Ethereum (ETH) price is expected to note a massive surge following the launch of spot ETH ETFs this week.

However, the bigger question is whether the hype surrounding the ETFs will be able to bring interest back into staking or not.

Spot Ethereum ETF Could Bring Major Changes

Ethereum’s transition from proof of work to proof of stake was met with extreme bullishness. It introduced a new form of yield for ETH holders, something that Bitcoin cannot offer since it is a proof-of-work chain.

Plus, with ETH staking came the power of partial governance as becoming or endorsing a validator made the investors an integral part of the chain.

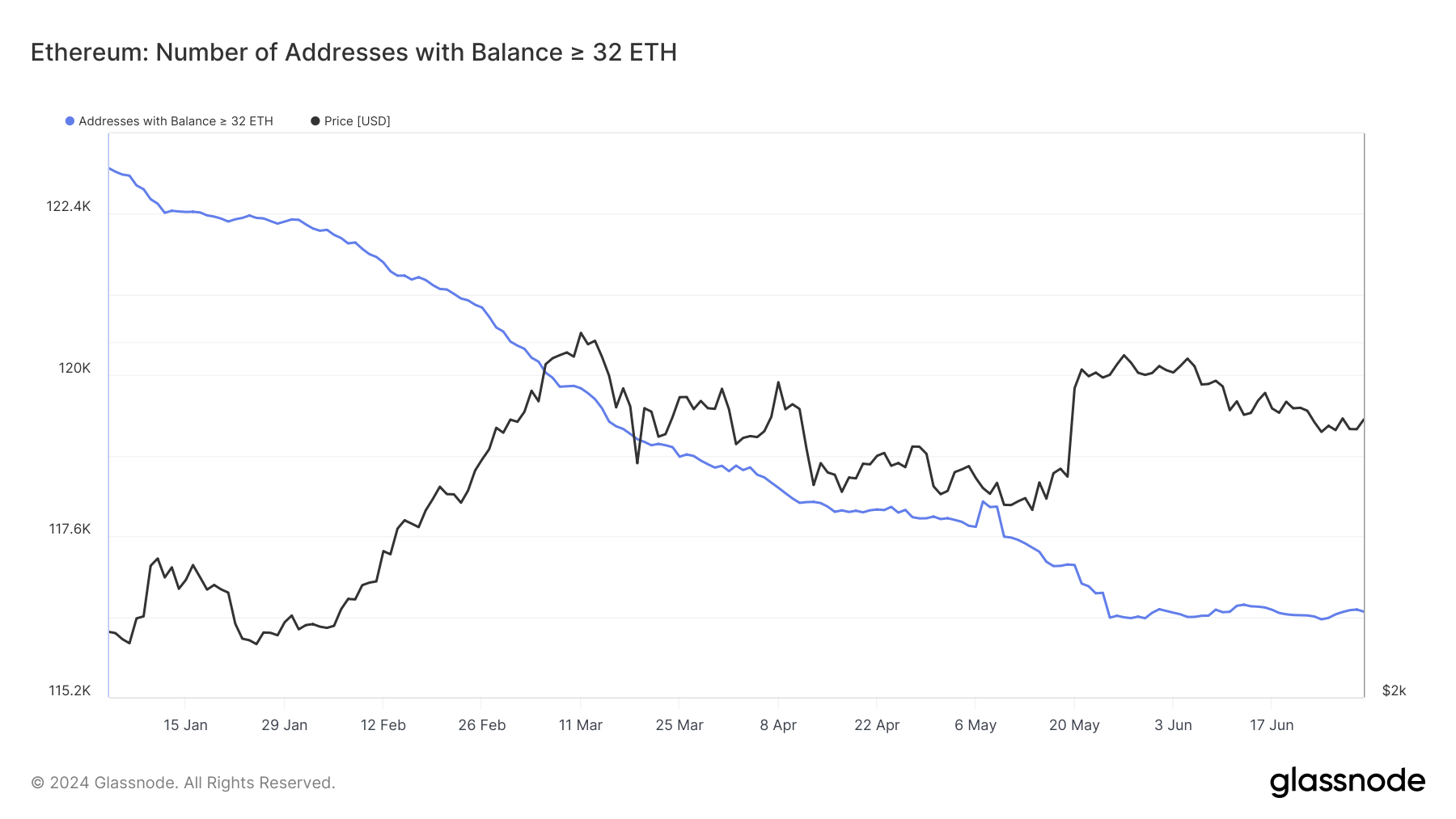

This ideology led to millions of ETH being staked in the chain. However, the eventual arrival of restaking in June 2023 resulted in significant outflows of staked ETH, which have been continuous since May 24 this year.

As the spot Ethereum ETF applications received approval on May 23, the validators halted their unstaking. Since then, the number of validators, i.e., the number of unique addresses holding at least 32 ETH, has been stable at around 116,480.

Read More: How to Invest in Ethereum ETFs?

Nevertheless, the launch of spot ETFs is expected to revive the interest in staking again. Discussing the same, Chen Arad, Co-founder and CXO of Solidus Labs, exclusively told BeInCrypto,

“A key element for institutional interest in Ethereum ETFs moving forward would be staking of ETH held by ETF funds, which is not currently included in the approved rule-change and proposals. This could make ETH ETFs an even more attractive product for wider audiences and open the door to further institutional inflows and engagement with DeFi.

However, to get regulators comfortable with the staking of ETH ETF funds, the industry needs to continue addressing fundamental concerns about compliance and security risks in the pre-chain block-building process.”

This could have a similarly bullish impact on Ethereum’s price as well.

ETH Price Prediction: Eyeing $4,000

Ethereum’s price bounced back from the support of 38.2% Fibonacci Retracement at $3,336. The second-generation cryptocurrency is currently changing hands at $3,474. There is anticipation that ETH will reclaim the 50% Fib line at $3,582.

Ethereum’s price would be open to a massive recovery if this happens, potentially even flipping 61.8% of the Fib line into support. This level lies at $3,829, which could boost ETH toward $4,000 in the long run.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, a failure to breach any of these key resistance levels could result in a slowdown in recovery. If ETH investors sell their holdings during this duration, the altcoin could end up at $3,336 again, invalidating the bullish thesis.