The Ethereum and EOS long-term charts suggest that they have both reached a bottom and are close to initiating the next bullish market cycle.

Since a rapid upward move on Oct 25, most major altcoins have been holding up while Bitcoin has been decreasing. This has been especially visible when looking at their BTC pairs, which have been gaining value during most Bitcoin decreases since.

Previously, this has been a sign that the altcoin market is getting stronger and has been a precursor to another possible ‘altseason.’

Well-known author and analyst Nik Patel stated in a tweet that he has a neutral view towards Bitcoin but gave a bullish outlook for both Ethereum and EOS. He suggested that they both could really shine in the coming weeks and could begin to eat into Bitcoin’s dominance.

What I think happens over the next 6-8 weeks:$BTC chops between $8-10k and ETH/BTC breaks above 0.023 but is outperformed by EOS > BTC dominance starts dropping off further > alts break out of multi-month consolidations

— Nik (@cointradernik) November 17, 2019

Below, we will take a look at both the price of ETH and EOS to analyze how likely these claims are.

Ethereum

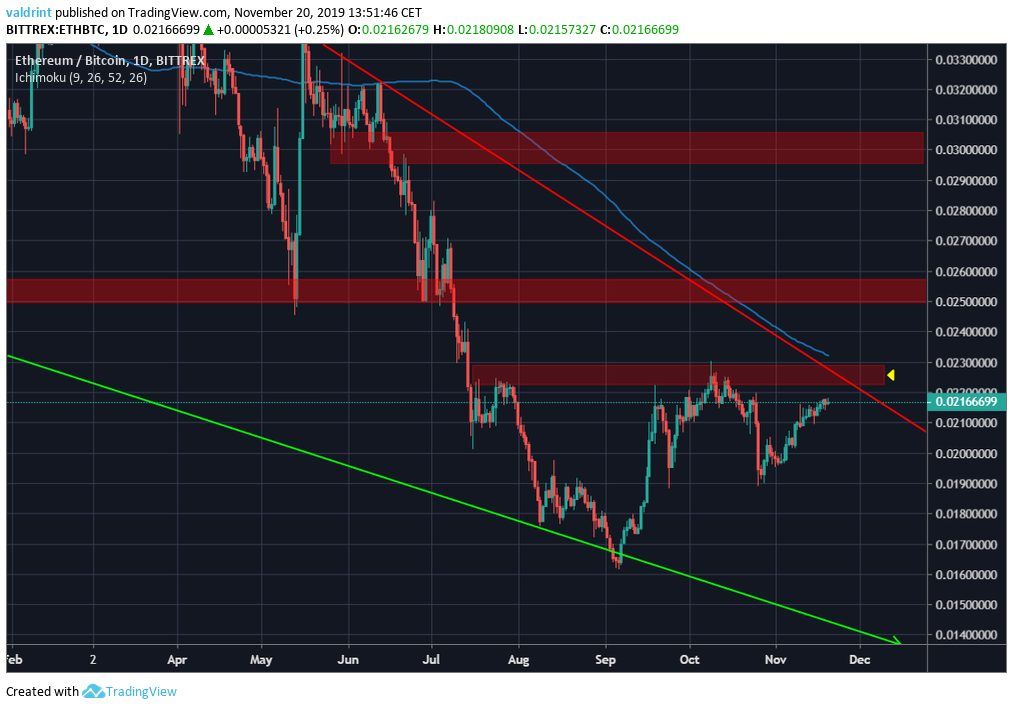

The ETH price has been trading inside a long-term descending wedge since September of 2018. Once it reached ₿0.015, both a significant support area and the support line of the wedge, it began the current upward move.

Also, this move was combined with a bullish divergence in both the weekly RSI and MACD. Divergence in such high time-frames is often a very strong sign of a reversal, which gains more validity by the fact that the price is trading inside a bullish pattern.

There is a very strong resistance area at ₿0.0225. The area is at a convergence of the resistance line, previous resistance area, and the 200-day moving average (MA).

A breakout above this area would likely trigger a very rapid price increase, causing the price to reach values of at least ₿0.025, and possibly higher towards ₿0.03.

EOS

EOS

Similar to Ethereum, the EOS price reached a long-term support area at 3000 satoshis before initiating an upward move.

While the divergence is minimal, the RSI reached oversold values for the first time. Additionally, there is a bullish cross in the MACD. This is only the second time this has happened. During the first at the beginning of the year, EOS made a big move to the upside.

In the short-term, there is a resistance area at 4000 satoshis, which creates an ascending triangle when combined with the current ascending support line.

The price has moved above the 100-day moving average (MA). A breakout from the first resistance area would likely take the price to 4800 satoshis, a resistance area strengthened by the 200-day MA.

Therefore, after a long period of consolidation, both EOS and Ethereum look poised to make moves to the upside.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Did you know you can trade sign-up to trade Bitcoin and many leading altcoins with a multiplier of up to 100x on a safe and secure exchange with the lowest fees — with only an email address? Well, now you do! Click here to get started on StormGain!