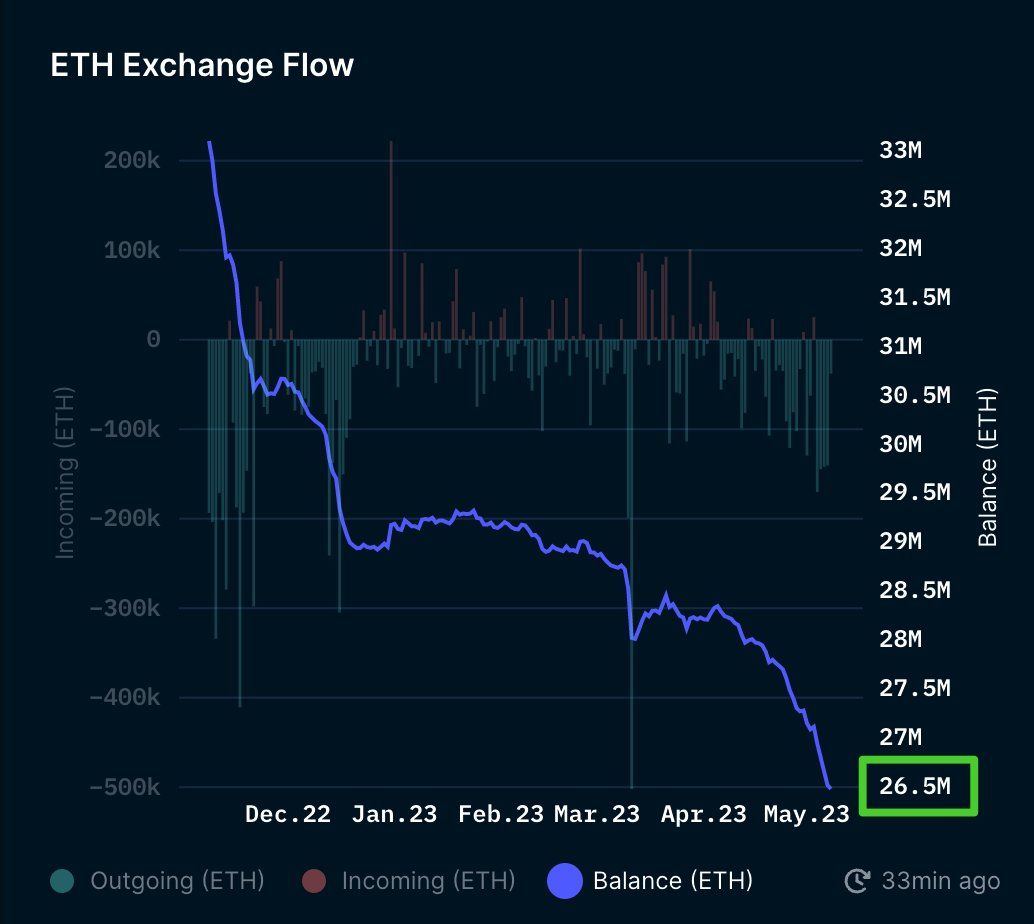

The amount of Ethereum stored on centralized crypto exchanges has fallen to its lowest level for half a year.

On May 8, on-chain analytics provider Nansen reported that Ethereum held by exchanges had reached a 6-month low. Just 26.5 million ETH, valued at roughly $49 billion, resides on centralized exchanges.

Since the beginning of the year, the amount of ETH on exchanges has declined by around 10%. Furthermore, there was a massive exodus of Ethereum from exchanges in the wake of the FTX collapse in late 2022.

Nansen also reports that Coinbase has the largest share of exchange Ethereum with 31% or 7.91 million ETH. Binance is second with 19% or 4.78 million ETH, and Bitfinex is third with 8.3% of the exchange ETH balance.

Ethereum Staking Breakdown

With so many yield opportunities available in the Ethereum ecosystem, leaving it sitting on an exchange makes little sense.

Moreover, self-custody and staking have been the destinations for a large chunk of the ETH leaving exchanges.

