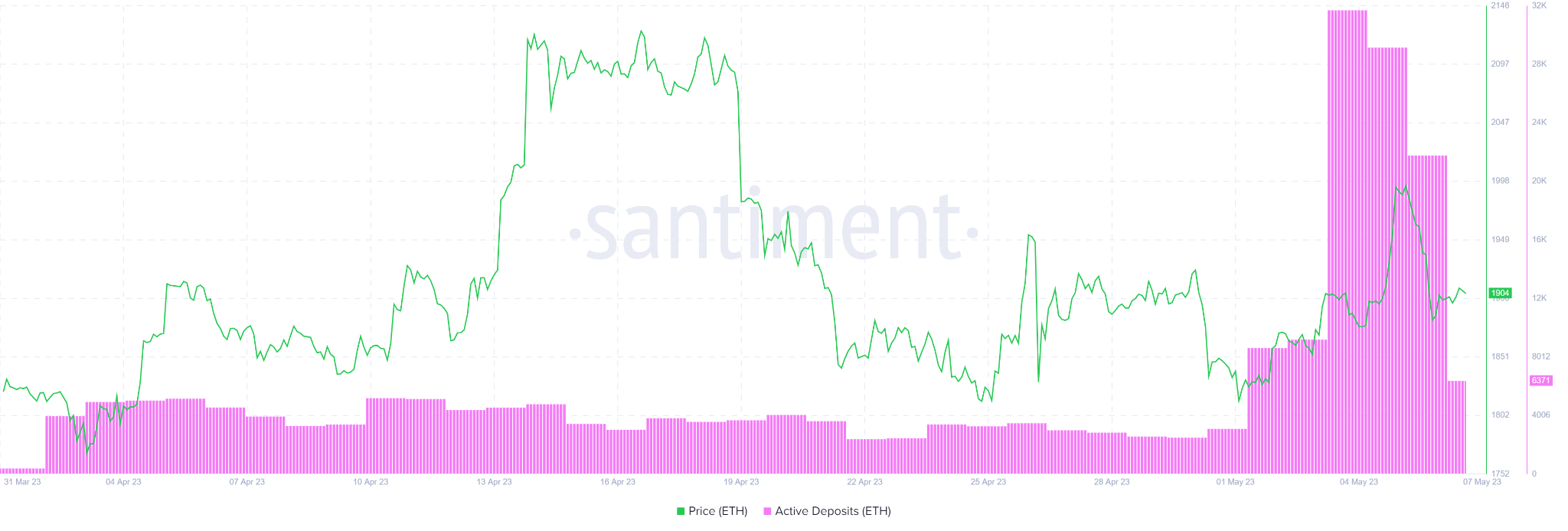

Active deposits on the Ethereum network hit an 18-month high on Friday, surging to over 20,000 deposits. The increase marks its highest level since November 2021.

But what’s driving the spike in activity?

The blockchain analytics platform Santiment tweeted that PEPE token traders looking to cash out their profits from the meme coin may be behind the increased number of active addresses.

Ethereum Gas Fee and Deposits Rising

Certainly, active Ethereum deposits began to climb from the beginning of May, coinciding with the opening of meme coin season.

And given the volatile hype cycle that tends to define the economics of tokens like PEPE, trading them in for a more established asset like ETH is probably a smart move.

PEPE Trading Hikes Gas Fees

Since its launch in April, more than 410,000 PEPE transactions have been completed on Uniswap. And as one Twitter user calculated, these transactions have burned a total of around 5,300 ETH in gas fees.

What’s more, the number of gas fees burned by PEPE transactions started to climb even faster from May 1, in lockstep with Ethereum deposits.

Since then, the ERC-20 token has been listed on Binance and KuCoin. This may further fuel the PEPE fire and burn yet more gas, even if the coin can’t sustain its heady gains.

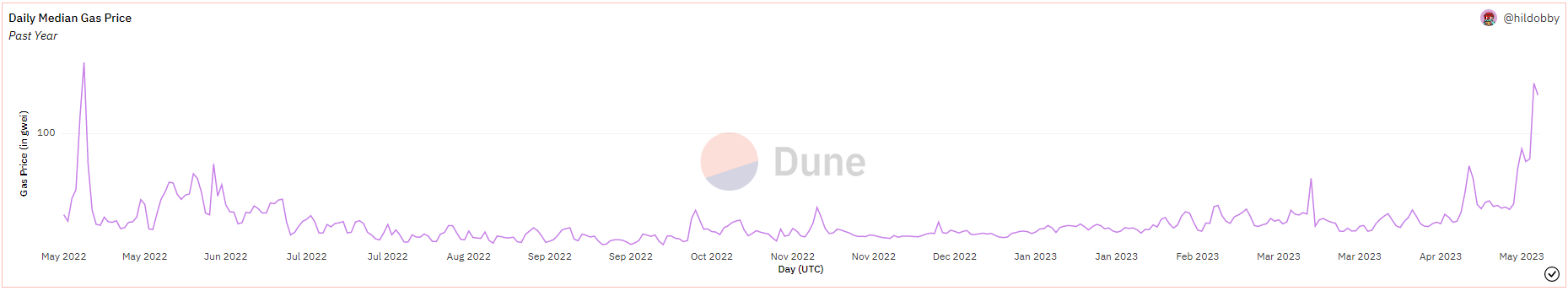

For those who aren’t interested in meme coins, such spikes in interest can be annoying. The surge in activity on the Ethereum network has the immediate effect of pushing up gas fees, with knock-on consequences across the ecosystem.

As one gas fee price tracker shows, gas fees have also trended upward since the end of April. Average gas fees even briefly topped 240 gwei on Friday, their highest level since this May last year.

What Next For ETH Price?

Pointing to previously observed trends, Santiment noted that spikes in active Ethereum deposits often foreshadow volatility in the price of ETH.

Santiment’s logic is that as investors move idle ETH to exchanges, the increased supply may cause fluctuations in the market. As such, any surge in active ETH deposits could be a harbinger of price turbulence.

One major movement could certainly impact supply and demand dynamics. That’s the recent decision by the Ethereum Foundation to transfer 15,000 ETH to a Kraken deposit address. As well as injecting liquidity into the market, if historical patterns repeat themselves, the move could also pre-empt a drop in the price of ETH.

Previously, the Ethereum Foundation has successfully timed such selloffs to make the most of peaks in the price of ETH.