Ethereum’s recent decline has drawn attention across the crypto market as the second-largest cryptocurrency struggles to recover from its 15% weekly loss. The ongoing bearish conditions have dragged ETH down to levels not seen in months.

However, this sharp correction may signal the start of a recovery, as Ethereum appears to have reached the point of bearish saturation.

Ethereum Enters Historic Reversal Point

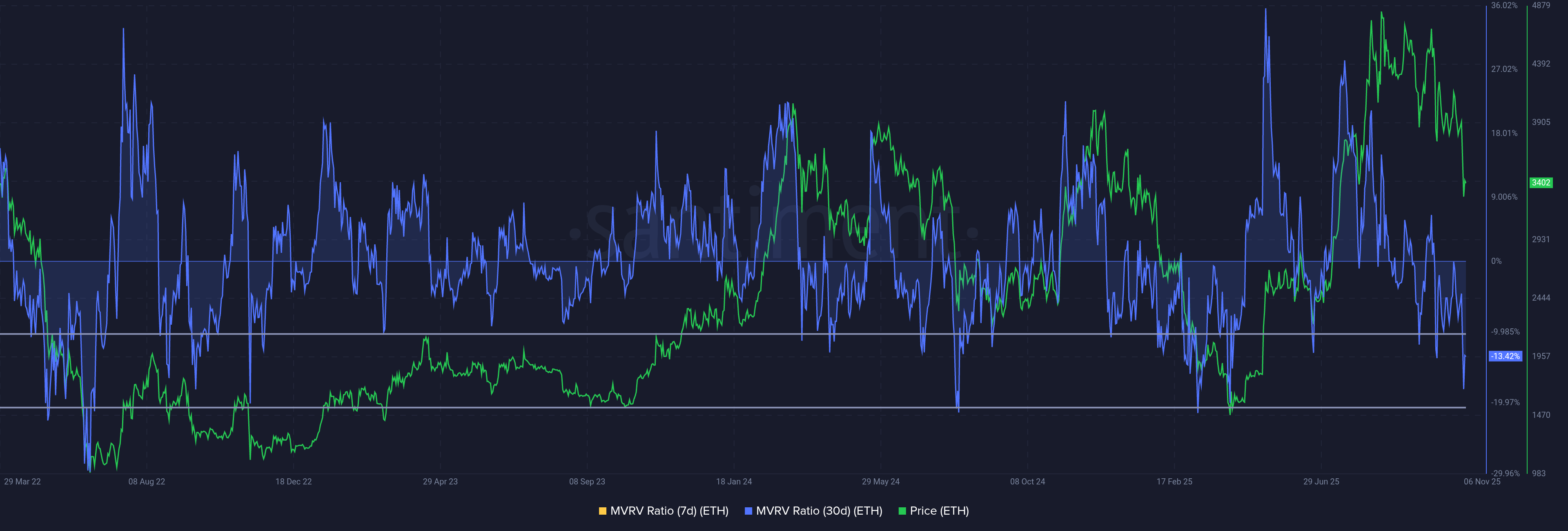

The 30-day MVRV ratio highlights that Ethereum has officially entered the “opportunity zone,” a range historically linked to potential reversals for the first time in five months. This zone, defined between -10% and -20%, represents periods when investors stop selling as losses deepen. Instead, they often accumulate at discounted prices, providing support for an upcoming recovery.

SponsoredHistorically, ETH has rebounded whenever it enters this zone, signaling a shift in investor sentiment from fear to accumulation. This trend often precedes bullish rallies as traders begin to anticipate price growth once market selling pressure stabilizes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

