The Ethereum (ETH) price has struggled to regain its footing since deviating above the $1,660 resistance area. But despite this struggle, Ethereum is still expected to outperform Bitcoin (BTC).

Ethereum (ETH) Price Drop Incoming?

The technical analysis from the daily time frame shows that the Ethereum price action gives a mixed outlook. Initially, the ETH price broke out from a descending resistance line and validated it as support on Feb. 13 (green icon). Afterward, it reached a new yearly high of $1,742 on Feb. 16.

However, the price has fallen since. The drop shows that the previous breakout is only a deviation (red circle) above the $1,660 resistance area, and the latter is still intact.

Currently, the ETH price is approaching the channel’s resistance line once more. However, there is strong support at $1,408, created by the channel’s support line and the 0.5 Fib retracement support level.

Since the daily RSI is falling, a drop to this level is the most likely scenario.

On the other hand, reclaiming the $1,660 resistance area would invalidate this bearish forecast. In that case, the ETH price could increase to $2,000.

Similar to the price action, Ethereum news is also mixed. An Ethereum blockchain network upgrade that brings various improvements to the Ethereum ecosystem was deployed on March 2.

The upgrade will deal with decentralized applications and smart contract functionality. The Ethereum burn rate has decreased significantly since the middle of February, likely due to decreased interest in the non-fungible token (NFT) market. Finally, since the Securities and Exchange Commission (SEC) has not made a ruling on Ethereum’s classification, the token is at risk of being branded as a security. In that case, it would be subject to numerous regulatory requirements.

Ethereum (ETH) Bullish vs. Bitcoin (BTC)

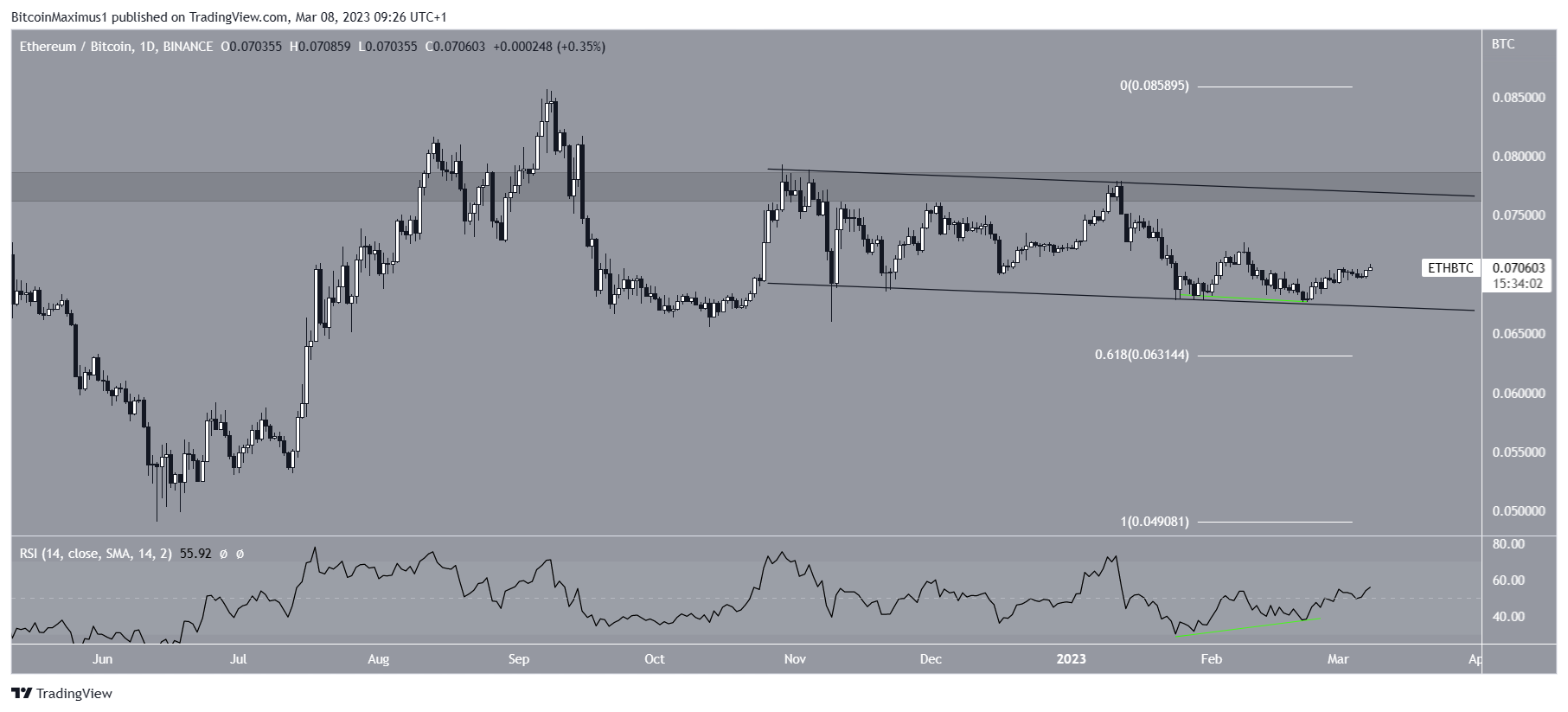

While the ETH/USDT chart gives mixed readings, the Ethereum vs. Bitcoin price action and indicator readings are decisively bullish.

Firstly, the price has created a double bottom at the support line of a descending channel. The double bottom is considered a bullish pattern, and channels usually lead to breakouts. Moreover, this entire movement was combined with bullish divergence in the daily RSI (green line).

As a result, an increase toward the resistance line and the ₿0.078 area is likely.

On the other hand, a breakdown from the channel would invalidate this bullish outlook and could trigger a fall to the 0.618 Fib retracement support level at ₿0.063.

To conclude, while the direction of the ETH/USDT trend is unclear, the ETH/BTC movement is bullish. An increase to the confluence of resistance levels at ₿0.078 is expected. A breakdown from the channel would invalidate this and could trigger a fall to ₿0.063.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.