The fundamentals supporting bullish price action on Ethereum (ETH) are everywhere. Is it time for ETH to break out for good this time?

Several indicators point to another breakout rally in the second-largest cryptocurrency by market capitalization. Will institutional investors join their retail counterparts and smash through the $1,500 mark?

SponsoredNew Record Price in Sight

The monthly ETH price may be off to a good start after closing its previous monthly candle above the $1,300 price level. Ethereum’s market cap has recorded a 98% increase since the beginning of the year. At the time of writing, ETH traded just shy of $1,500.

The current price levels have served as strong resistance and were last seen during the 2017 ICO mania. After consolidating at the $1,300 price zone over the last few days, more volatility could be imminent.

ETH On-Chain Indicators Bullish

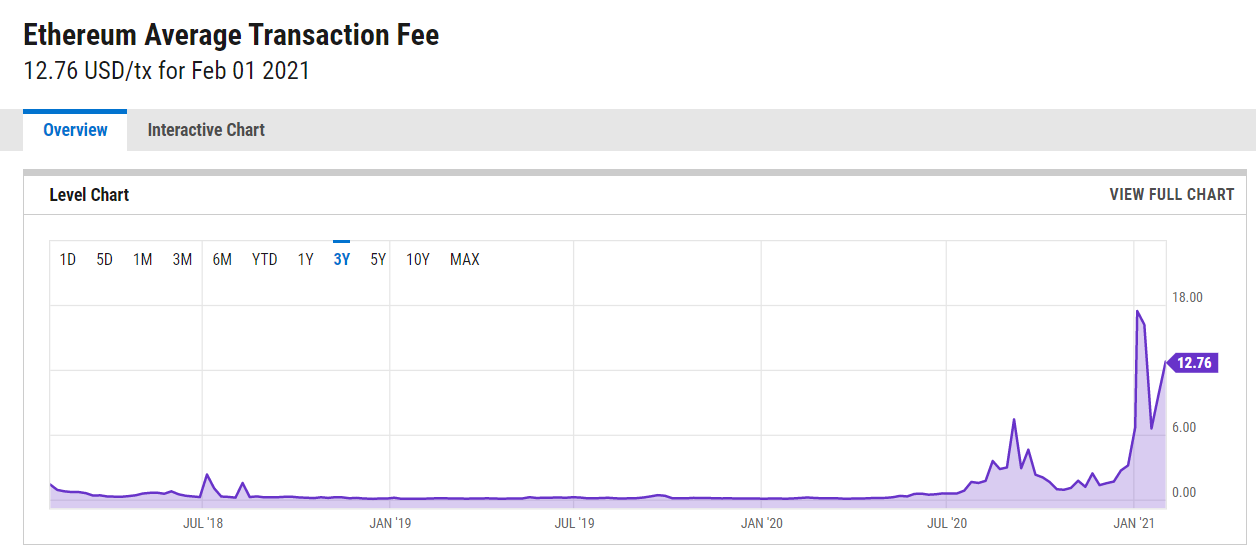

According to statistics from data analytics platform YCHARTS, the average Ethereum transaction fee is quickly heading towards its previous peak. At press time, this figure stood at $12.76, less than its previous January peak of $17.43.

SponsoredThe average transaction fee is the mean value market participants are willing to pay to interact with the network. The high fees suggest massive demand. Even the Grayscale Ethereum Trust recently reopened to investors and traders.

It’s pertinent to point out the difference between these levels with those of the last bull cycle. Activity on the Ethereum network has exploded in the last 30 months.

On July 5, 2018, the average transaction fee was just $2.03. This figure represents about 18% of the present cost. The rise of the Decentralized Finance (DeFi) ecosystem may have contributed significantly to this spike.

Similarly, Ethereum’s hash rate is surging steadily towards new highs. This metric measures the speed at which mining machines solve mathematical puzzles and validate blocks on the network.

An increase in value reflects more computational power being put to work in processing transactions.

Historical records show that a new high in the ETH price has always accompanied a rise in hash rate. This suggests that Ether may still have a lot of room for growth at its current price.

The high number of addresses in profit also supports the bullish thesis, according to data from Glassnode. The number of holders in profit has reached a new all-time high of over 52,000 addresses. This figure is likely to rise in tandem with the price.