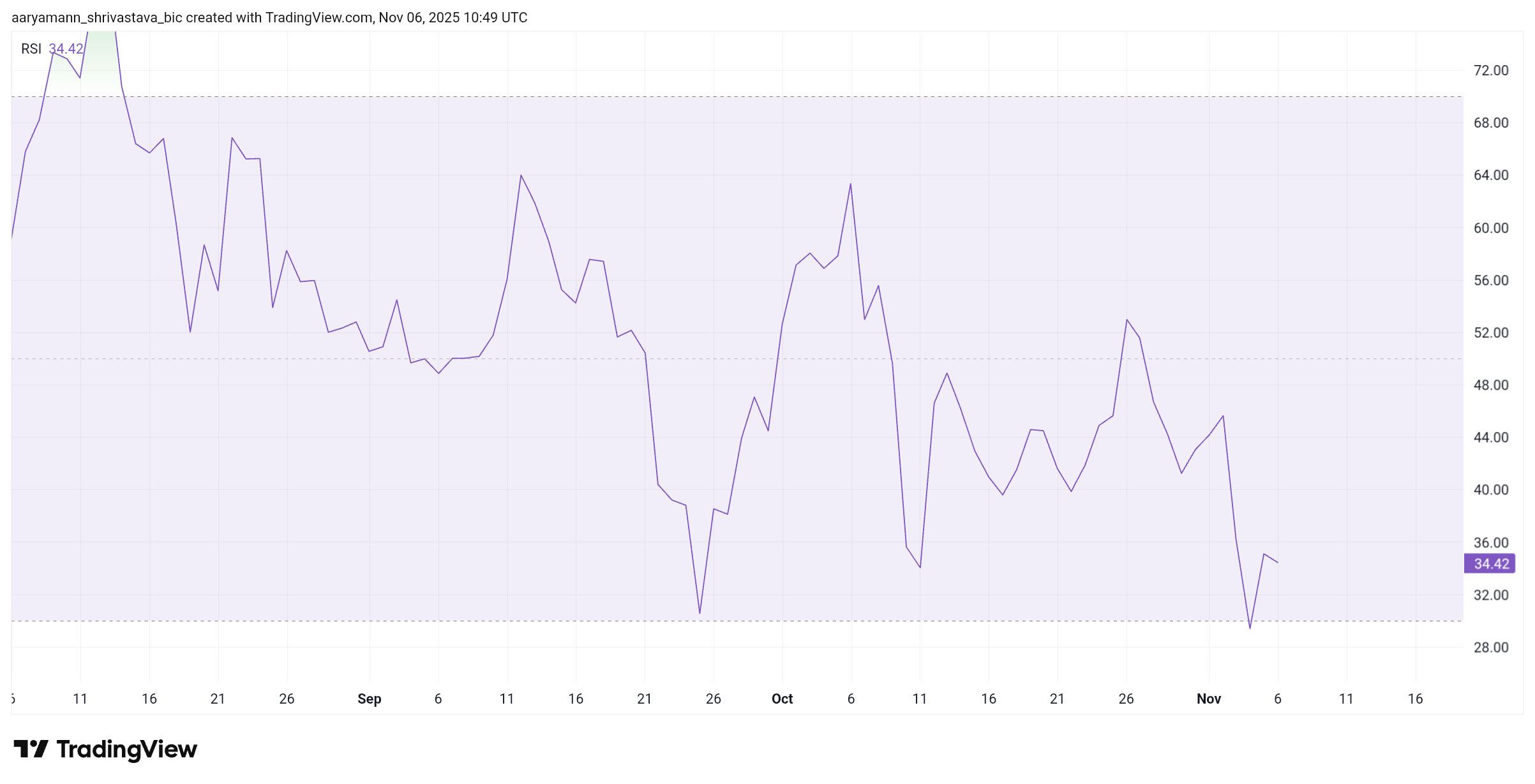

On the macro scale, Ethereum’s Relative Strength Index (RSI) supports this optimistic outlook. Currently hovering near 30.0, the RSI indicates ETH is approaching oversold conditions. Assets near this threshold often experience reversals, as selling momentum weakens and buyers begin to reenter the market.

If ETH dips any further below the 30.0 RSI level, it could trigger a strong technical rebound. Such signals typically attract traders seeking short-term gains while also improving the long-term outlook. The combination of low MVRV and near-oversold RSI reinforces the possibility of Ethereum’s bullish reversal in the coming days.

ETH Price Has A Bullish Future

Ethereum’s price stands at $3,397 at the time of writing, following its steep 15% weekly decline. To recover, ETH must reclaim $3,800, a level that previously acted as a critical support zone.

If the momentum aligns with technical indicators, Ethereum could rise past $3,489 resistance and breach the $3,607 barrier, targeting $3,802 next. Sustained investor accumulation would further strengthen this rally.

However, if investor sentiment weakens, Ethereum could slip below $3,367 support, potentially falling to $3,131. This drop would invalidate the bullish thesis and prolong ETH’s consolidation phase.