Ethereum price prediction: ETH is underpriced after the Merge upgrade. This is according to 46% of Finder’s panel of in-industry experts.

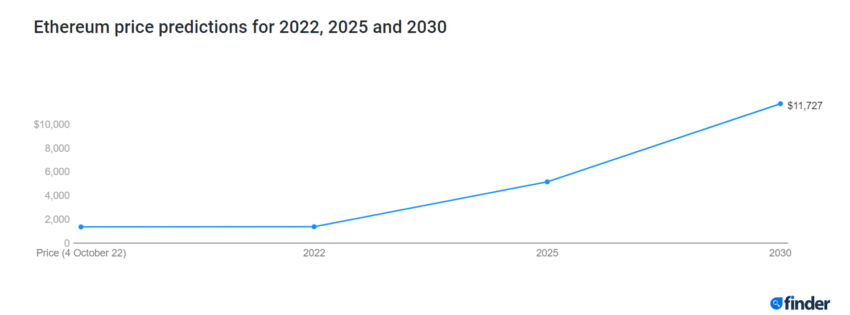

The panel of 55 fintech and crypto experts predicts that ETH could dip to $963 in the months ahead. But, don’t panic. ETH is estimated to end 2022 at $1,377.

Looking all the way through to the end of the decade, the panel predicts that ETH will jump to $5,154 by December 2025. And it will hit $11,727 by the end of 2030.

ETH price prediction: Expert opinion

Joseph Raczynski is a technologist and futurist for Thomson Reuters. He says ETH will reach $1,700 by December of this year. Raczynski says the benefits from the Merge have not yet been priced in.

“ETH has fallen in value, though one could argue, Ethereum is actually more valuable and secure now. The narrative is also way better on the environmental impact, reducing electricity consumption by over 99%.”

Ben Ritchie is the managing director at Digital Capital Management. He thinks ETH is underpriced. He feels it could be priced around $8,000 by 2025.

“The unfavorable market conditions hindered the network’s growth, but when these factors are set aside, the probability of its success will significantly increase.”

Could ETH be overpriced?

Chloe White is an independent crypto-asset consultant. She thinks Ethereum is overpriced, and says geopolitical pressures are too sharp for ETH to overcome.

“The Merge does have some effect on the supply of ETH. But not enough to offset the weight of the current macroeconomic and geopolitical forces that are straining markets globally. Waters will be choppy for months to come.”

31% of the experts say that ETH is priced fairly. Yves Longchamp is the head of research at SEBA Bank.

“The Ethereum ecosystem is undergoing a series of upgrades. All are intended to lead the Ethereum network to greater scalability, transaction speed, and cost efficiency. Once complete the Merge will set up Ethereum to be a global settlement layer, fit for building powerful decentralized applications.”

Price of Decentralization

Despite all the positives, many think that the upgrade comes at a cost. 50% of the panel has said that the biggest trade-off is decentralization.

Jeremy Britton is the CFO at Boston Trading Co. He feels that while Ethereum has won points with environmentalists, it “lacks the decentralization for which crypto was intended.”

Tommy Honan is the strategic partnerships head at Swyftx. He says centralization worries will dissipate over time. But, the situation lets Bitcoin have an advantage over ETH.

“Early statistics on concentration of staking validators is quite concerning, given 5 or so based in the US account for around 64% of staked ETH globally. Although I believe this will level out over time, it means the Merge event has further contributed to the centralization of Ethereum, another card for the Bitcoin maximalists to hold over its closest rival.”

Despite apprehensions surrounding the centralization issue, 56% of panelists (56%) feel that Ethereum network won’t be monopolized by a single player. On the other hand, 22% fell this will happen eventually.

Got something to say about this ETH price prediction or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Trusted

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.