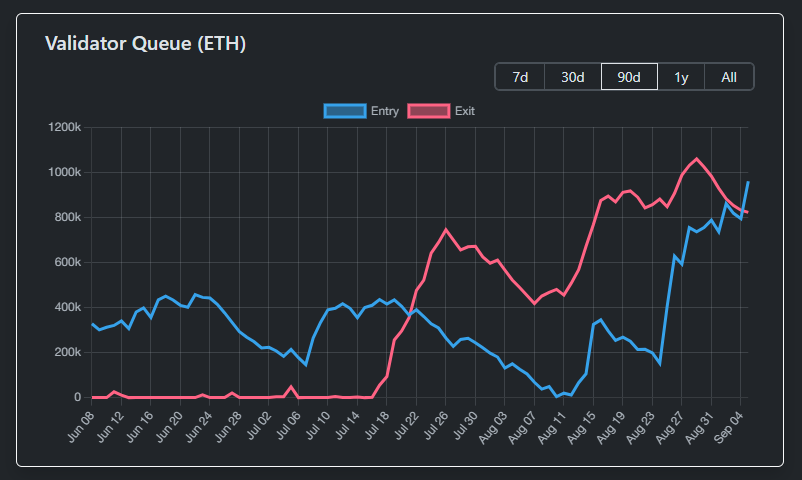

After more than a month of a strong rise in the ETH unstaking queue, a reversal occurred in September 2025. The Entry Queue has surpassed the Exit Queue, signaling continued strong confidence in the Ethereum ecosystem.

This shift reinforces demand for ETH staking at a time when the altcoin shows signs of outperforming Bitcoin.

Nearly 960,000 ETH in the Entry Queue

According to Validator Queue data, the Entry Queue currently holds 959,717 ETH and has an estimated wait time of 16 days. In contrast, the Exit Queue holds only 821,293 ETH and has a wait time of 14 days.

Ethereum’s staking queue represents the process where anyone wishing to become a validator must wait for their turn after locking up ETH.

Previously, BeInCrypto warned about rising ETH in the unstaking queue. However, the chart shows a decline in September. Meanwhile, the volume of ETH waiting to be staked has grown more quickly.

This reversal eases earlier concerns that ETH’s price might face selling pressure from the growing unstaking volume. Instead, fresh capital flowing into staking indicates that the community remains optimistic about Ethereum’s long-term outlook.

“Honestly, this is pretty striking, because we haven’t seen queues of this size since 2023 when the Shanghai upgrade enabled withdrawals. And now in 2025, the entry queue has once again surged to record numbers,” Everstake.eth said.

OnchainLens observed a notable example: A wallet from Ethereum’s ICO era staked 150,000 ETH, worth $656 million, after eight years of inactivity.

In contrast, long-dormant Bitcoin whale wallets have recently become active, with one 13-year-old wallet transferring 80,000 BTC, valued at over $9 billion, to sell. Meanwhile, Ethereum wallets are increasingly moving towards staking, which highlights a clear difference between the two leading cryptocurrencies.

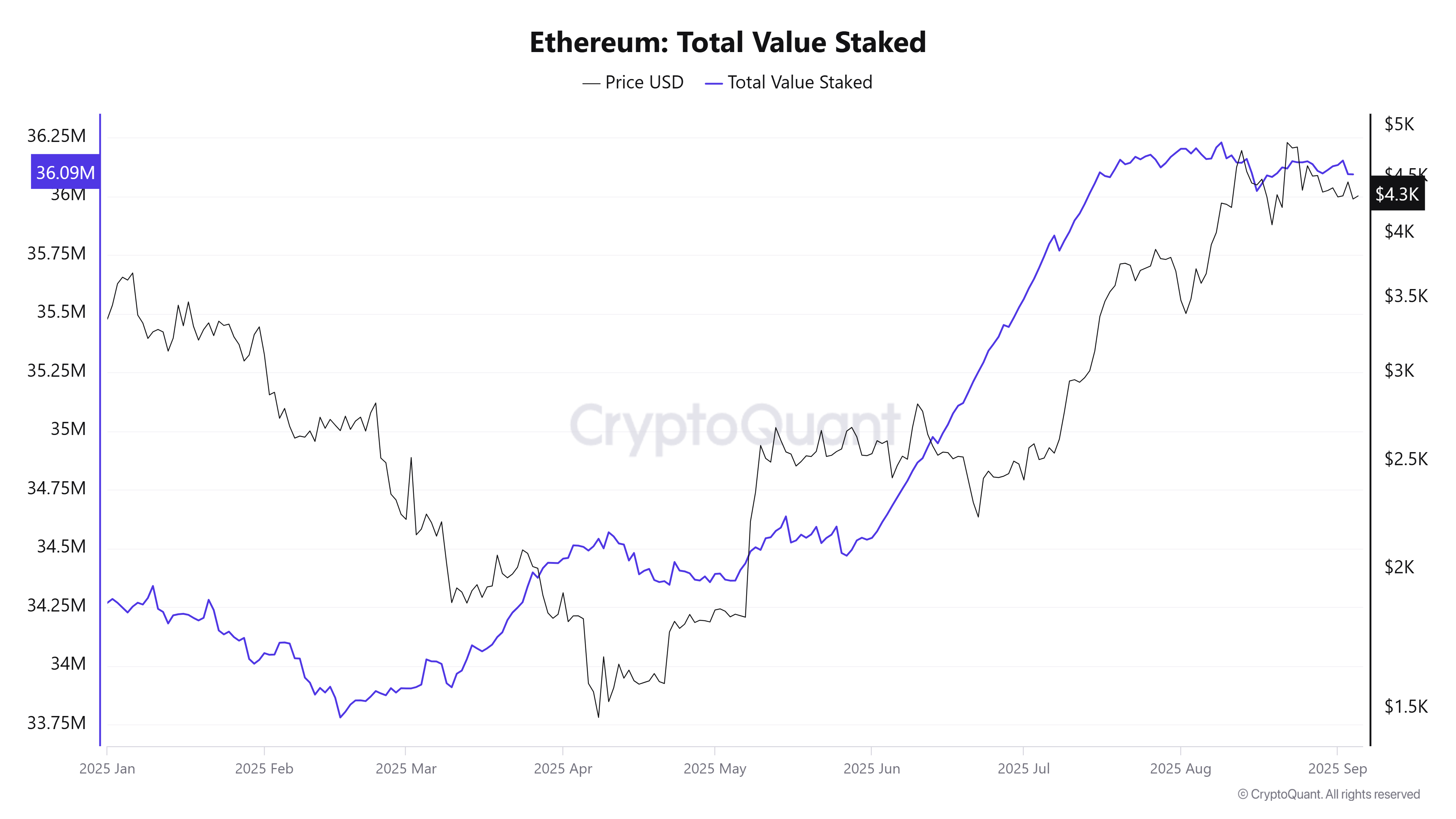

CryptoQuant data shows a strong upward trend in staked ETH since mid-2025. The total rose from 34.5 million ETH in May to over 36 million today. This number will likely grow further along with the ETH currently waiting in the staking queue.

Everstake.eth explained three main reasons why more ETH is being staked. First, many investors believe in Ethereum’s long-term value and want to secure it. Second, ETH’s rising price and record-low gas fees make staking more attractive. Finally, more companies and funds are joining Ethereum staking, channeling larger sums into the network.