The Ethereum (ETH) price has dropped sharply since reaching a high on September 2. However, the long-term support structure is still intact, allowing for the possibility of continuation to the upside.

Long-Term Levels

At the beginning of July, the Ethereum price broke out above the $360 area, something it had not done since July 2018. The same area also acted as the top of the upward movement in July 2019.

While the price continued increasing, reaching a high of $488.84 on September 2, it dropped sharply afterward and is in the process of creating a shooting star candlestick. This move also validated the $480 area as resistance, which is also the 0.5 Fib level of the previous downward move.

Technical indicators show that the move is overextended since both the RSI and Stochastic RSI are oversold, but there is no bearish divergence in either or on the MACD.

If the price manages to break out from the current resistance area, it would increase all the way to $730, the 0.85 Fib level of the downward move, and the level in which the previous fall accelerated.

Cryptocurrency trader @TheEurosniper stated that he’s buying Ethereum near the current level, outlining a target of $840 for the ensuing move. This is only slightly below our target and is the top of the preceding move from which we drew the Fibonacci retracement.

Oversold Conditions

The daily chart shows that the price is still trading at the $395 minor support area, which has held since the beginning of August.

Technical indicators are relatively bullish. The stochastic RSI is extremely oversold and has made a bullish cross, and there is bullish divergence on the MACD. The RSI is attempting to form support above 50 and is beginning to move upwards.

As long as the ETH price is trading above this level, it should continue moving upwards.

ETH Wave Count

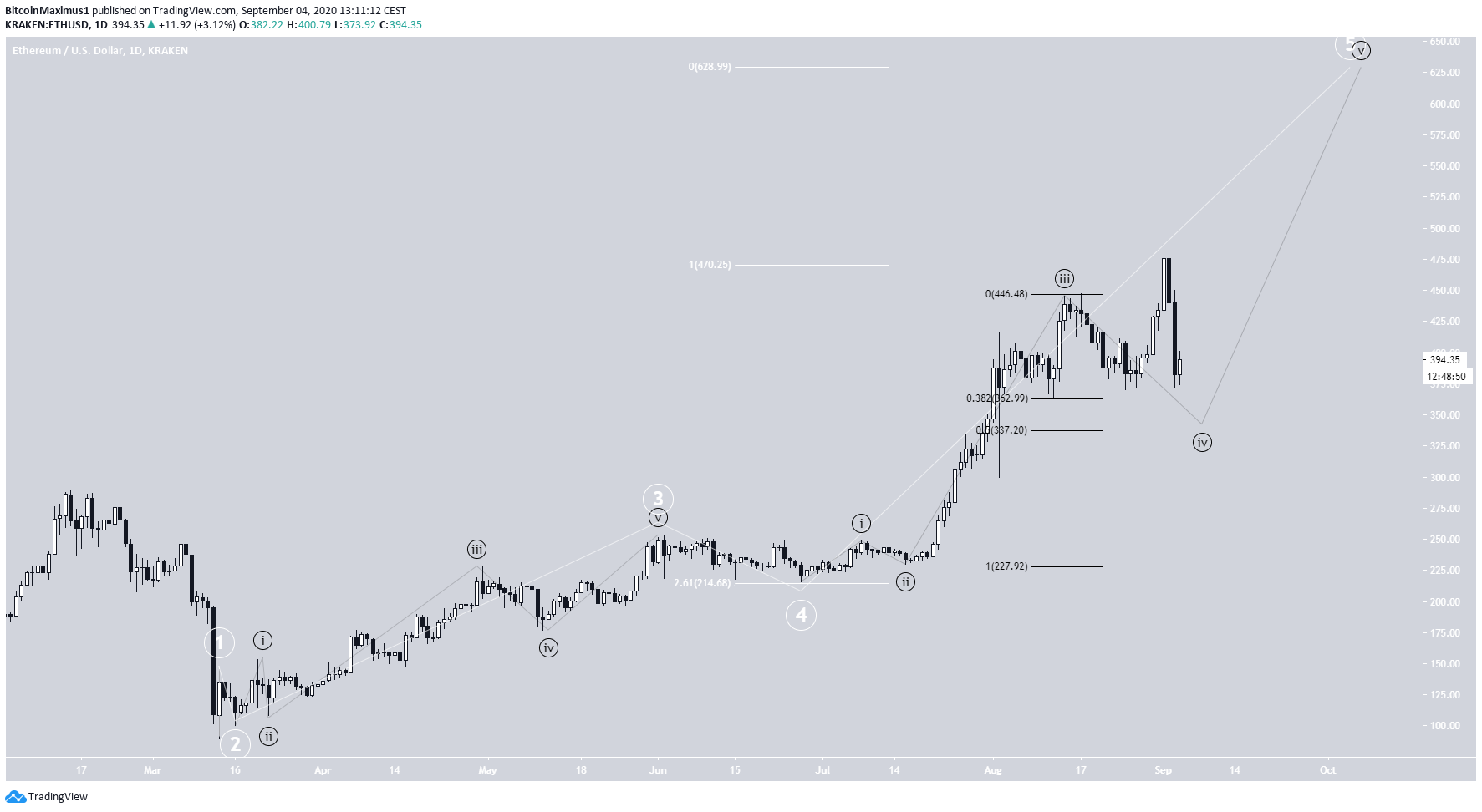

Counting from the March 13 low, the Ethereum price seems to be in the process of completing a bullish impulsive formation (shown in white below).

Since June 28, the price has been in the fifth wave, which has extended. Currently, the price is in the process of completing the fourth sub-wave (black below). The two most likely levels for the current correction to end are found at $368 and $332, the 0.382, and 0.5 Fib levels of the entire sub-wave 3.

While the top of the entire formation depends on the completion of the fourth sub-wave, a preliminary target is found by projecting the 2.61 Fib of waves 1 – 3 to the bottom of wave 4, giving a target of $628.

To conclude, the Ethereum price should complete its corrective structure near the current price level and begin another upward move.