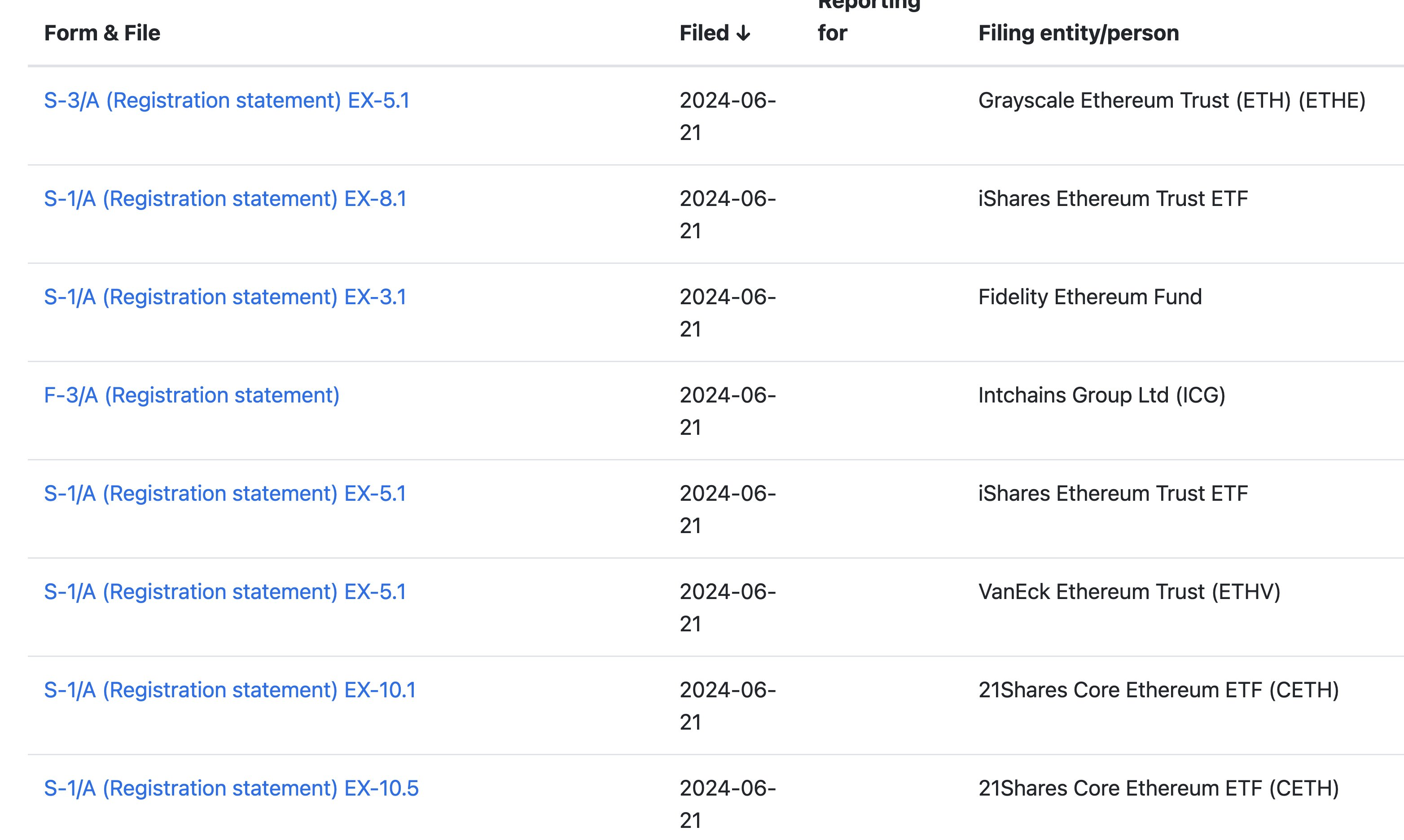

On June 21, major asset management firms, including BlackRock, VanEck, Franklin Templeton, Grayscale Investments, Invesco Galaxy, 21Shares, and Fidelity, submitted updated S-1 Registration Statements to the US Securities and Exchange Commission (SEC) for spot Ethereum (ETH) exchange-traded funds (ETFs).

These new filings include more details on seed investments and fees, boosting confidence that these ETFs might soon begin trading.

Ethereum ETF Issuers Reveal Fees and Seed Investments

21Shares’ filing indicates that it received approximately $340,739 from the initial sales of its seed creation basket through 21 Shares US LLC. In comparison, Invesco Galaxy’s amended application states its seed investments at around $100,000. Notably, major asset management firms such as Fidelity and BlackRock raised $4.7 million and $10 million for their seed investments, respectively.

Additionally, some firms are beginning to disclose the fees they will charge. Franklin Templeton has set its fees at 0.19%, with a six-month waiver for assets up to $10 billion. VanEck, on the other hand, has set its fee at 0.20%, with a waiver for the first $1.5 billion in assets. Bloomberg ETF analyst Eric Balchunas said these are “pretty damn low” and expressed eagerness to see the fees Grayscale would charge for its product.

“[These low fees] add a touch of pressure on BlackRock to stay under 30bps at least. So far, it looks like ETH will have as low or even lower fees than Bitcoin,” Balchunas added.

Read more: Ethereum ETF Explained: What It Is and How It Works

Stakeholders have explained that the S-1 approval is one of the final steps before the financial instruments begin trading. Balchunas has maintained his prediction that the funds will launch in early July.

“The ball’s in SEC’s court to let issuers know about any final changes and effectiveness (aka final approval). We holding the line with July 2nd as our over/under for ETH ETFs launch date,” Balchunas remarked.

Crypto hedge fund founder Quinn Thompson suggests that Ether ETF products might exceed expectations, considering the recent hype surrounding them. According to him, focusing on the initial inflows might overlook the broader impact these products would have on the digital asset.

“For the past 24 months, the industry has faded ETH and flocked to the BTC and SOL barbell, and as is usually the case in ‘The Ultimate MOMO asset class’, flows tend to go too far in one direction and then too far in the other. Debating the magnitude of day 1, week 1 or month 1 inflows misses the forest for the trees. The very existence of ETH ETFs will force a large re-rating for the asset. Once BTC stops going down, and potentially sooner, ETH will start to shine,” he stated.

Read more: How to Invest in Ethereum ETFs?

Nevertheless, Balchunas, while conceding that he previously downplayed the Ethereum ETFs, maintains that they would be fortunate to receive 20% of spot Bitcoin ETF inflows.

“Thank you for all the reminders that I once referred to ETH spot ETFs as “small potatoes.” In hindsight, that was too dismissive, I take it back. That said, I do still think ETH will be lucky to get 20% of the AUM BTC ETFs have. We’ll see though,” he wrote.