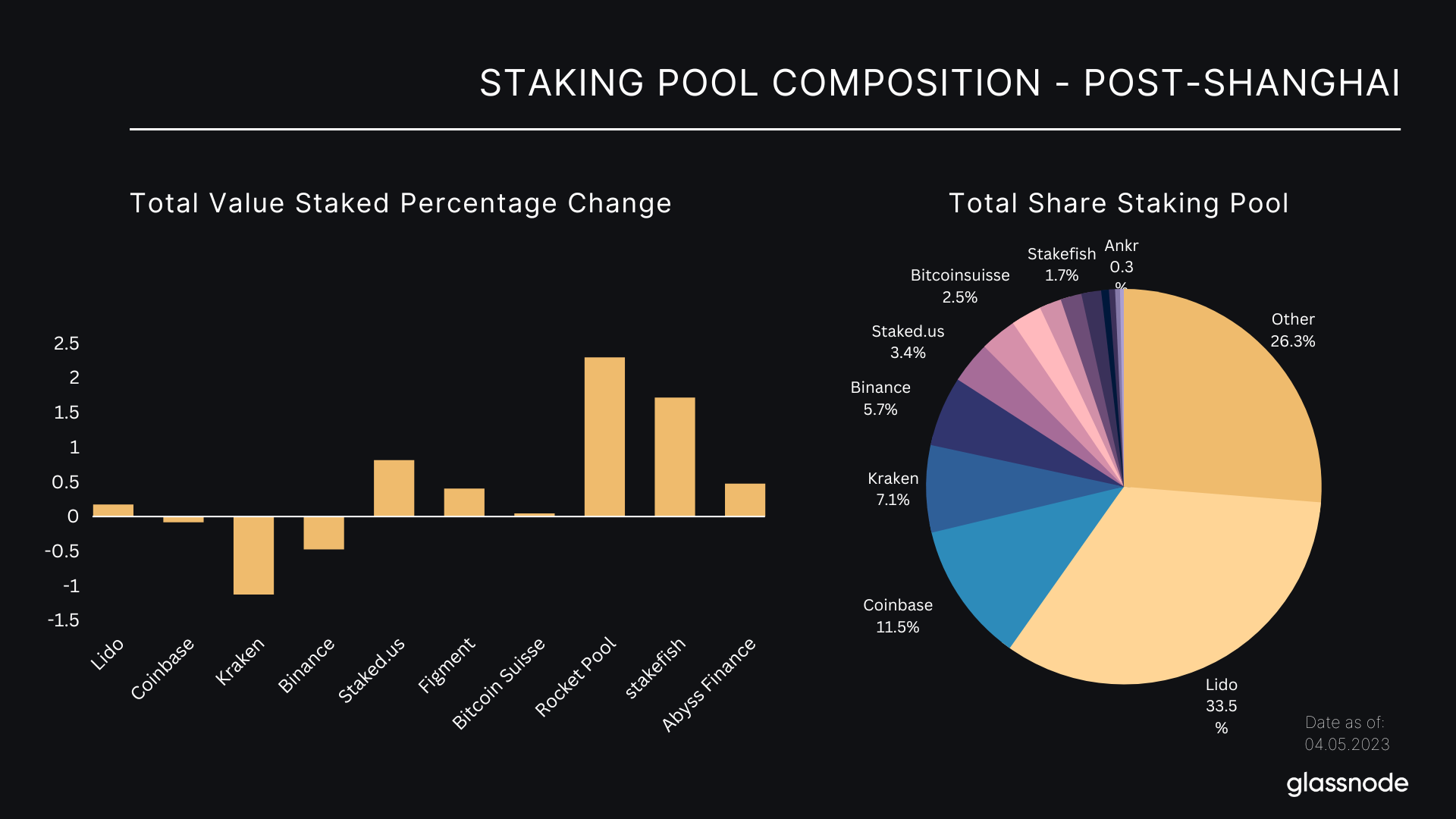

On May 8, analytics provider Glassnode reported where the 1.55 million ETH withdrawn from the Beacon Chain had gone.

It reported that there was no appreciable increase in exchange inflow volume after the Shanghai upgrade. Therefore, there was no increase in selling pressure after withdrawals were enabled, as predicted.

Following an initial surge of withdrawal requests, it noted that staking exits have now tapered off and leveled off between 300 and 700 per day.

Kraken represented the largest portion of ETH withdrawals, with around 32%. This was due to the SEC enforcement action, which resulted in the closure of Kraken staking services.

Glassnode noted that Lido, which has yet to enable withdrawals, has been the biggest beneficiary of the Shapella upgrade.

Lido currently has a market-dominant share of 33.5%, followed by Coinbase, which has an 11.5% staking provider share. The research concluded:

“Overall, the results of the analysis suggest that the mechanics of Proof-of-Stake for both incoming and exiting validators have played out as intended, with Ethereum’s consensus mechanism remaining stable throughout the process.”

ETH Price Outlook

Despite the low sell-side pressure following Shapella, ETH prices have retreated in the shadow of their big brother.

ETH prices have retreated 1.2% on the day in a fall to $1,842 at the time of writing. The asset touched $2,000 briefly over the weekend but resistance proved too strong.

ETH has declined 13.4% since its 2023 high and is down 62.2% from its all-time high. Support currently lies just above $1,800 in the short-term time frame.