On February 5, the Ethereum price broke out from an ascending channel and has been increasing since.

Ethereum Price Highlights

- The price has made a double bottom.

- Ethereum broke out from an ascending channel.

- There is resistance at ₿0.0217, ₿0.0225 and ₿0.026.

- The price has moved above its 200-day moving average (MA).

- It is following a short-term ascending support line.

Let’s take a closer look at the Ethereum price movement and attempt to determine where it is heading to next.$ETH #ETHEREUM

— Michaël van de Poppe (@CryptoMichNL) February 5, 2020

The $BTC pair is basically also running towards the next target.

Think we're going to calm down there for a little, but let's see. pic.twitter.com/TU19kgLjhL

Ethereum’s Double Bottom

Throughout September and December 2019, the Ethereum price created a double bottom near ₿0.0175. The double bottom was combined with a bullish divergence in the RSI, which was in oversold territory. Afterward, the price began to increase — an event that also caused the RSI line to go above 50, suggesting that the price has begun a bullish trend. The most significant resistance area which is also the previous breakdown level is found at ₿0.026.

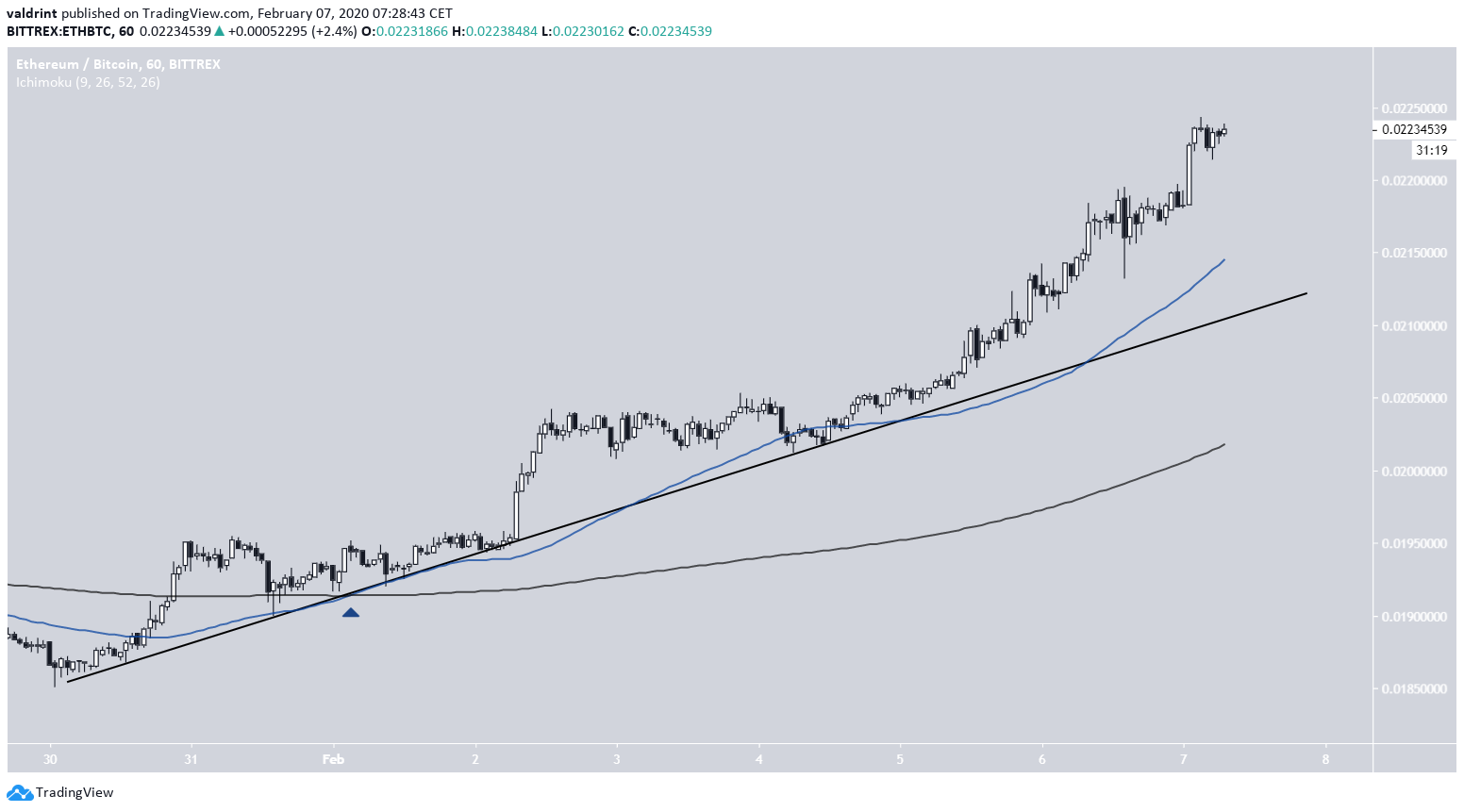

Ascending Channel

Since the second bottom on December 29, 2019, the Ethereum price was trading inside an ascending channel. On February 5, the price broke out from this channel amidst a bullish engulfing candlestick. The price has reached the target outlined in the tweet, which is found at ₿0.0217 — while the next resistance area is found at ₿0.025, the final resistance area before the previously mentioned breakdown level. Technical indicators provide a bullish outlook. The Ethereum price moved above its 200-day moving average on February 2 — something it has not done since May 2019.

In addition, while the RSI is overbought, it has not generated any trace of bearish divergence. In the short-term, if the price were to retrace, it would likely find support at ₿0.0205 and consolidate between this support area and resistance.

Technical indicators provide a bullish outlook. The Ethereum price moved above its 200-day moving average on February 2 — something it has not done since May 2019.

In addition, while the RSI is overbought, it has not generated any trace of bearish divergence. In the short-term, if the price were to retrace, it would likely find support at ₿0.0205 and consolidate between this support area and resistance.

Short-Term Movement

Short-Term Movement

In the short-term, the Ethereum price has been following an ascending support line since January 30.

The 50- and 200-hour MAs have made a bullish cross and the former is supporting the line.

As long as the price stays above this support line, it is expected to continue moving upwards. Since the price has almost reached the second resistance area at ₿0.225, a breakout above it could greatly accelerate the rate of increase.

To conclude, the Ethereum price has broken out above a significant resistance level. Since the price has yet to show any weakness, we believe it will continue moving upwards at least until it reaches ₿0.0225 and possibly higher.

To conclude, the Ethereum price has broken out above a significant resistance level. Since the price has yet to show any weakness, we believe it will continue moving upwards at least until it reaches ₿0.0225 and possibly higher.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored

Short-Term Movement

Short-Term Movement